Shares of PepsiCo Inc. (NASDAQ: PEP) were up 4% on Wednesday after the company delivered solid results for the third quarter of 2022 and hiked its full-year forecast. Revenue and earnings both surpassed expectations and the strong business momentum encouraged the company to raise its outlook for organic revenue and core constant currency EPS for the full year.

Quarterly performance

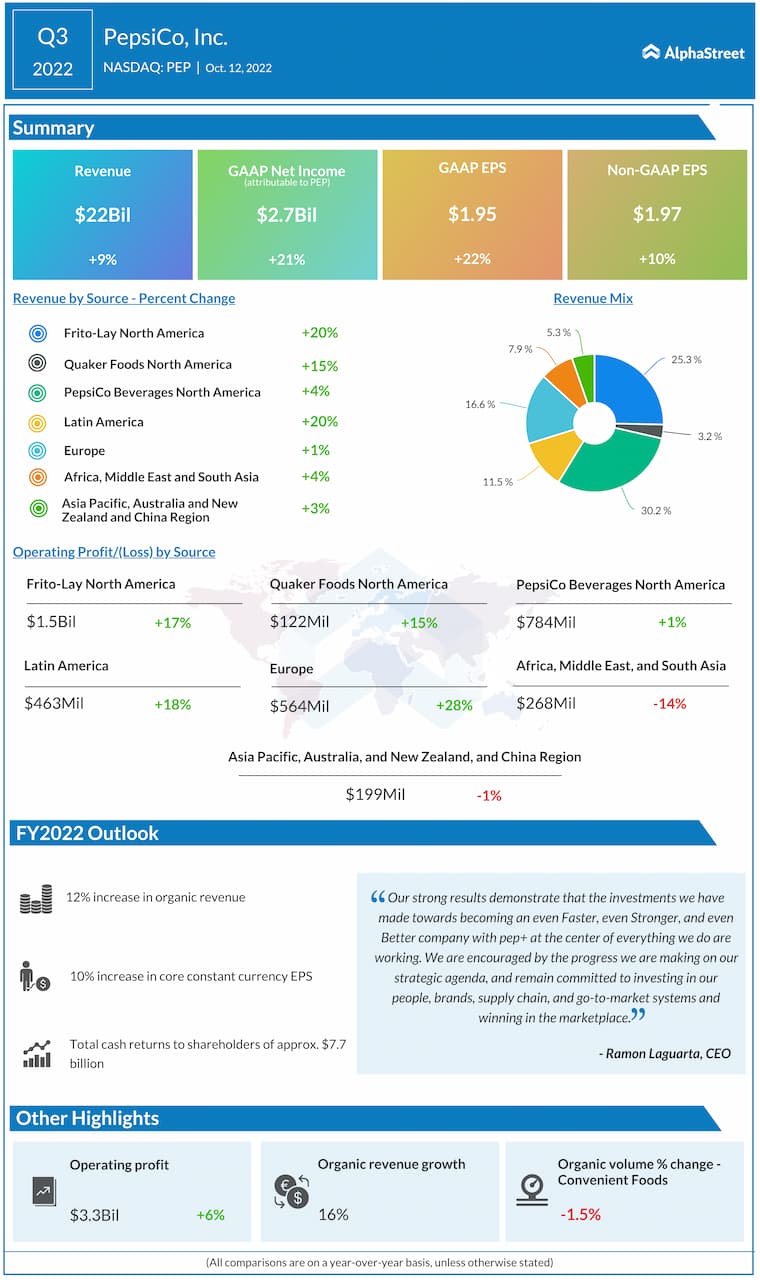

PepsiCo’s Q3 net revenue increased 9% year-over-year to $21.97 billion, beating estimates of $20.8 billion. Organic revenue grew 16%. GAAP net income increased 21% YoY to $2.7 billion, or $1.95 per share. Core EPS rose 10% to $1.97, surpassing projections of $1.84.

Trends

During the quarter, PepsiCo recorded strong organic revenue growth across all its geographies. The company’s North America and International businesses each posted organic revenue growth of 16% in Q3.

The Frito-Lay North America and Quaker Foods North America segments both delivered double-digit organic revenue growth with share gains in salty and savory snacks, lite snacks, rice and pasta, ready-to-eat cereal and hot cereal categories.

Within Frito-Lay, PepsiCo witnessed strong performances from popular brands such as Cheetos, Doritos, and Lay’s. The company’s strategy of providing healthy snacking options for customers is paying off as smaller, nutrition-focused brands such as PopCorners and SunChips also did well during the quarter, delivering double-digit revenue growth.

The company continued its product innovation efforts as it released new flavors under its Doritos, Cheetos, SunChips and Lay’s brands during the quarter. The Frito-Lay segment delivered strong revenue growth across all channels, including double-digit increases in the large format, foodservice, and convenience and gas channels.

Organic revenues in the PepsiCo Beverages North America segment increased 13% in Q3 helped by double-digit revenue growth in brands such as Gatorade and Pepsi. The company is investing in fast-growing, high-profit categories in order to improve margins in this division.

As part of these efforts, PepsiCo is expanding its presence in the energy and low-alcohol categories and investing in zero sugar offerings. It is also looking to strengthen its position in the sports nutrition category with the launch of the Gatorade Fast Twitch sports drink for athletes.

PepsiCo saw strong organic revenue growth across its international divisions with double-digit increases in places like Latin America, Mexico, Brazil and Chile. The company also witnessed strong performances in developed markets, with double-digit organic revenue growth in regions such as the UK, France and Spain.

Outlook

PepsiCo continues to see strong business momentum and it expects its snacks and beverages divisions to do well through the remainder of the year. Based on these expectations and a strong year-to-date performance, the company raised its guidance for the full year of 2022.

The company now expects organic revenue to grow 12% versus the previous outlook of 10%. Core constant currency EPS is now expected to increase 10% versus the prior estimate of 8%. Core EPS is expected to be approx. $6.73 in FY2022, up around 7.5% compared to last year.

Click here to access the full transcripts of the latest earnings conference calls