Qualcomm Inc. (NASDAQ: QCOM) has witnessed significant growth in market value since Wednesday evening after its impressive earnings report set-off a stock rally. The chipmaker is off to a strong start to fiscal 2021, taking advantage of its dominance in the smartphone market and growing licensing business.

Qualcomm owes a part of its blockbuster performance in the final months of the fiscal year to the widespread adoption of 5G technology in the smartphone market. Experts are quite bullish on the company’s prospects and the majority of them recommend buying the stock, which is expected to cross the $150-mark in the twelve-month period. Investor sentiment also got a push from the favorable court ruling in a recent antitrust lawsuit.

5G Power

The Silicon Valley semiconductor company is looking for a more pronounced growth in the next fiscal year, thanks to the high demand for its 5G chips. In what could be a win-win deal, Qualcomm has reportedly secured a contract to supply chips for Apple’s (AAPL) iPhone. The strong shipment volumes support the view that all smartphone brands would migrate to 5G technology in the near future, which also gives a sense of the growth prospects of the cell phone industry. With almost all OEMs now having 5G smartphones, the opportunities in that area would be substantial once markets fully open.

“Our foundational 5G innovations’ unmatched patent portfolio and ecosystem collaborations enable us to drive the industry forward to facilitate the rapid global adoption of 5G. Our continued innovation drive success and stability in our licensing business. All major handset OEMs are under license and we now have over 110 5G agreements,” said Qualcomm’s chief executive officer Steve Mollenkopf.

Diversification

Meanwhile, Apple’s move to come out with its own microprocessor has cast uncertainty over the sustainability of its deal with Qualcomm, which keeps expanding its chip business beyond smartphones. Of late, there has been a spike in the revenue Qualcomm generates from sales to automotive companies and providers of IoT technology. Estimates show that the demand for those products is picking up in emerging markets, after slipping in recent quarters.

From Qualcomm’s fourth-quarter earnings conference call:

“The automotive industry is transforming at an unprecedented rate and we are incredibly well-positioned to lead the industry with a long-term opportunity to expand our dollar share of content in auto as we have done in smartphones. Turning to IoT, we are extending our IP investments from across the company into our portfolio of connected and non-connected products with a broad portfolio of technologies, including connectivity, lower power processing, and security.”

Record Results

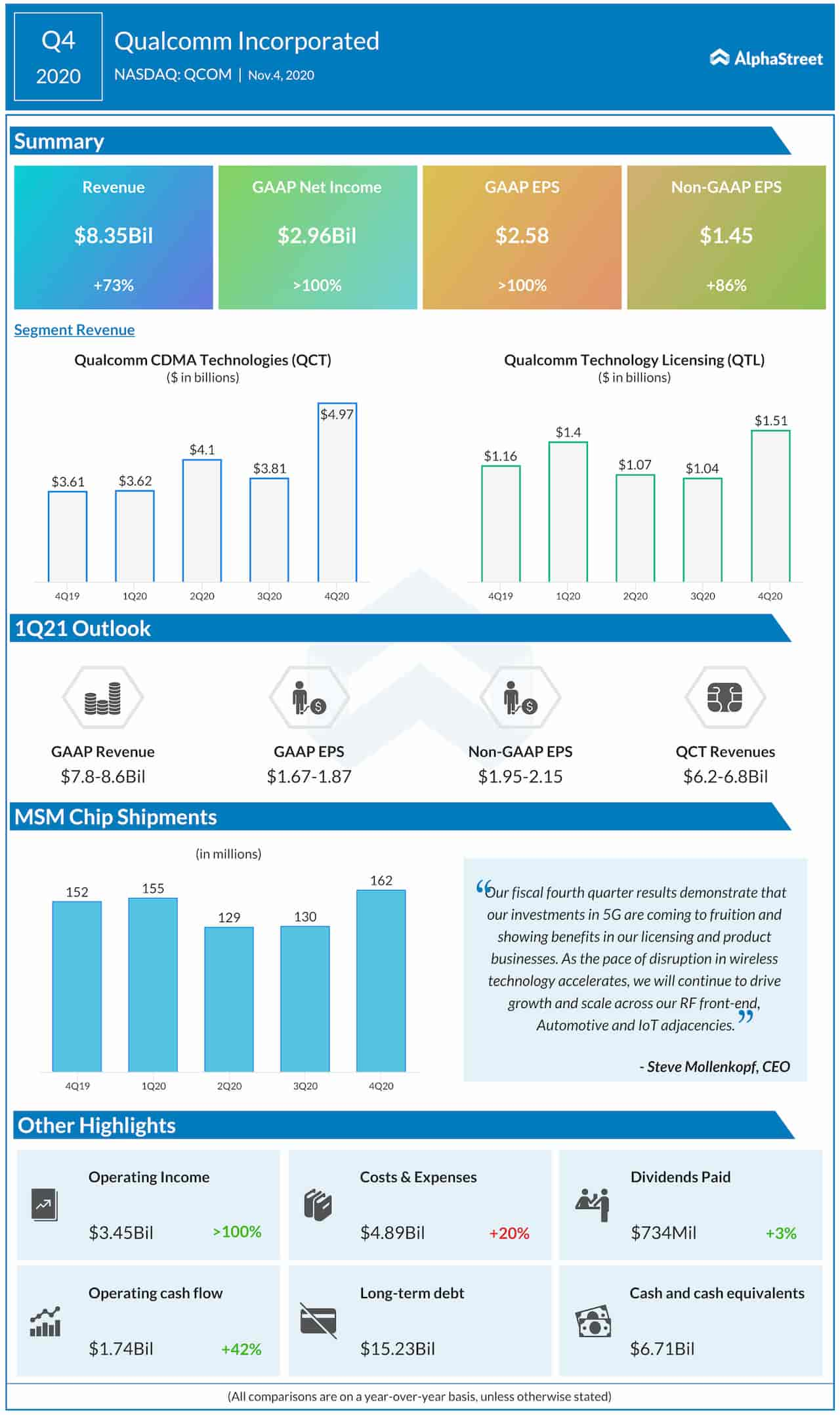

In a sign that settlement of the long-drawn-out litigation with Apple and signing of a multi-year licensing agreement with the tech giant has started yielding the desired results, Qualcomm’s revenue surged 73% to $8.4 billion in the fourth quarter of 2020. The top-line also benefited from a one-time payment from Huawei, and far exceeded the market’s projection. Consequently, adjusted earnings climbed 86% annually to $1.45 per share and beat the Street view.

The management’s bullish guidance shows the current momentum will be carried forward to the first quarter. Further ahead, margins could come under pressure in the second quarter from higher R&D and SG&A expenses, mainly related to certain employee-related costs.

Read management/analysts’ comments on Qualcomm’s Q4 2020 earnings

Shares of Qualcomm have set new records regularly in th past. They got a major boost after the earnings release and climbed to a new high on Wednesday evening. Having gained about 17% since the last close, the stock traded sharply higher during Friday’s regular session.