Positive Outlook

Mastercard’s business is pretty stable since people use credit cards for convenience and also as a substitute for cash. With more and more customers and merchants getting used to the benefits of using credit cards, demand will keep increasing. Interestingly, Mastercard does not essentially compete with Visa Inc. (NYSE: V) because the companies have a comfortably high number of merchants and customers in their respective networks, and the market is growing.

Mastercard Incorporated Q3 2022 Earnings Call Transcript

The company looks to overcome the effects of high inflation and geopolitical issues by focusing on the modulation of expenses and continued business expansion through programs like the Digital First initiative and capturing of new payment flows.

Mastercard’s CEO Michael Miebach said at the last earnings call “…the macroeconomic and geopolitical environment remains uncertain. Inflationary pressures have remained elevated and central banks are continuing to take aggressive steps to bring inflation in line. Pensions remain high with the war in Ukraine and the supply of natural gas to Europe is a concern. Despite all of this, unemployment rates remain low, wages are rising, consumer savings levels remain elevated, and credit is readily accessible.”

Since Mastercard’s capital spending as a percentage of revenue is moderate, as it already has a full-fledged payment network in place, the operating margin is relatively higher. It is worth noting that in the most recent quarter, the company generated a net profit which is a whopping 43% of its revenue for the period. After missing in the preceding quarter, third-quarter profit topped expectations, as it did in almost every quarter over the past eight years.

