Tailwinds

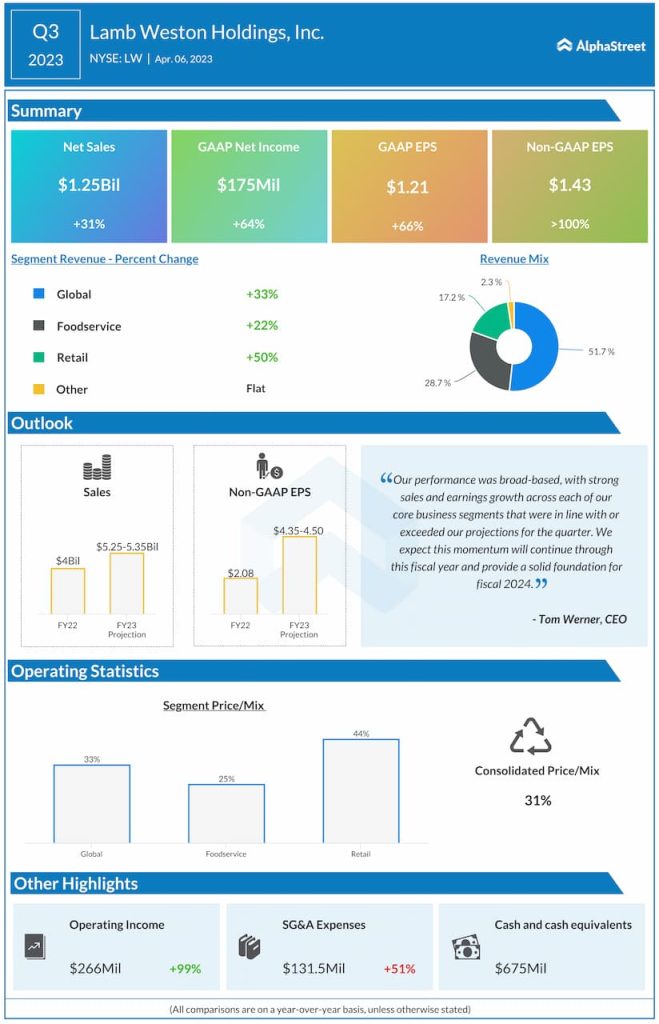

Lamb Weston saw profit growth and margin expansion during the quarter. In Q3, GAAP net income increased 64% to $175 million, or $1.21 per share. On an adjusted basis, EPS more than doubled to $1.43. Gross profit jumped 80% to around $398 million while gross margins expanded 860 basis points to 31.7% versus the prior-year quarter.

The company witnessed healthy growth within the French fries category despite a challenging environment. The potato products maker saw an improvement in total restaurant traffic during the third quarter compared to the previous year, driven almost entirely by quick-service restaurants (QSRs), with particular strength across burger and chicken restaurant chains, which are major contributors in driving demand for fries.

On its quarterly conference call, Lamb Weston said the fry attachment rate remained solid. Fry attachment rate is the rate at which consumers order fries when visiting food service outlets. The company also saw solid demand for fries in food-at-home channels. In Q3, shipments in the Retail segment grew, driven by gains in products sold under licensed restaurant brands. It expects the strong demand in this channel to continue into fiscal year 2024.

The addition of Lamb Weston Europe, Middle East and Africa, or Lamb Weston EMEA, is another tailwind for the company. This acquisition adds six factories and around GBP2 billion of production capacity to the company’s global manufacturing footprint, which will increase its ability to serve customers in major markets around the world.

Lamb Weston raised its guidance for the full year of 2023. The company now expects net sales to range between $5.25-5.35 billion versus its previous range of $4.8-4.9 billion. Around $300-325 million of this increase reflects the consolidation of LW EMEA while the remaining $100-150 million increase reflects its strong performance in Q3 and expected momentum in Q4. Adjusted EPS is now expected to be $4.35-4.50 versus the prior range of $3.75-4.00.

Headwinds

In the third quarter, Lamb Weston’s overall volume remained flat as growth in shipments to large chain restaurant and retail channel customers in North America offset the impact of exiting certain lower-priced and lower-margin business. A drop in traffic at casual dining and full-service restaurants in North America also impacted volumes. Volumes remained flat in the Global segment while in Foodservice, it fell 3% due to a slowdown in casual and full-service restaurant traffic.

The company expects to see a volatile macro environment in North America and Europe in the near term due to higher input costs and inflationary pressures on consumer demand and restaurant traffic.

On its call, Lamb Weston said it expects changes in product mix and consumer demand to pressure its production in the near term and in turn shipments of high-demand products such as retail and premium fries and batter-coated products. It expects the pressure on volume and its ability to meet rising consumer demand will continue until the capacity investments in Idaho, China, Argentina and the Netherlands become available over the next few years.