Thriving on its steady market share growth and innovative products, Micron Technology Inc. (NASDAQ: MU) has successfully navigated the ups and downs of the industry so far and reaffirmed its dominance in the memory and storage solutions market. While remote work and digital transformation helped the chipmaker overcome the impact of coronavirus to a large extent, volatile demand and inventory issues remain a concern.

This week, Micron’s stronger-than-expected fourth-quarter results failed to impress the market as investor sentiment fell amid concerns over the company’s decision to discontinue shipments to Huawei Technologies. Earlier, the China-based network gear maker had faced the ire of the US government for alleged breach of intellectual property rights. Micron’s management expects to offset the Huawei impact by the end of the second quarter.

Cautious View

Commenting on the results, Micron’s CEO Sanjay Mehrotra said in his opening remarks during the fourth-quarter earnings call, “The positive momentum in our financial performance in the calendar year 2020 has been interrupted by the unprecedented combination of a global pandemic, and US restrictions on shipments to Huawei. As we look towards the second half of fiscal 2021, we expect that the underlying momentum in our product portfolio and secular industry drivers such as AI and 5G will drive materially better financial and business performance.”

Shares of the tech firm pared their recent gains after the earnings announcement and opened Wednesday’s session lower. But it’s a matter of time before they emerge from the temporary slump and regain footing, with experts predicting that the value would grow by a fifth this year. In short, the company is unlikely to let down new investors and long holders, given the favorable valuation and stable orders. In recent years, Micron generated profit that consistently exceeded expectations, irrespective of market volatilities.

Not a Smooth Ride

In the current situation, it might not be easy for the company to find new customers to replace Huawei, which accounted for about 10% of its sales in the most recent quarter.

Though long-term demand looks impressive, the pandemic-driven downtrend in enterprise spending on IT solutions and inventory build-up has left the market speculating about the company’s growth prospects. It needs to be noted that the industry is already suffering from an excess supply of flash memory chips.

Micron’s executives are optimistic about its fabrication plants adding more capacity in the near future, citing the improvement in production since the early days of the crisis. Given the high capital investment involved, it is crucial for the company to achieve full production capacity to ensure optimal return on investment.

Cuts Capex

The management has trimmed its capital spending program but largely maintained the pipeline, with a slew of SSD and Mobile NAND products slated for launch in the coming quarters. This year, the company expects to tap the unveiling opportunity in the data center space and bets on the pandemic-driven cloud migration to offset the weakness in traditional on-site enterprise demand. An anticipated recovery in the smartphone business, combined with the 5G ramp, is another promising factor.

Also read: Micron Q4 2020 Earnings Transcript

Economic recovery from the sharp recession in calendar Q2 is underway, but the pace has been limited by the continuation of the pandemic. Smartphone, auto, and consumer end-markets have started to recover, and we see further demand improvements ahead. Cloud and laptop demand continues to be healthy, supported by the work-from-home, and shop from home trends. Gaming demand is robust.

