Shares of General Mills Inc. (NYSE: GIS) were up nearly 3% on Thursday after the company delivered better-than-expected results for the third quarter of 2023 and raised its full-year guidance again. Here are the key takeaways from the earnings report:

Results beat estimates

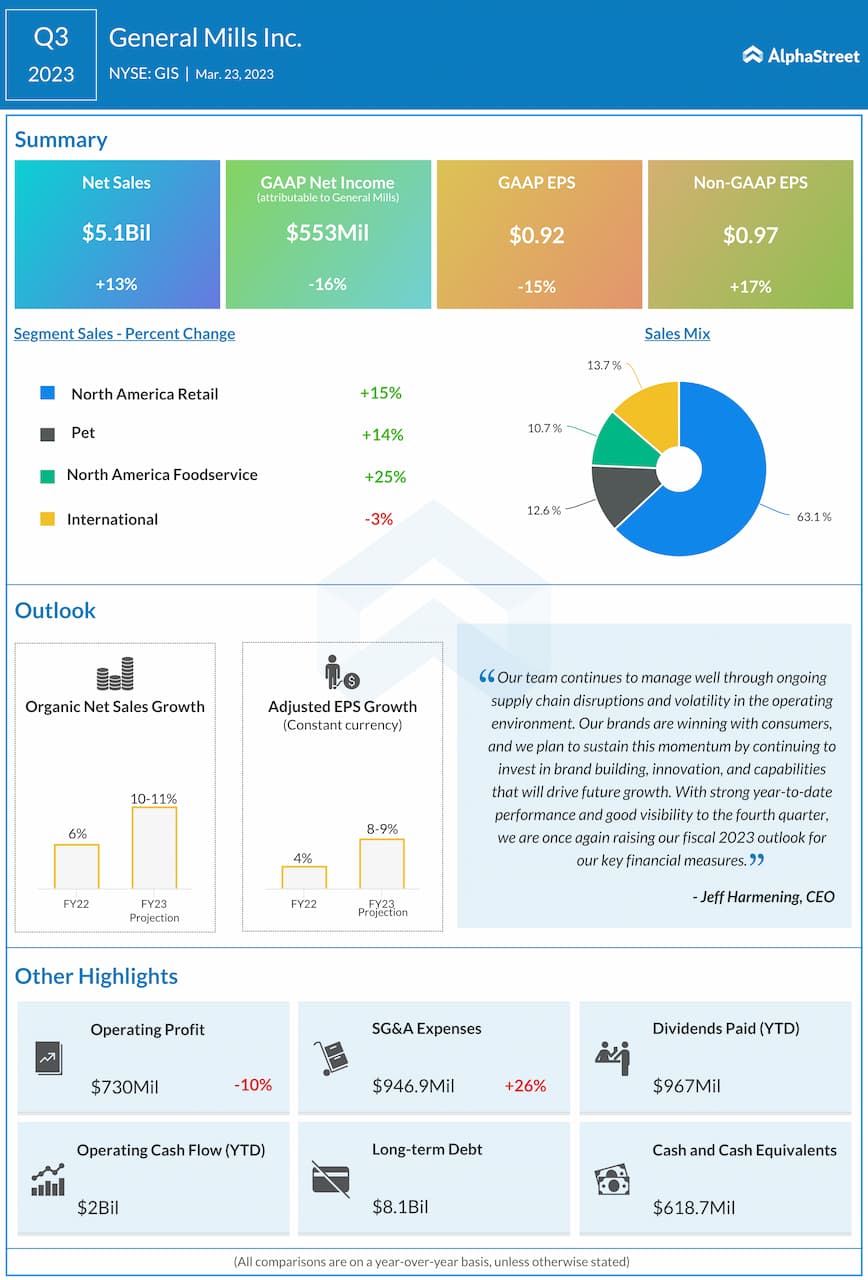

Net sales increased 13% year-over-year to $5.1 billion in the third quarter of 2023. Organic net sales increased 16%, driven by price increases and mix. GAAP earnings decreased 16% to $553 million, or $0.92 per share in the quarter. Adjusted EPS increased 17% to $0.97, driven mainly by higher adjusted operating profit.

Strong segment performance

General Mills saw broad-based growth across its segments during the third quarter. On an organic basis, net sales increased across all its segments, with three out of four witnessing double-digit growth.

Net sales in the North America Retail segment increased 15% on a reported basis and 18% on an organic basis, driven by price increases and mix. The growth was supported by double-digit increases in US Meals & Baking Solutions and US Snacks as well as a 7% gain in US Morning Foods.

Pet segment sales were up 14% on both a reported and organic basis. North America Foodservice sales rose 25% on a reported basis and 19% on an organic basis. The sales growth was driven by price increases and mix. The International segment saw a 3% drop in sales in Q3 due to lower pound volume but organic sales rose 8% with growth across Europe & Australia, distributor markets, Brazil and China.

Innovation continues to be a key part of General Mills’ strategy and this has helped its new product retail sales stay 30% higher than the category average over the past three years. The company is continuing on this path with new mini versions of Cinnamon Toast Crunch and Reese’s Puffs in its cereal category and a new Haagen-Dazs Macaron ice cream line in International. In the Pet segment, the company is trying out new products in the dry dog food, fresh dog food and treats categories.

Raised outlook

General Mills expects its performance in fiscal year 2023 to be impacted by the economic health of consumers, inflation and the frequency and severity of supply chain disruptions. The company expects input cost inflation for the year to be 14-15% of total cost of goods sold. It also anticipates supply chain disruptions to be moderately lower compared to the prior year.

Based on its business momentum, General Mills is once again raising its guidance for fiscal year 2023. The company now expects organic sales to increase 10-11% compared to the previous range of around 10%. Adjusted EPS is now expected to increase 8-9% in constant currency compared to the previous range of 7-8%.