Strong Q3

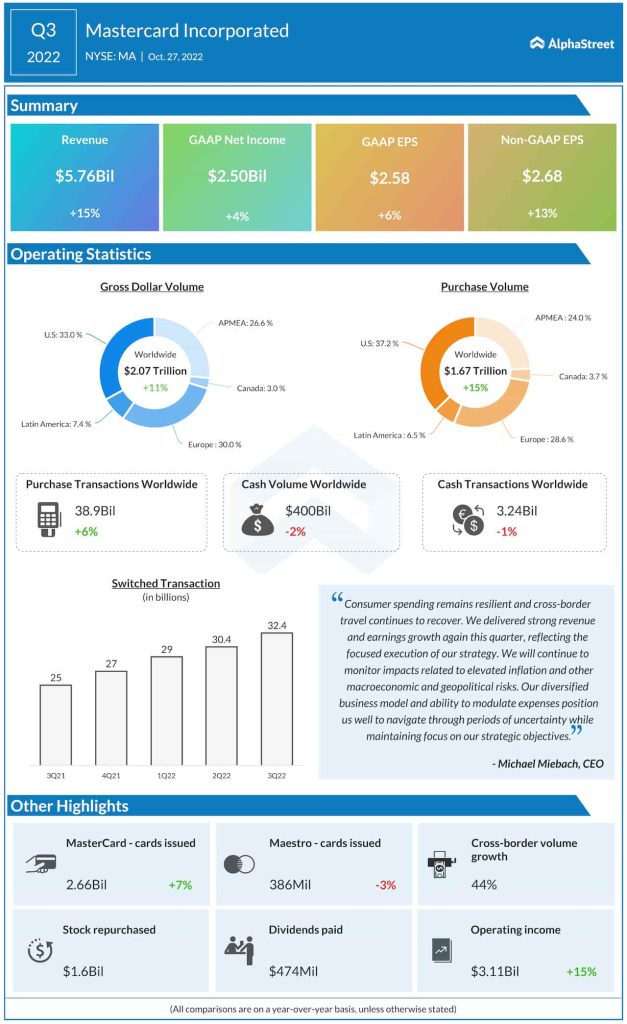

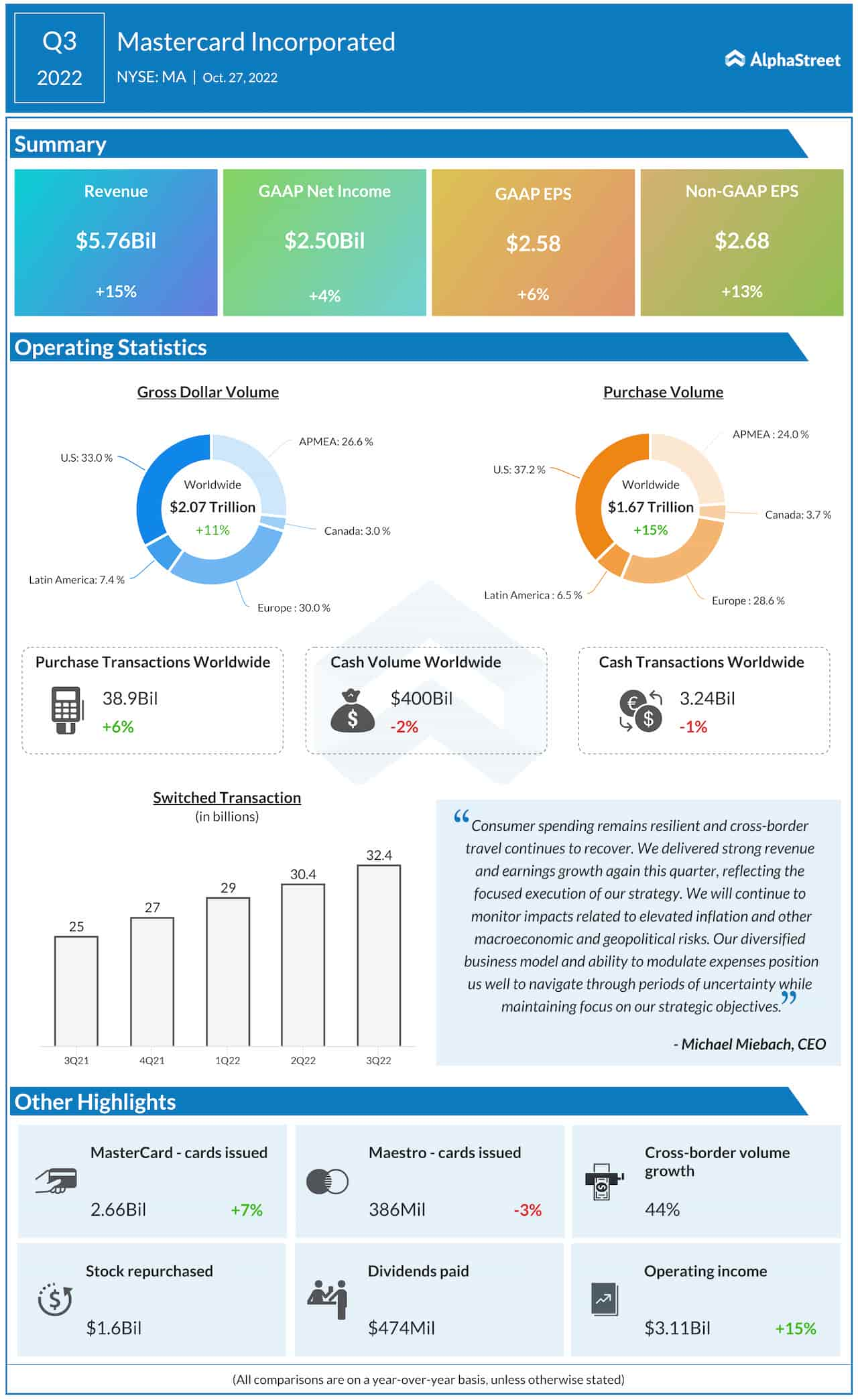

Gross dollar volume and purchase volume grew by double digits in the September quarter, and total revenue rose 15% to $5.8 billion. That translated into a 13% increase in adjusted earnings to $2.68 per share. The management continues to return capital to shareholders – repurchased $1.6 billion of shares in Q3 – thanks to the healthy cash flow.

In the rapidly changing payments market, meanwhile, credit card companies face the risk of losing market share to fintech companies, with the latter’s virtual cards gaining popularity. Also, the lingering recession risks do not bode well for Mastercard because it ultimately affects consumers’ spending power.

Visa stock can add value to your portfolio. Here’s why

While most Wall Street stocks languish below their long-term average values, MA remains an exception. On Friday, the stock was above the $ 370 mark and it traded higher in the early hours of the session.