Shares of Electronic Arts Inc. (NASDAQ: EA) were down 1% on Wednesday. The stock has gained 9% over the past three months. The company delivered mixed results for the fourth quarter of 2023 a day ago but the Street was impressed with the bookings and outlook. Here are the key takeaways from the earnings announcement:

Mixed results

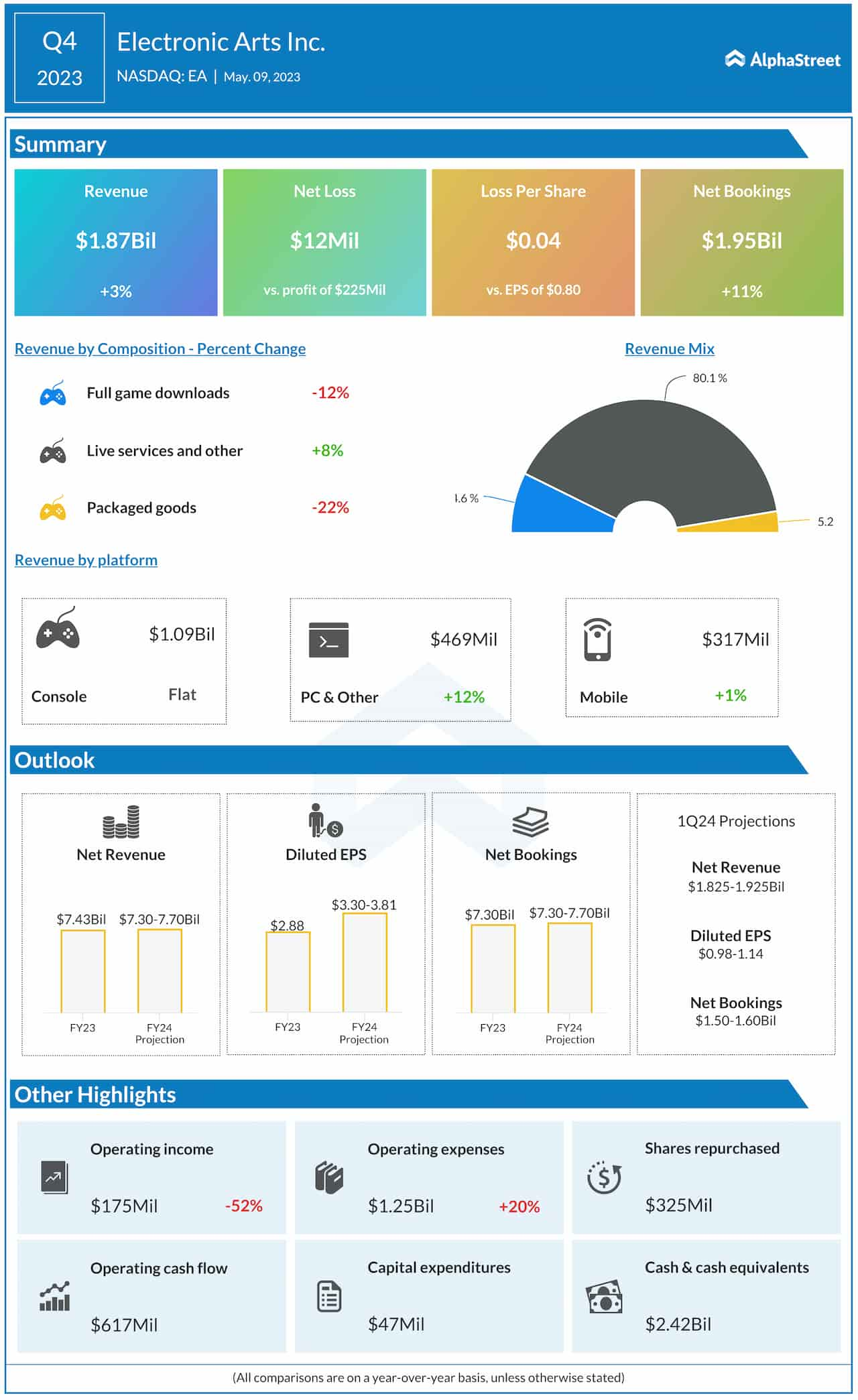

For the fourth quarter of 2023, Electronic Arts generated revenue of $1.87 billion, which was up 3% from the same period last year and also above expectations. The company delivered a loss of $0.04 per share in the quarter, which missed estimates. It compares to EPS of $0.80 reported in the year-ago period.

Bookings

In Q4, EA’s net bookings rose 11% year-over-year to $1.94 billion, driven by strong performances in live services and full game. Live services net bookings were up 9% YoY, fueled by EA SPORTS FIFA. Net bookings for the EA SPORTS FIFA franchise rose 31% YoY. Net bookings for FIFA Ultimate Team and FIFA Online 4 were up double digits while FIFA Mobile grew triple digits compared to last year, with Mobile reaching $100 million in net bookings for the first time.

Apex Legends witnessed a rebound during the fourth quarter, with Season 16 seeing a rise in peak engagement by over 20% versus the previous season. The launch of Star Wars Jedi: Survivor last month was met with positive responses and it drove growth in engagement as well.

Outlook

Electronic Arts expects to see healthy engagement across its portfolio and continued resilience in its live services business in fiscal year 2024. The company expects net bookings to range between $7.3-7.7 billion, which would be flat to up 5% YoY, based on strength in live services and gains from EA SPORTS FC and Star Wars Jedi: Survivor. EA SPORTS FC is expected to deliver low single-digit net bookings growth during the year. EA expects revenue of $7.3-7.7 billion and EPS of $3.30-3.81 in FY2024.

For the first quarter of 2024, net bookings are expected to grow 15-23% YoY to $1.5-1.6 billion, driven mainly by full game sales of Star Wars Jedi: Survivor. Revenue is expected to be $1.8-1.9 billion while EPS is expected to be $0.98-1.14.