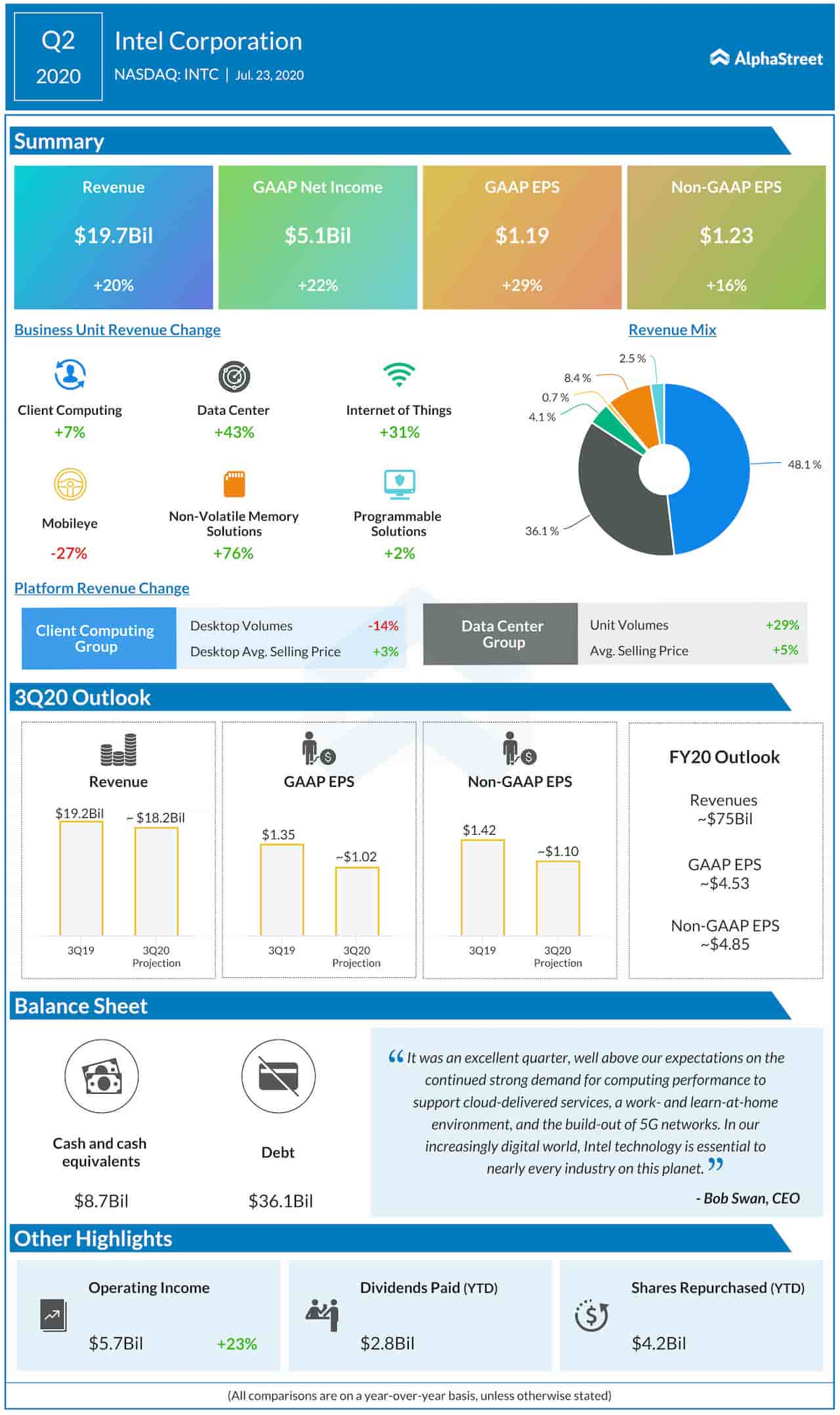

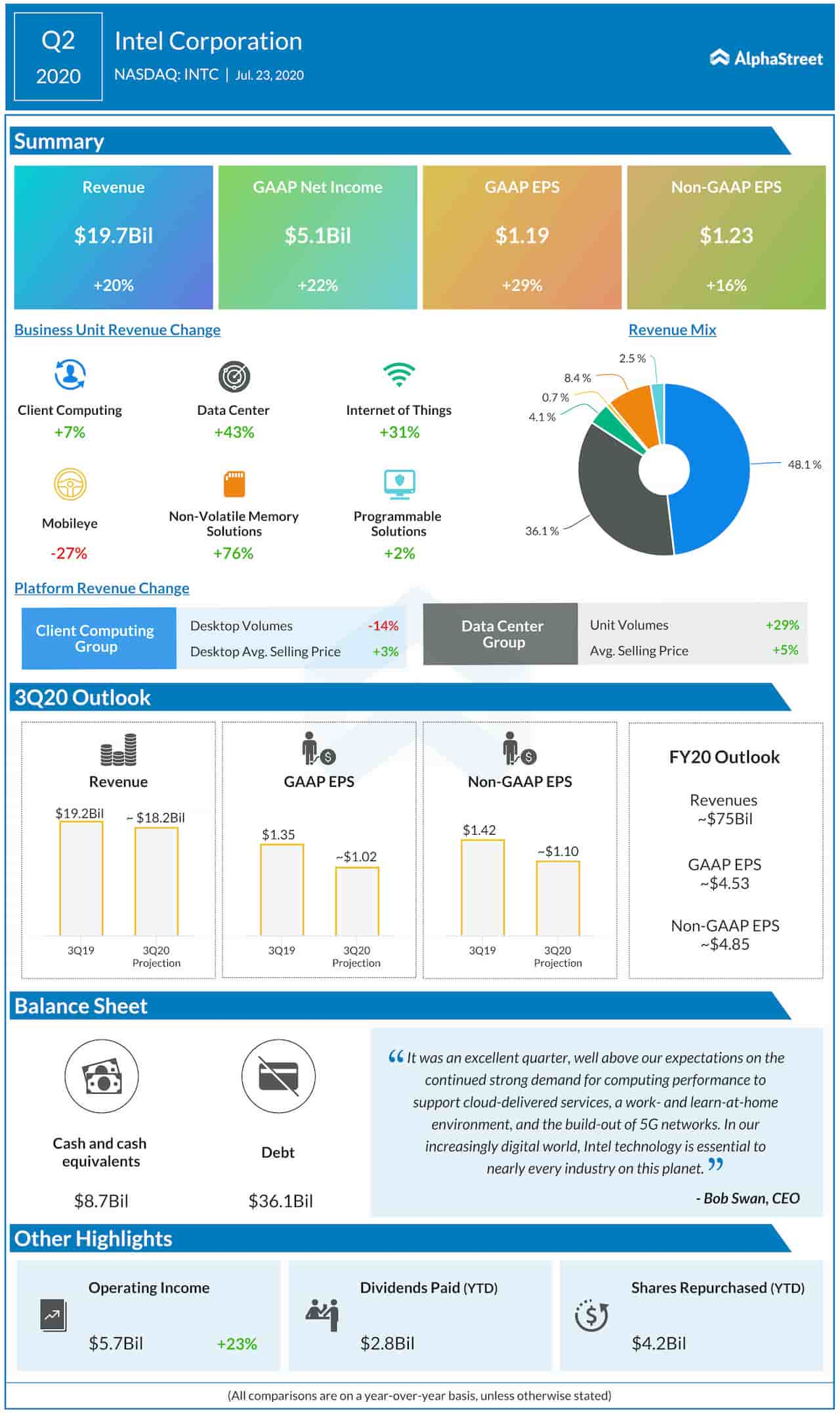

Chipmaker Intel Corporation (NASDAQ: INTC) reported a 20% growth in second-quarter revenues, reflecting the strong demand for cloud services during the COVID-related shutdown. However, the stock declined on Thursday evening due to the weak guidance issued by the management.

Earnings, excluding special items, moved up to $1.23 per share from $1.06 per share in the second quarter of last year. Unadjusted net income rose to $5.1 billion or $1.19 per share from $4.2 billion or $0.92 per share a year earlier. The bottom line topped expectations.

At $19.7 billion, total revenues were up 20% year-over-year and above analysts’ consensus estimate. Intel’s stock dropped during Thursday’s after-hours trading, after closing the regular session lower.

“In our increasingly digital world, Intel technology is essential to nearly every industry on this planet. We have an incredible opportunity to enrich lives and grow this company with a continued focus on innovation and execution,” said CEO Bob Swan.