Shares of PepsiCo Inc. (NASDAQ: PEP) were up over 1% on Thursday after the company reported its earnings results for the fourth quarter of 2022. The results surpassed expectations and the outlook did not disappoint either. The company benefited from its growth investments as well as its strong portfolio. Here’s a look at the key takeaways from the report:

Better-than-expected results

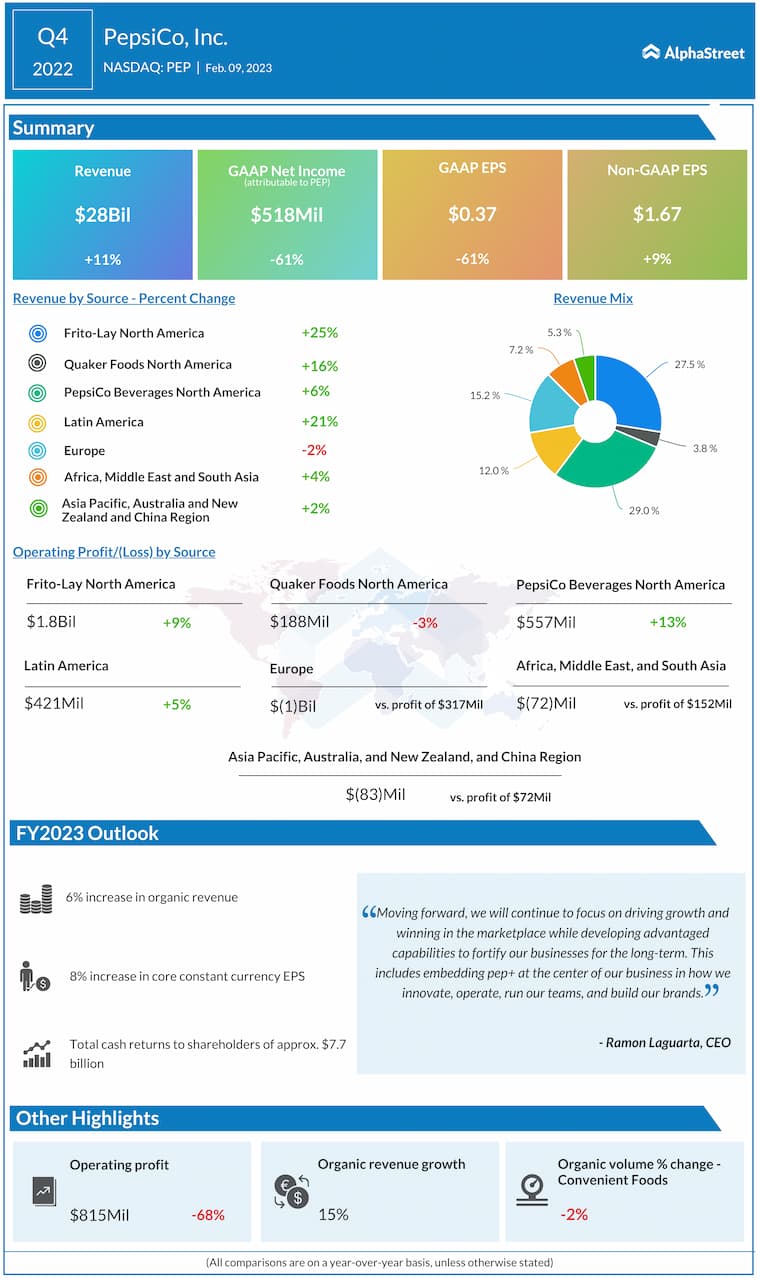

PepsiCo’s revenue increased 11% year-over-year to $28 billion in Q4 2022, beating estimates of $26.8 billion. Core EPS rose 9% YoY to $1.67, surpassing projections of $1.65. Organic revenue grew 14.6%, helped by strong performances from the beverage and convenient foods businesses, despite high inflation and macroeconomic headwinds.

Portfolio performance

During the fourth quarter, the Frito-Lay North America segment delivered organic revenue growth of 17% helped by double-digit revenue growth from brands such as Doritos, Cheetos, Lay’s and Ruffles. The company also saw double-digit revenue growth in smaller, nutritious brands such as PopCorners and SunChips.

The Frito-Lay business saw strong revenue growth across all channels including large format, foodservice, and convenience and gas during the quarter. The growth was also helped by product innovation as the company rolled out new flavors and versions within its leading brands. These included Frito-Lay Minis, which are bite-size versions of Doritos, Cheetos and Sun Chips snacks, new flavors such as tangy tamarind, ketchup and spicy mustard within Doritos, as well as Cheetos Bolitas.

Quaker Foods North America posted 10% growth in organic revenue for the fourth quarter helped by strength in lite snacks, rice and pasta, and ready-to-eat cereal categories. PepsiCo Beverages North America saw organic revenue growth of 10% for the fourth quarter helped by strong demand for brands such as Pepsi, Mountain Dew, Gatorade and Aquafina.

In Q4, the international convenient foods and beverages businesses delivered organic revenue growth of 19% and 8% respectively, helped by strength and resilience in both developed as well as developing and emerging markets.

Outlook

Looking into 2023, PepsiCo expects its North America businesses to remain resilient and its international businesses to perform well. The company expects organic revenue to grow 6% while core constant currency EPS is expected to grow 8%.

Foreign currency headwinds are expected to impact net revenue and core EPS by approx. 2 percentage points. In FY2023, core EPS is estimated to be $7.20, which represents an increase of 6% from core EPS of $6.79 in FY2022.