Q2 2021 results

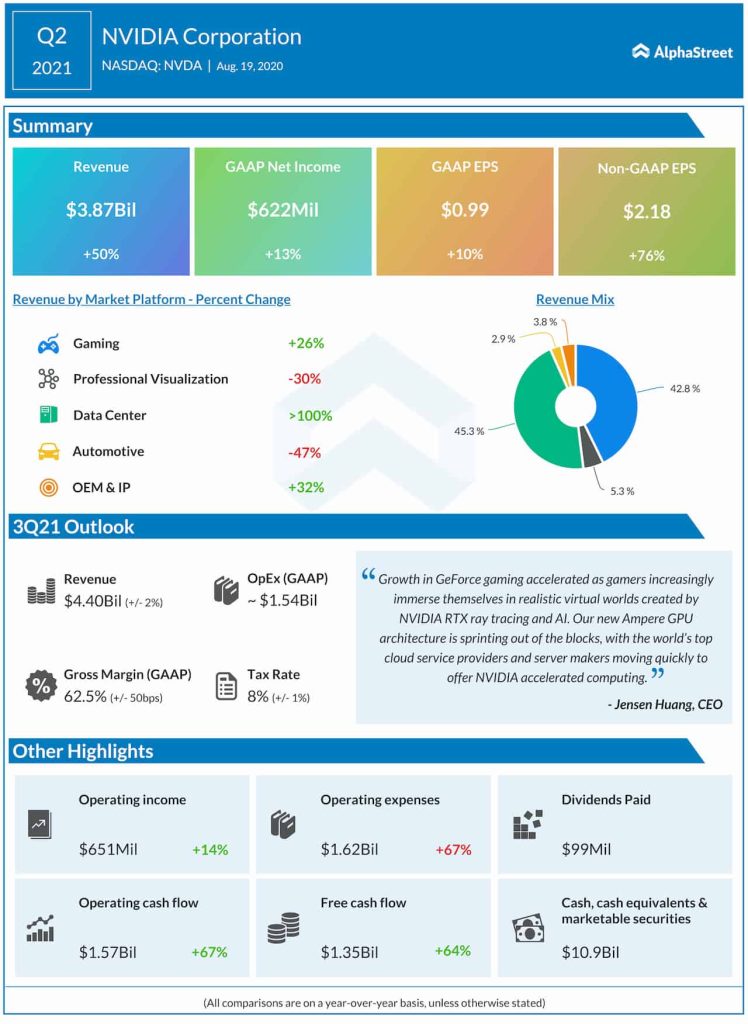

Gaming revenue rose 26% to $1.65 billion in Q2. At the outset of the pandemic, many retail outlets were closed and demand shifted to online channels. As the quarter progressed and the stores reopened, retail demand picked up, cafes largely reopened and online sales continued to thrive. The demand for gaming laptop was very strong as students and professionals turned to GeForce-based systems to improve how they work, learn and game from home.

Related: Nvidia Q2 earnings beat; revenue up 50%

Professional Visualization division revenue was $203 million, down 30% year-on-year with declines in both mobile and desktop workstations. Sales were hurt by lower enterprise demand and the closure of many offices around the world. Industries negatively impacted during the quarter include automotive, architecture, engineering and construction, manufacturing, media and entertainment, and oil & gas.

Automotive revenue was $111 million, down 47% year-on-year. The impact of the pandemic was less pronounced than expected, with auto production volumes starting to recover after bottoming in April.

Outlook

The GPU giant’s revenue guidance for the fiscal third quarter topped the analysts’ views. Nvidia projected revenue to be $4.4 billion, plus or minus 2%. Revenue from gaming is forecast to be up just over 25% sequentially, with data center to be up in the low-to-mid single-digits sequentially.

Also read: Intel (INTC) Q2 revenue up 20%; earnings top view

During the Q2 earnings call, CFO Colette Kress stated that data center will have a strong Q3 despite the COVID challenge.

“We have a little bit more of a mixed outlook in terms of our vertical industries, given a lot of the uncertainty in the market and in terms of the overall economy. On-premises are challenged, because of the overall COVID, but remember, industries are quickly and continuing to adopt and move to the overall cloud, but overall, we do expect a very strong Q3.”

ADVERTISEMENT

Nvidia expects gaming to be strong in the second half of the year. The company expects it to be the one of the best gaming seasons ever as PC gaming has grown strongly and the way people spend their time for gaming now.

Stock performance

The Philadelphia Semiconductor Index (SOX) fell 0.9% yesterday as most of its constituents ended with negative returns. Nvidia stock had soared 106% so far this year and 189% in the past 12 months.