Shares of Pfizer Inc. (NYSE: PFE) were down over 1% on Tuesday after the company delivered mixed results for the second quarter of 2023 and narrowed its guidance for the full year. The stock has dropped 30% year-to-date. Here are the key takeaways from the Q2 earnings report:

Mixed results

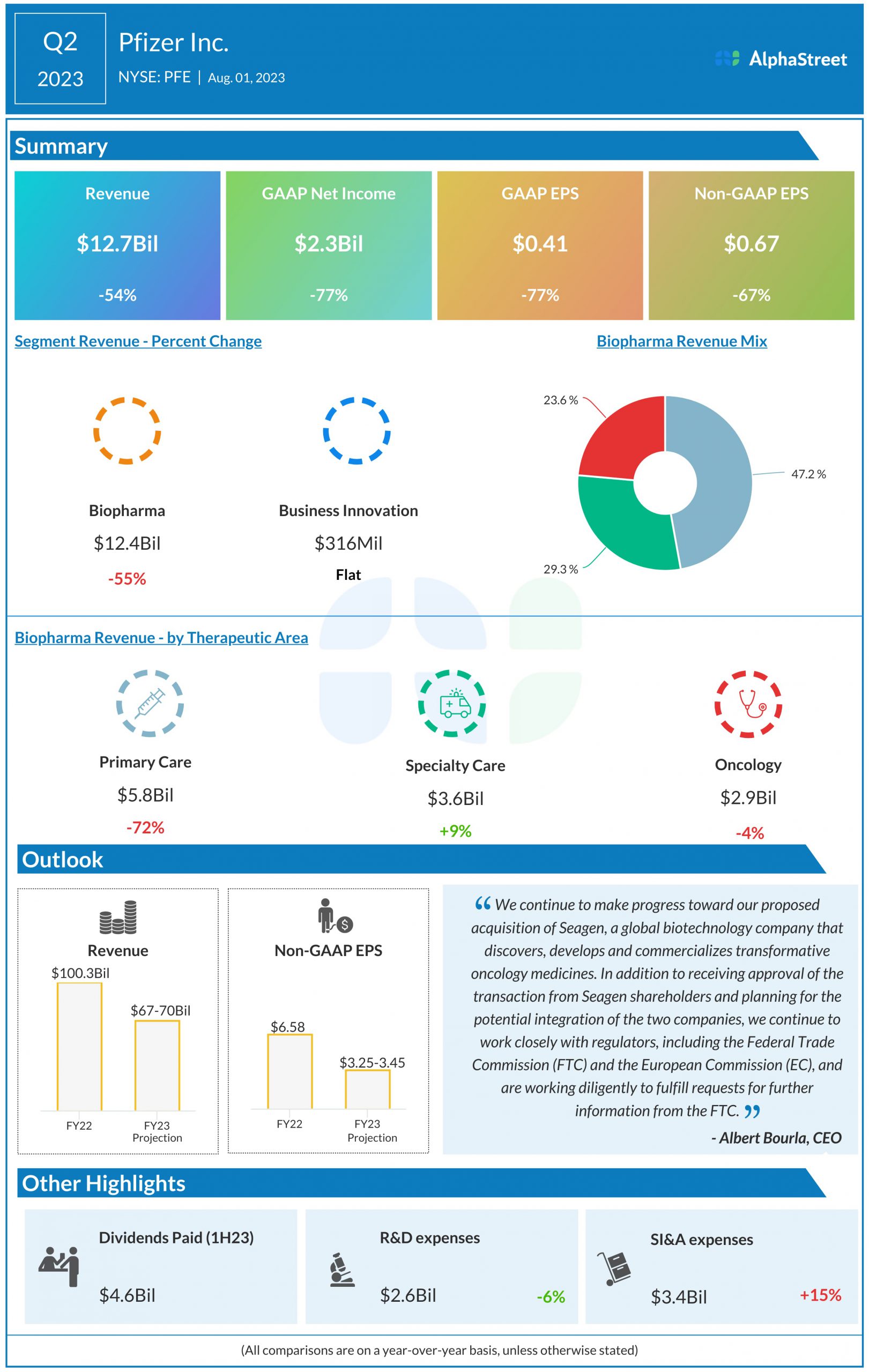

Pfizer’s total revenues decreased 54% year-over-year to $12.7 billion on a reported basis, missing market estimates. Revenues fell 53% on an operational basis. Excluding COVID-19 products, revenues grew 5% operationally. GAAP EPS dropped 77% YoY to $0.41. Adjusted EPS declined 67% to $0.67 but surpassed analysts’ expectations.

COVID-19 portfolio

In the second quarter, revenues from Comirnaty declined 82% operationally compared to the prior-year period. The decline was caused by lower contracted deliveries and demand in international markets as well as lower US government contracted deliveries. Paxlovid revenues decreased 98% operationally, mainly due to the lack of US sales and lower contractual deliveries in most international markets.

On its quarterly conference call, Pfizer said it was facing uncertainty with regards to the demand projections for its COVID-19 products. It expects to gain more clarity during the second half of the year. The company also expects a new wave of COVID-19 to start in the US this fall based on the rise in infection rates it is currently seeing.

Outlook

Pfizer narrowed its revenue guidance for fiscal year 2023 to $67-70 billion from the previous range of $67-71 billion. The midpoint of the guidance range reflects a 31% operational decrease from 2022. Revenues are expected to be down in 2023 versus last year due to lower revenues from COVID-19 products. This decline is expected to be partly offset by the non-COVID-19 portfolio, new product launches, and recently acquired products.

Comirnaty revenues are expected to be down 64% YoY to approx. $13.5 billion in 2023. Paxlovid revenues are projected to be down 58% to approx. $8 billion. Excluding COVID-19 products, Pfizer now expects operational revenue growth of 6-8% in 2023. Adjusted EPS is expected to range between $3.25-3.45 in FY2023.