Shares of Pinterest Inc. (NYSE: PINS) were up over 5% on Friday, a day after the company delivered better-than-expected results for the third quarter of 2021. Although revenue and earnings surpassed expectations, monthly users didn’t show much growth. Despite this, there is a fair bit of optimism surrounding the stock and here are a few things to keep in mind if you have an eye on it:

Strengths

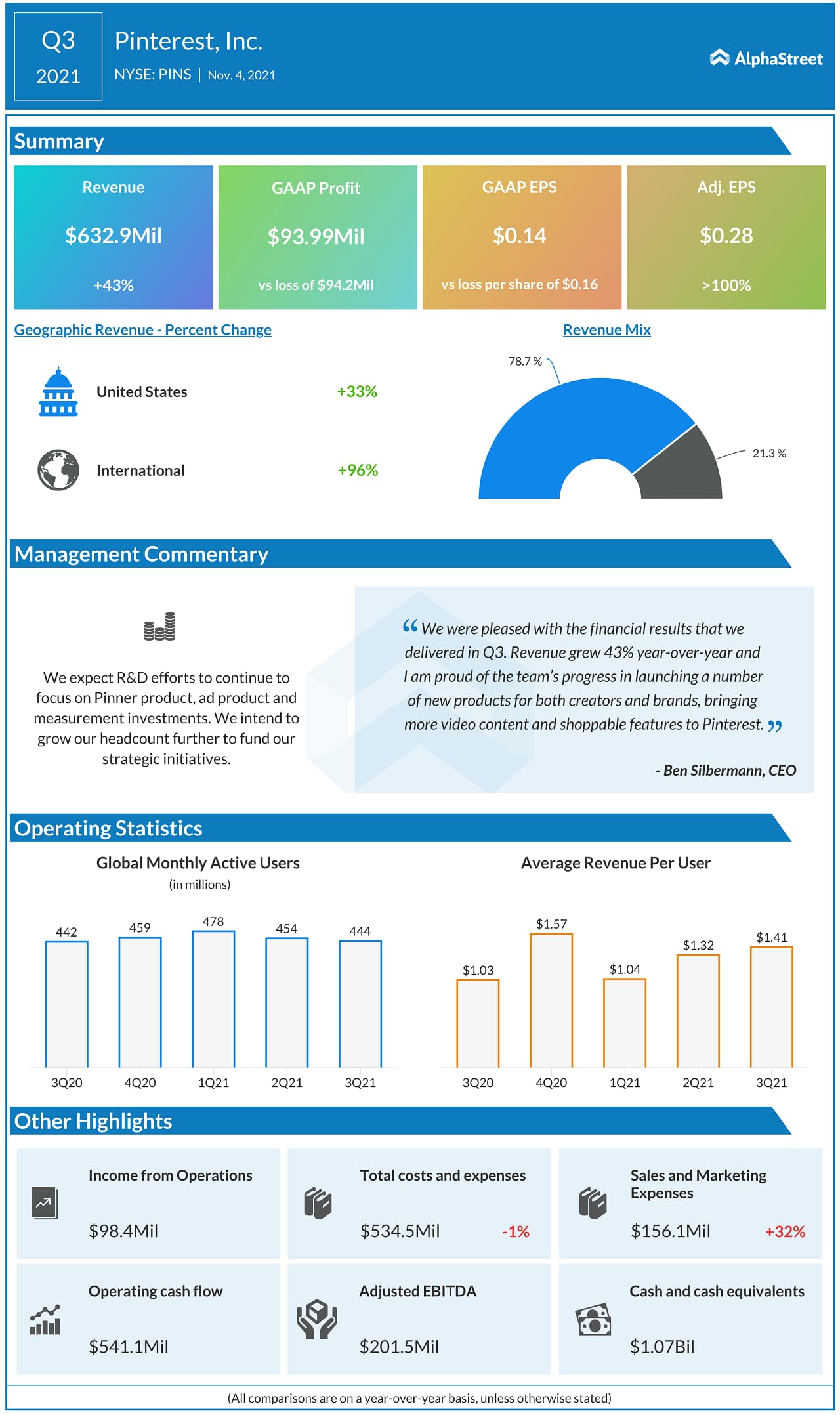

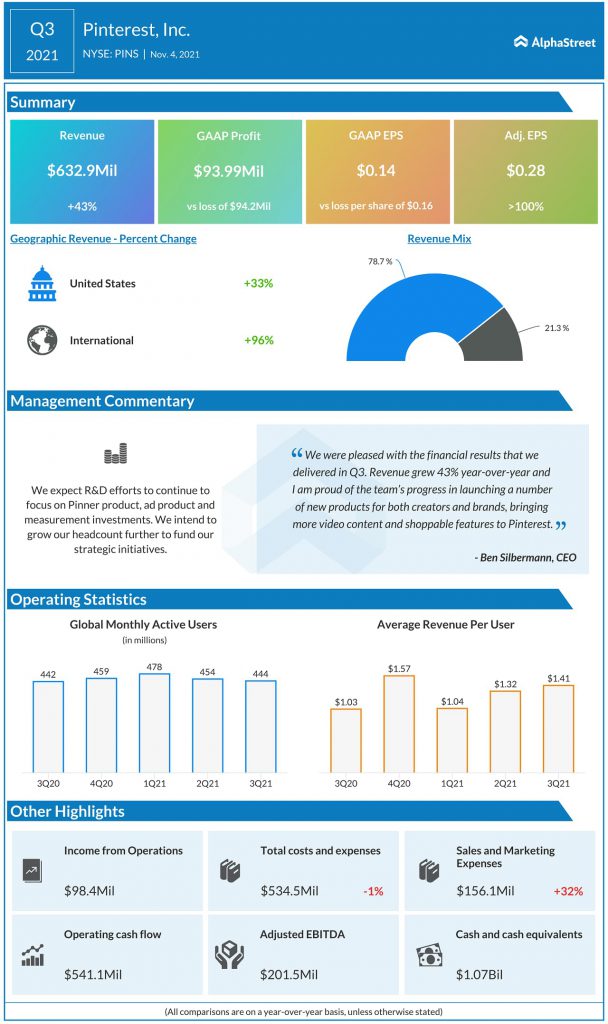

Pinterest’s revenue grew 43% year-over-year to $633 million in Q3. This growth was driven by higher demand from large retail advertisers and international marketers. The company saw revenue growth in both its US and international markets. US revenue increased 33% to $498 million, driven by a 44% growth in ARPU generated from the region. For the fourth quarter, Pinterest expects revenue to grow in the high teens percentage range year-over-year.

The company has significant opportunity for international expansion. In Q3, international revenue jumped 96% to $135 million, driven by an 81% increase in ARPU. Pinterest is yet to monetize several international markets, providing it with ample room for growth. Global ARPU grew 37% YoY to $1.41, fueled by advertising demand.

Pinterest reported a profit of $0.14 per share on a GAAP basis in Q3 versus a loss of $0.16 per share in the year-ago quarter. Adjusted EPS more than doubled to $0.28 per share.

