Holiday Blues

The retailer’s holiday sales were marred by elevated inflation and the squeeze on consumer spending, though its initiatives to revamp the store network and add new features got a fillip after Tom Kingsbury took charge as the chief executive officer. They include extensive store redesign and expansion of Sephora beauty care locations to all Kohl’s stores, after a fruitful initial phase.

However, it will take a long time for those efforts to translate into profitability. The main impediments to the sales turnaround plan are macroeconomic uncertainties and weak consumer confidence. Also, while the company is operating as an omnichannel retailer, its e-commerce sales have been inconsistent. In fiscal 2022, digital sales decreased by 7%, with digital penetration representing 32% of net sales.

“We have made progress over the past couple of years in our pricing and promotional optimization efforts. We will build on this progress in 2023, accelerating our efforts to reduce our reliance on general promotions. We will test everyday value pricing with a small percentage of our product assortment and, if successful, grow it appropriately in subsequent years. We fully recognize the sensitivities around pricing with our customers, and we’ll approach this with great measure and flexibility,” said Tom at the fourth-quarter earnings call.

Under Pressure

The Wisconsin-based retailer has been under pressure from investors for its lackluster financial performance. At one point, the company was on the verge of a takeover but the sale bid was later scrapped. Meanwhile, the intense investor scrutiny led to the exit of CEO Michelle Gass last year amid calls from activist investors for a change in leadership.

