Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) were up over 5% on Thursday. The stock has gained 26% over the past three months. The company delivered revenue growth for the second quarter of 2025, with strong performance from its core franchises. It also has an encouraging content pipeline which positions it well for future growth. Here are the main points from the Q2 report:

Revenue and earnings

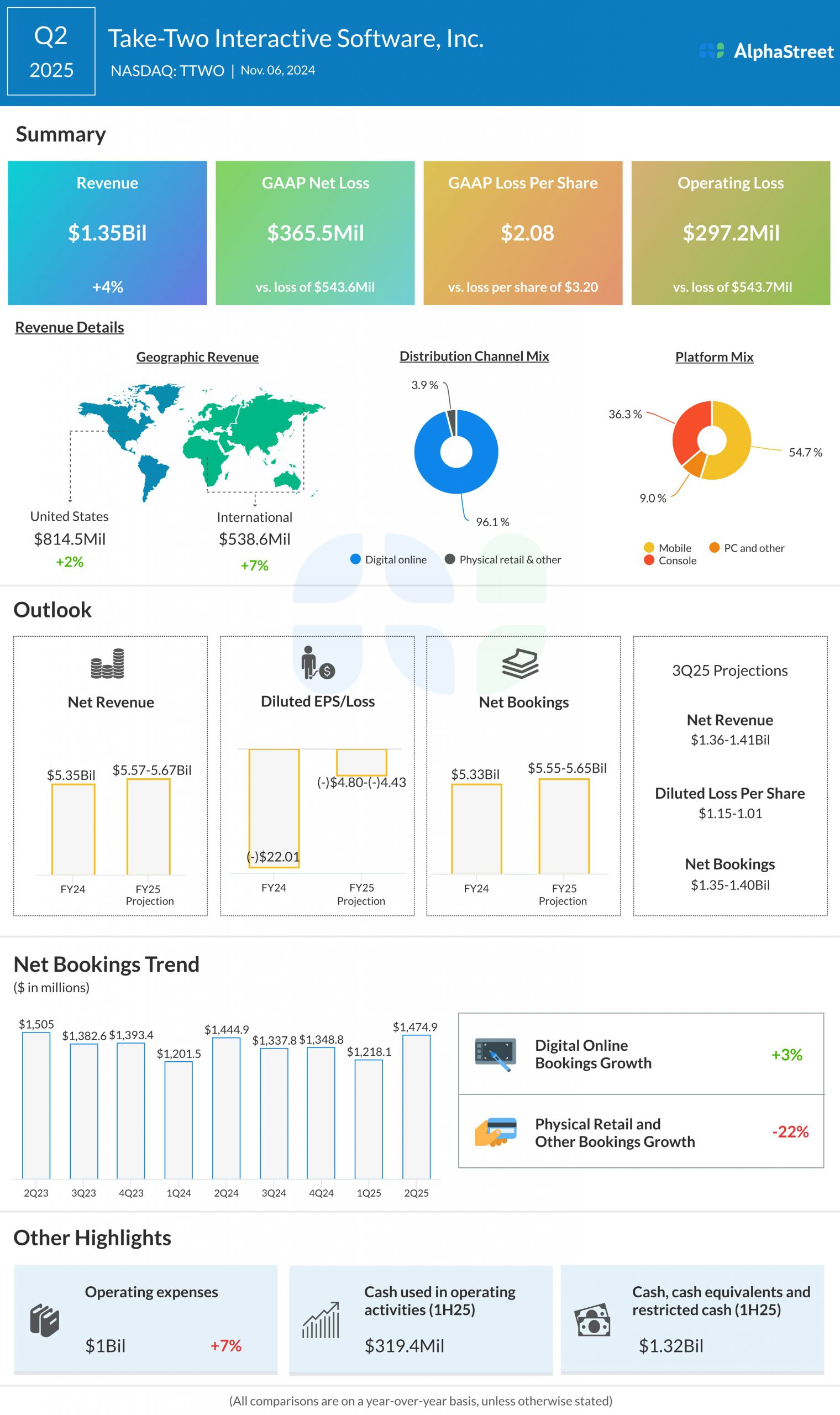

Take-Two’s net revenue increased 4% to $1.35 billion in Q2 2025 compared to the same period a year ago. Net loss was $365.5 million, or $2.08 per share, compared to $543.6 million, or $3.20 per share, last year.

Business performance

In Q2, net bookings grew 2% year-over-year to $1.47 billion. The largest contributions to net bookings came from NBA 2K25 and NBA 2K24, Grand Theft Auto Online and Grand Theft Auto V, Toon Blast, the hyper-casual mobile portfolio, Match Factory!, Empires & Puzzles, Words With Friends, Red Dead Redemption 2 and Red Dead Online, and Toy Blast. Recurrent consumer spending increased 8% in Q2.

As mentioned on the quarterly call, TTWO recorded better-than-expected sales for Grand Theft Auto V in Q2. To-date, the title has sold-in more than 205 million units worldwide. It also saw strong engagement for Grand Theft Auto Online. Red Dead Redemption 2 also performed well and has sold-in more than 67 million units to-date. NBA 2K25 has sold-in nearly 4.5 million units to-date. It also delivered double-digit growth in average revenue per user and 40% growth in average games per user.

Zynga performed well in Q2, driven by growth in Match Factory and Toon Blast. Toon Blast saw net bookings increase more than 50% over last year. TTWO is also working on expanding its offerings within its direct-to-consumer business.

Outlook

For the third quarter of 2025, Take-Two expects net bookings to range between $1.35-1.40 billion, with the largest contributions coming from NBA 2K, the Grand Theft Auto series, Toon Blast, the hyper-casual mobile portfolio, Match Factory, Empires & Puzzles, the Red Dead Redemption series, Words with Friends, and Merge Dragons. The company expects recurrent consumer spending to increase by around 9% in Q3. Net revenue is expected to be $1.36-1.41 billion.

For the full year of 2025, net bookings are expected to be $5.55-5.65 billion, representing a YoY growth of 5%. The largest contributors to bookings are expected to be NBA 2K, the Grand Theft Auto series, Toon Blast, the hyper-casual mobile portfolio, Match Factory, Empires & Puzzles, the Red Dead Redemption series, Sid Meier’s Civilization VII, and Words with Friends. Recurrent consumer spending is expected to grow approx. 4%. Net revenue is expected to be $5.57-5.67 billion.