The company has sizeable opportunity in the area of shopping. During the third quarter, it expanded its shopping features to seven new markets including Italy, Spain and Switzerland. The roll-out of features like the multi-feed catalog tool has helped drive growth in catalogs on the platform. During the third quarter, product searches were up over 100% YoY and searches on the Shop tab by Gen Z pinners increased over 200% YoY.

Challenges

Pinterest’s global monthly active users (MAUs) inched up just 1% to 444 million in the third quarter. This slowdown was caused by the pandemic unwind in the US and international markets. As people resumed their social lives, they engaged less in activities like cooking, DIY and home décor which they had enjoyed during the lockdown.

Although the return to out-of-home activities spurred interest in use cases like women’s fashion and beauty, they could not offset the drop in engagement in at-home use cases. The return of Gen Z users to school led to a slowdown in user growth in that demographic.

Another point to note is the 10% decline in US MAUs to 89 million during the quarter versus the year-ago period. This has raised concerns over Pinterest’s ability to grow users in the region. International MAUs rose 4% YoY to 356 million. As of November 2, US MAUs stood at approx. 89 million while global MAUs were approx. 447 million.

In addition, although the company is seeing strong growth in international markets, ARPU in these regions remains much lower at $0.38 compared to $5.55 in the US.

According to TipRanks, the majority of analysts have rated the stock as Hold or Buy. It has an average price target of $57.33, which represents a 24% upside from the current level.