ADVERTISEMENT

Sanjay Mehrotra, chief executive officer of Micron

Upbeat Start to FY21

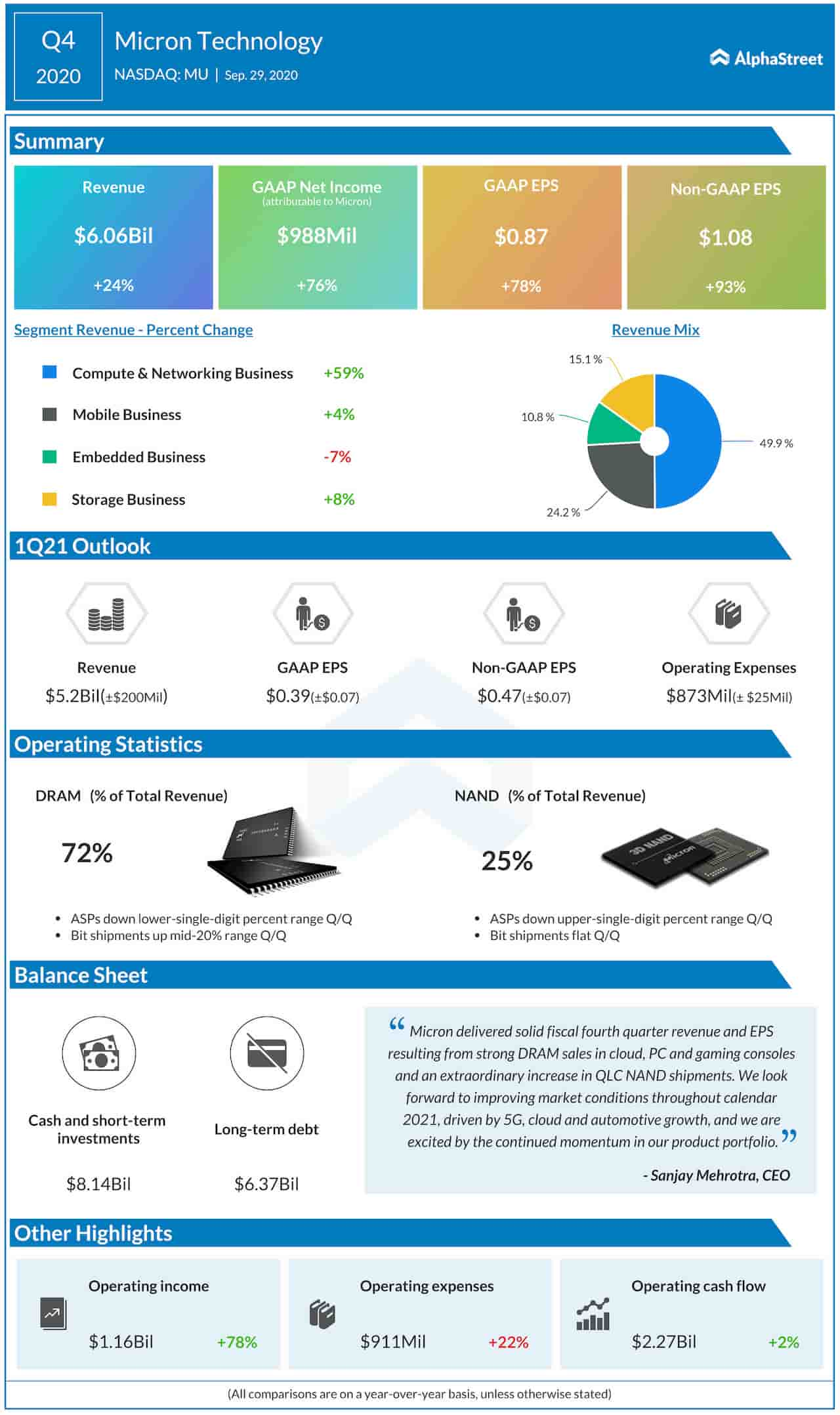

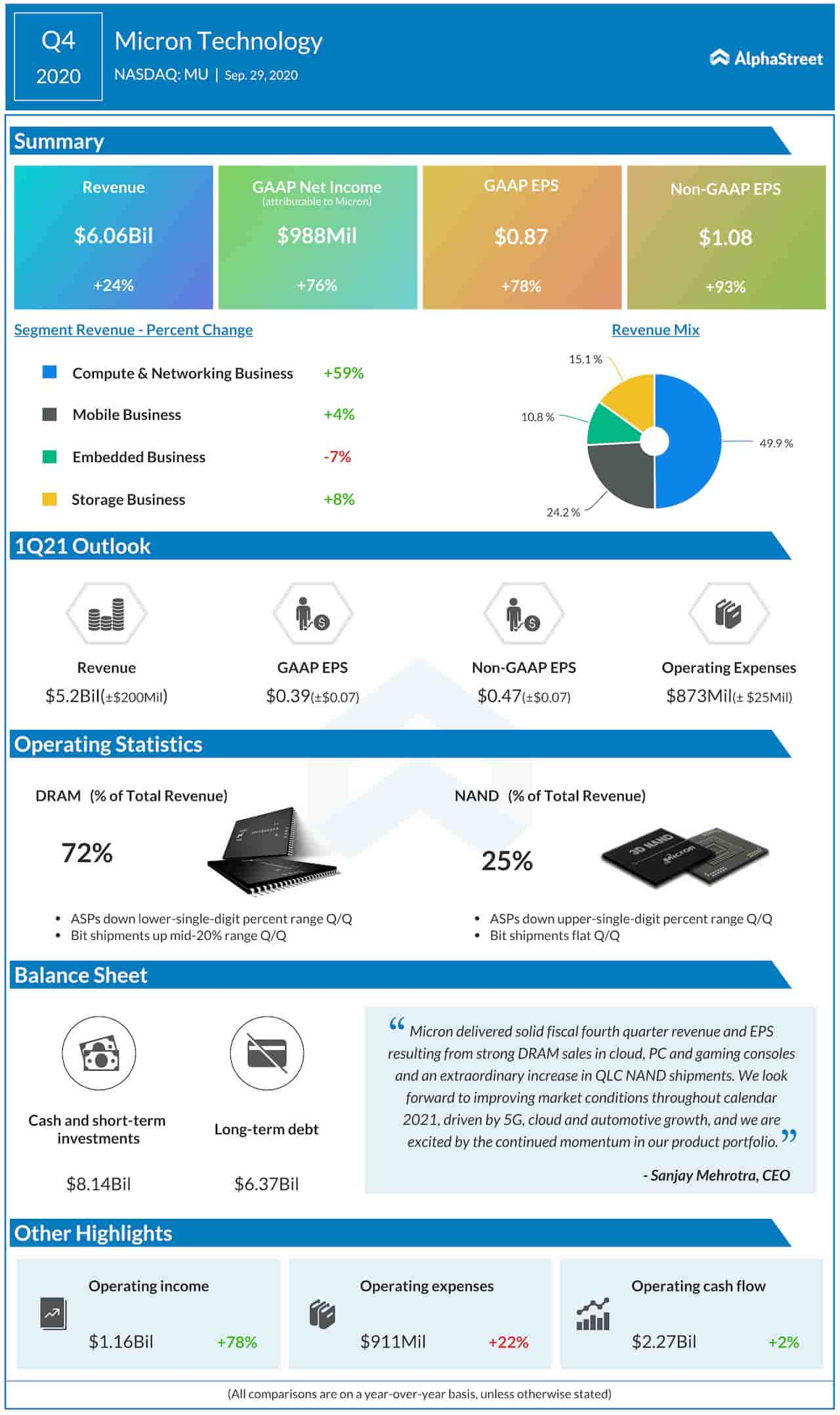

The core Compute & Networking business recorded a sharp increase in the final three months of the fiscal year, resulting in a 24% growth in total revenues to about $6 billion. The solid top-line performance, supported by higher Mobile and Storage business revenues, drove up earnings to $1.08 per share. Market watchers had predicted slower growth for the bottom-line and revenues. The results benefited from the high demand for DRAM and NAND memory chips, especially in the gaming and cloud sectors.

Read management/analysts’ comments on quarterly reports

Micron’s market value has been on a steady uptrend for quite some time, except during the pandemic period. The stock has gained 7% in the past twelve months and partly recovered from the virus-induced pull-back in the early months of the year. However, it underperformed the benchmark Philadelphia Semiconductor Index during that period.