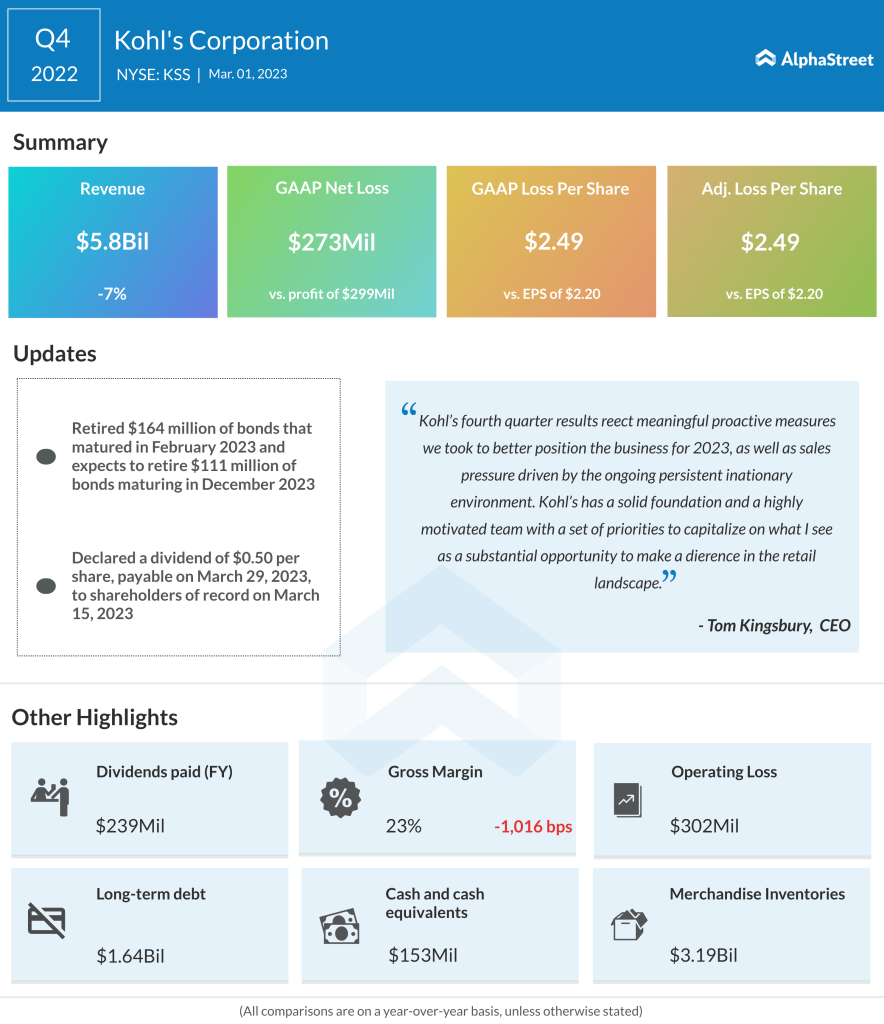

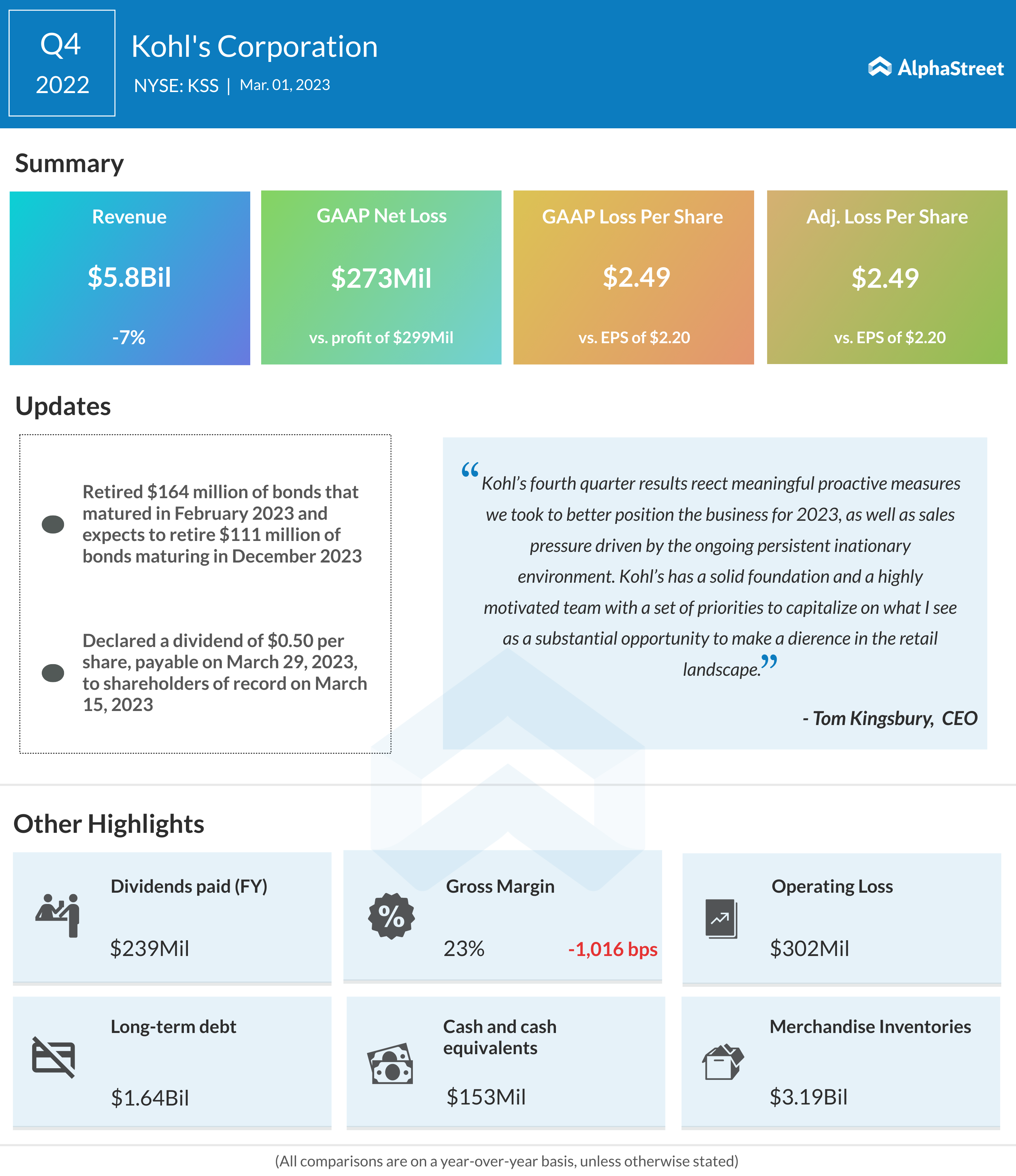

The company ended fiscal 2022 on a dismal note by reporting a net loss for the fourth quarter, defying expectations for profit. It incurred a loss of $2.49 per share for the December quarter, excluding special items, mainly due to a 7% decline in revenues to $5.8 billion. While the bottom line beat the Street view in the preceding quarter, it missed in the first and second quarters of the year.

After making a steady recovery in the early weeks of the year, Kohl’s shares changed course and have pared most of those gains. The stock traded lower in Wednesday’s session.