Fast food chain McDonald’s Corporation (NYSE: MCD) delivered unimpressive sales performance in the early half of the year, reflecting cautious consumer spending amid high inflation. The company is busy innovating core menu offerings to give customers a better experience, with the highlight being the launch of value meals.

McDonald’s stock suffered a major selloff this week following reports of an E. coli outbreak linked to its Quarter Pounder burgers. While the company withdrew the affected dish from its menu and initiated a review of its suppliers, the pullback extended into mid-week. Recently, the stock had hit a record high of $316.56, before losing momentum and entering a rough patch ahead of the upcoming earnings. However, MCD remains a good long-term investment, considering the attractive dividend yield and payout ratio.

Q3 Report Due

When the burger behemoth publishes its third-quarter 2024 report next week, the market will be expecting adjusted earnings of $3.20 per share, an increase of one cent from the comparable quarter of 2023. The consensus revenue estimate for the September quarter is $6.81 billion. In the prior-year quarter, the company generated revenues of $6.7 billion. The report will be out on Tuesday, October 29, at 7:00 am ET.

McDonald’s massive scale and successful franchise model have been the main driving force behind its consistent growth over the years, catalyzed by continued investments in the business and adoption of new technology. Meanwhile, the quick-service restaurant industry is currently facing a slowdown across markets where McDonald’s operates, including the US, Australia, Canada, and Germany. Besides economic uncertainties and inflation, geopolitical issues like the war in the Middle East are also taking a toll on customer traffic.

From McDonald’s Q2 2024 earnings call:

“The unique competitive advantages of McDonald’s afford us many levers to pull, and we have the financial wherewithal to sustain our investments as needed. One area of strength is our restaurant teams who continue to execute with excellence to serve our customers in local communities, creating a better customer experience has delivered operational improvements, improved service times, and increased customer satisfaction across most of our major markets.”

Weak Q2

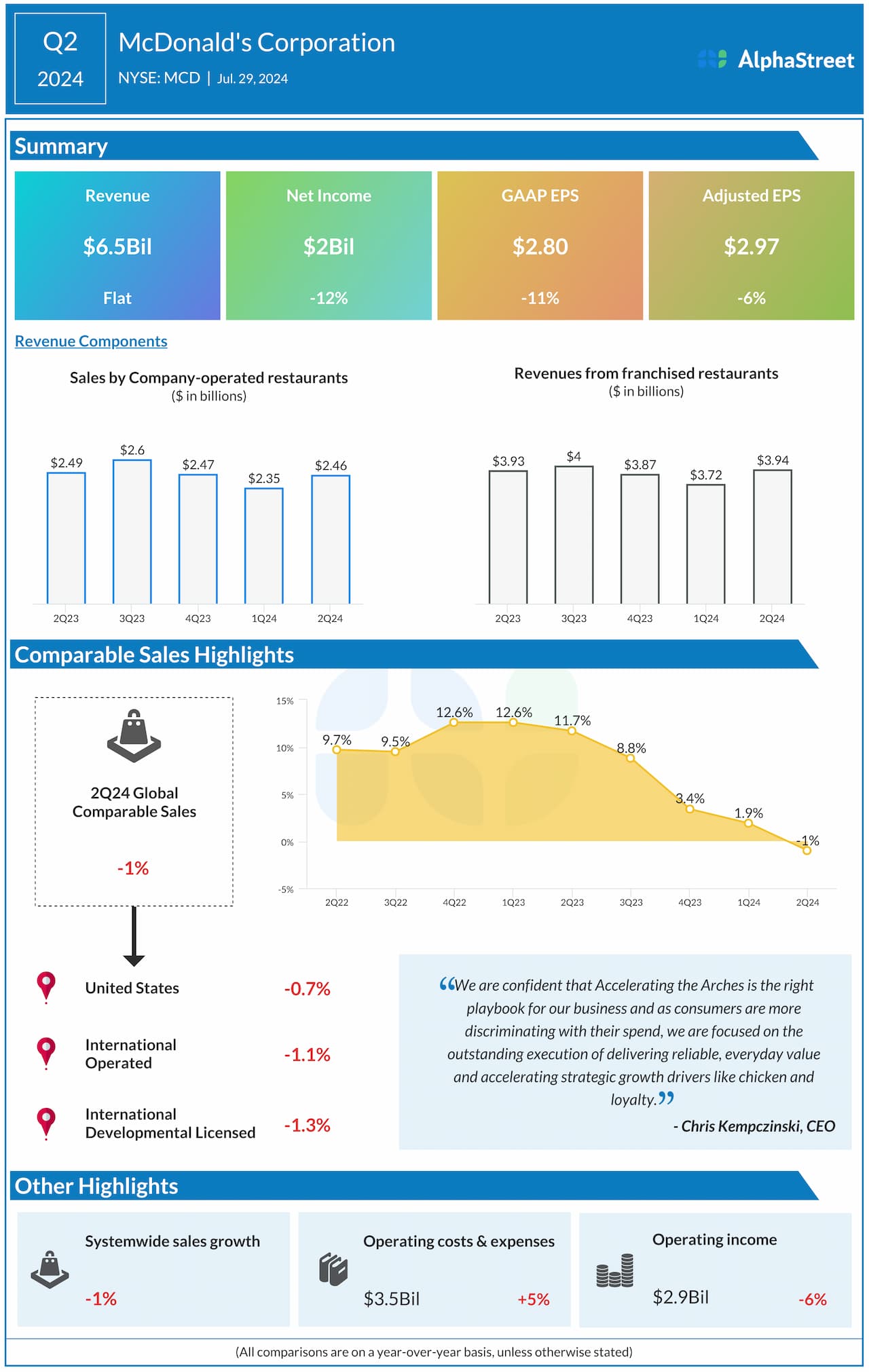

In the second quarter, the company’s consolidated revenue remained broadly unchanged at $6.5 billion. Earnings decreased 6% year-over-year to $2.97 per share during the three months, on an adjusted basis. Reported net income decreased by 12% to $2 billion, while earnings per share dropped 11% to $2.80, compared to the prior-year period. Both numbers missed analysts’ forecasts.

On Wednesday, McDonald’s stock traded down 5% in the afternoon, continuing the downtrend seen since the beginning of the week. The current value is the lowest since mid-September.