Quarterly performance

Trends

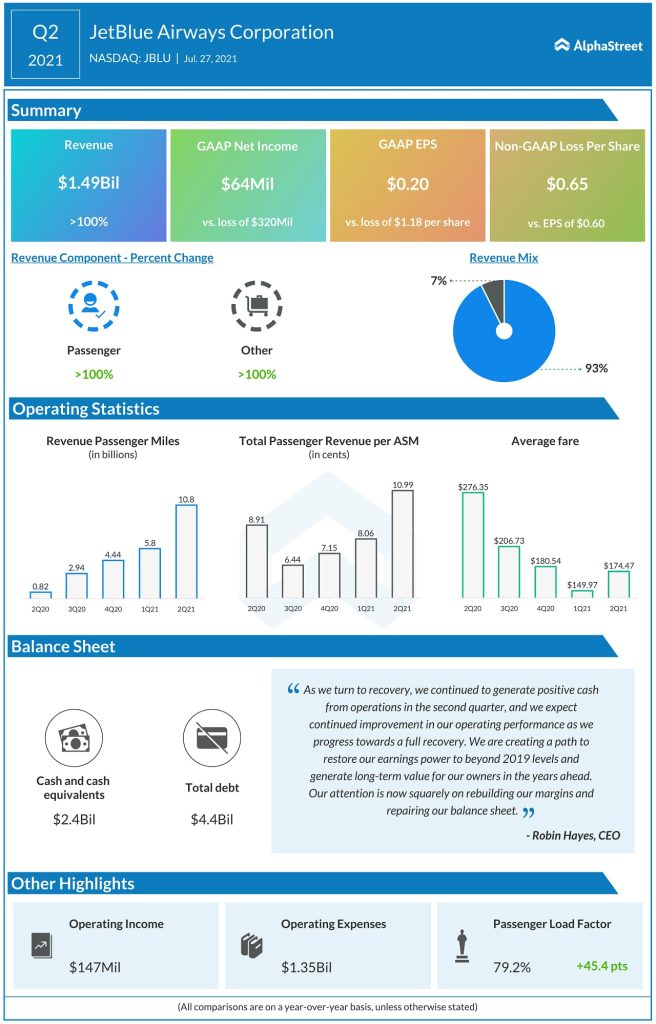

Air travel has picked up faster than expected, mainly for leisure and VFR i.e. visiting friends and family, helped by the widespread distribution of vaccines. The pent-up demand for travel led to revenues doubling in the second quarter on a sequential basis.

Leisure fares continued to see improvement and returned to pre-pandemic levels in July, supported by a strong recovery in demand and load factors. At the end of Q2, load factors were in the mid-80s with June capacity largely back to pre-pandemic levels.

JetBlue’s Northeast Alliance with American Airlines (NASDAQ: AAL) is bearing fruit. The company believes this partnership will help speed up its recovery as well as drive revenue and margin generation over the long term. Through this alliance, 20 new flights will launch this fall in multiple new markets from LaGuardia Airport in New York, with more to come in 2022. JetBlue expects capacity to largely go back to 2019 levels in Q3 helped by the higher demand and growth opportunities from this alliance.

Outlook

For the third quarter of 2021, JetBlue expects revenue to decline 4% to 9% year-over-two. Unit revenue is expected to improve on top of increasing capacity, with load factors in the mid-to-high 80s this summer and yields approaching 2019 levels. JetBlue anticipates a more robust recovery in business travel post Labor Day as employees return to offices and restrictions on travel begin to ease.

The airline expects capacity for Q3 to be down between flat to down 3% year-over-two. JetBlue is also tackling various cost headwinds, particularly in terms of maintenance, rents and ramp-up pressures. For the third quarter, the company expects CASM ex-fuel to increase 11-13%.

Click here to read the full transcript of JetBlue Q2 2021 earnings conference call