Intuit, Inc. (NASDAQ: INTU) has successfully navigated through multiple technological shifts and economic cycles over the years and emerged as a leading financial technology platform. Currently, the company is focused on preparing the business for the future by incorporating artificial intelligence into its products.

Shares of the Mountain View-headquartered company, the provider of popular tax preparation software TurboTax and finance management tool Mint, have gained about 8% so far this year. The valuation is favorable from an investment perspective, offering prospective buyers an opportunity to buy this promising stock at a reasonable price.

Valuation

The general outlook on INTU is bullish, with estimates indicating that the stock will likely reach near the $500 mark in the coming months. It is worth noting that in the past, the company delivered consistent returns to investors though the stock has withdrawn from its 2021 peak.

A part of Intuit’s revenue is cyclical due to the seasonal nature of its tax business, which causes quarterly profit and revenues to fluctuate heavily. The unique business model helps generate steady cash flows, enabling the company to return capital to shareholders and reinvest in the business. The core business, which accounts for more than half of the total revenues, has expanded steadily in recent years and its future prospects look bright.

Customer Base

The Small Business & Self-Employed business — the top segment in terms of revenue and customer numbers — witnessed a spike in the adoption of products after the business transitioned into the software-as-a-service model a few years ago. The QuickBooks portfolio – including QuickBooks Online Payroll, QuickBooks Live, and QuickBooks Online – has a growing customer base and will continue to be a key growth driver going forward.

From Intuit’s Q2 2023 earnings conference call:

“We’re seeing strong growth in the number of payment-enabled invoices set by our small business customers, a good sign that our innovation is continuing to drive digitization. The shift to digitalization and the power of our small business platform including QuickBooks and Mailchimp resonate with customers as they grow their businesses and improve cash flow. We continue to observe that our AI-driven expert platform is critical to our customer’s success.”

Q3 Report on Tap

The company is preparing to report third-quarter numbers on May 23, after markets close. Analysts estimate that adjusted profit, on a per-share basis, increased to $8.48 from $7.65 last year. The growth reflects an estimated 8.2% increase in revenues to $6.1 billion, which is broadly in line with the management’s projection. As per guidance issued by the company’s leadership recently, net income is expected to be between $8.42 per share and $8.49 per share.

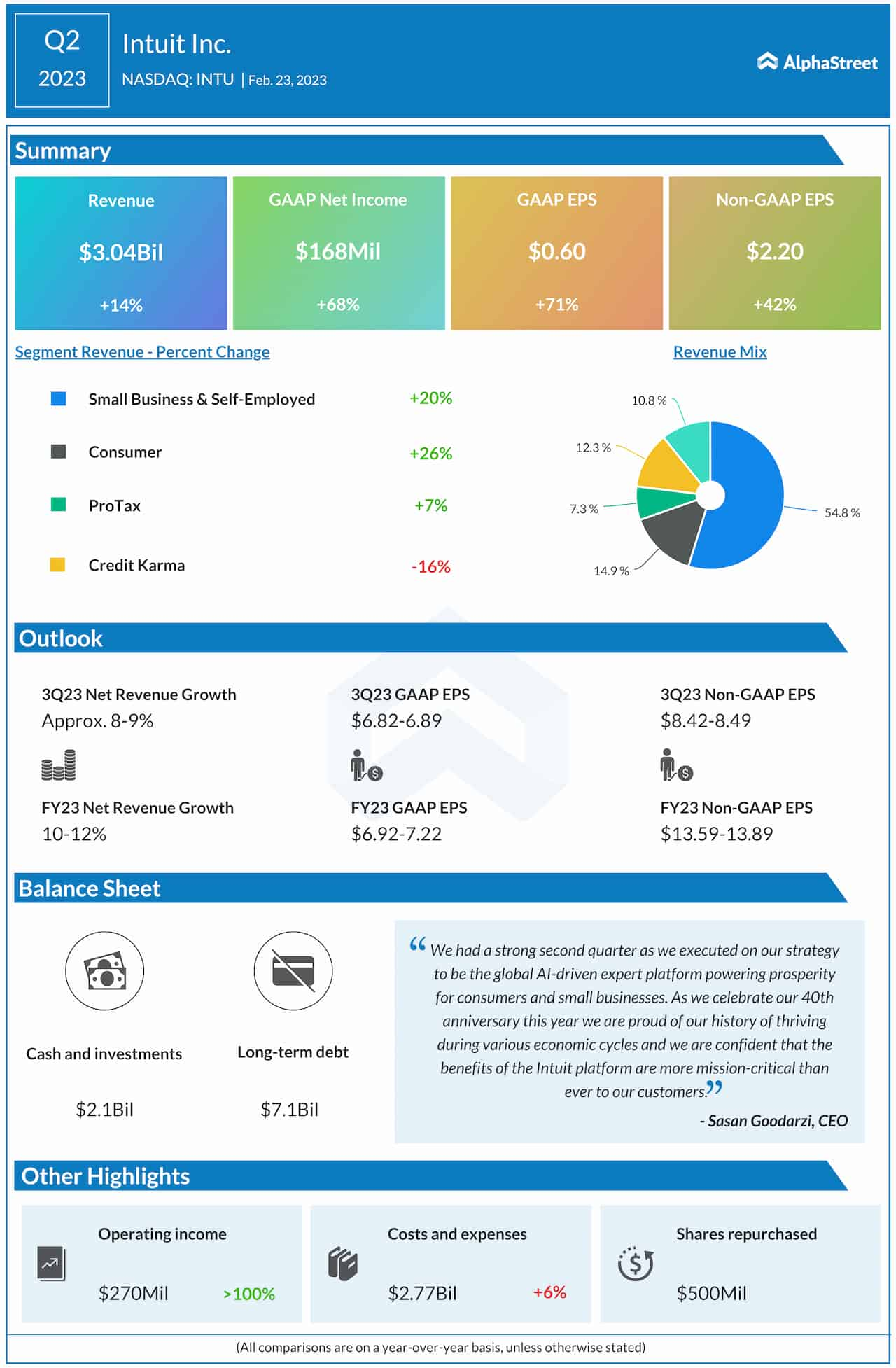

In the second quarter, both earnings and revenues came in above the market’s projection, marking the fourth beat in a row. At $3.04 billion, revenues were up 14% year-over-year. All operating segments, except Credit Karma, expanded during the quarter. Earnings, on an adjusted basis, were $2.20 per share, which is up 42% from the prior-year quarter.

Shares of Intuit stayed above their 52-week average on Monday, continuing the recent trend. The stock traded slightly lower during the session.