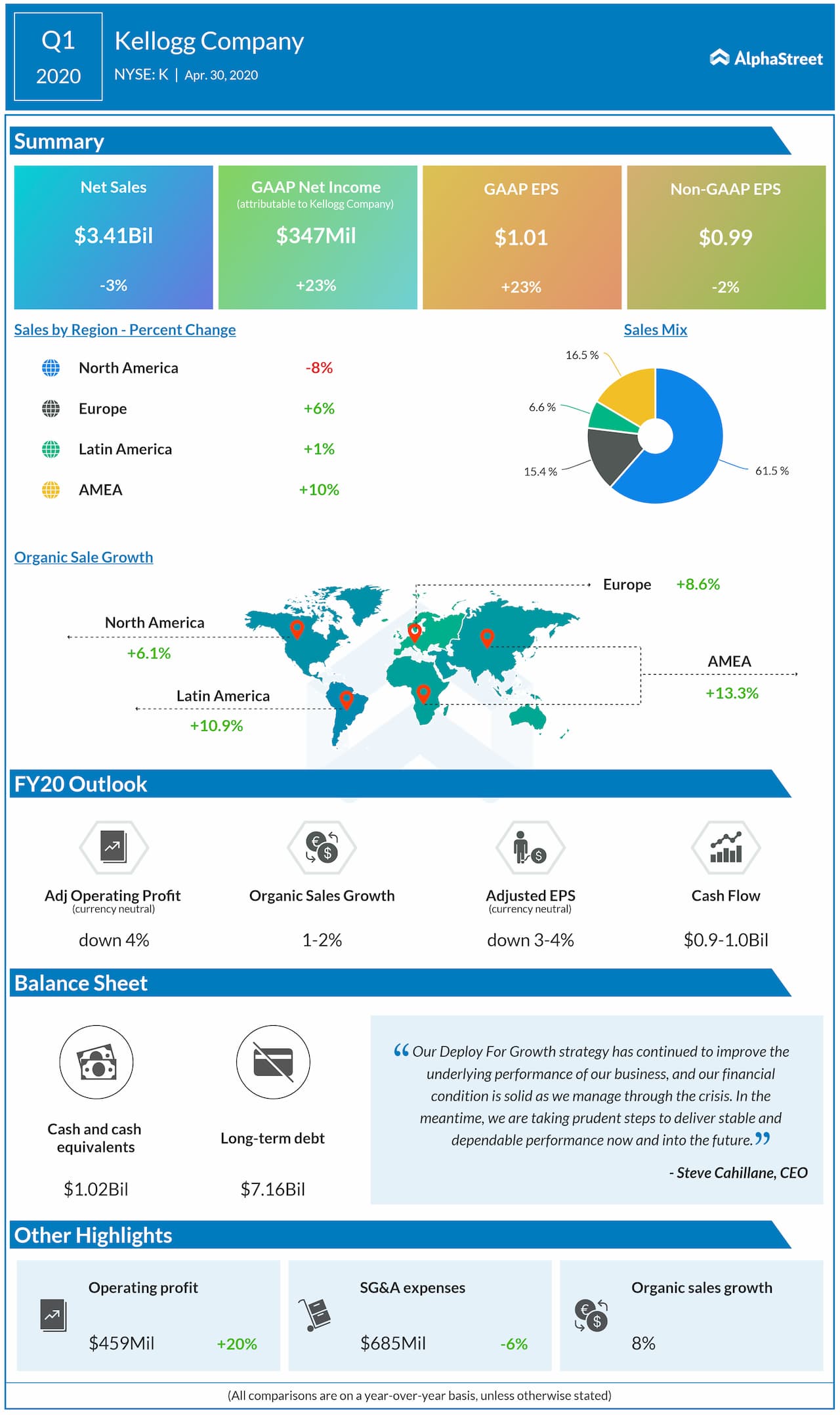

Kellogg (NYSE: K) reported a 3% decline in net sales for the first quarter of 2020 due to the impact of a recent divestiture. However, the results exceeded analysts’ expectations.

The absence of results in the quarter from the late July 2019 divestiture of the company’s cookies, fruit snacks, pie crusts, and ice cream cones businesses pulled down net sales by over 9% while adverse currency translation negatively impacted sales by nearly 2%.

The bottom line jumped by 23% owing primarily to favorable swing in mark-to-market adjustments and lower business and portfolio realignment charges. On an adjusted basis, earnings per share declined by 2% due to the absence of results from the divested businesses as well as adverse currency translation.

Kellogg affirmed its full-year financial guidance, with sales and profit delivery shifting toward the first half of the year. Organic net sales are expected to grow 1-2% from last year while adjusted earnings per share, on a currency-neutral basis, are anticipated to fall by 3-4% as the absence of results from divested businesses more than offsets growth in the base business.

Past Performance

Kellogg Q4 2019 Earnings Results

Kellogg Q3 2019 Earnings Performance