Investing in SLB?

An analysis by experts indicates that the recovery is not temporary, and they see SLB rising in double digits this year. There is enough reason to believe that Schlumberger would maintain the current momentum for the rest of the year and beyond. It is currently offering a good buying opportunity that investors, both long-term and short-term, would be keen to use.

Read management/analysts’ comments on Schlumberger’s Q3 2021 earnings

The Houston –based company, the largest oilfield services provider, has been going through a rough patch for quite some time due to faltering demand and changing dynamics of the industry. The question is, can Schlumberger overcome the challenges and regain its lost glory.

What’s in Store

On the positive side, the authorities have started relaxing production restrictions, allowing upstream and downstream oil companies to continue investing in the business. The resumption of capital spending, though with a higher degree of discipline than in the past, bodes well for oil field services companies. But the ongoing supply chain issues and production delays would remain a challenge in the near future.

“The market fundamentals have improved steadily throughout 2021, especially over the last few weeks, with oil and gas prices attaining recent highs, inventories at their lowest levels in recent history, a rebound in demand, and encouraging trends in the pandemic containment efforts. These strengthening industry fundamentals, combined with the actions of OPEC plus and continued capital discipline in North America, have firmly established a prospect of an exceptional multi-year growth cycle ahead,” Olivier Le Peuch, CEO of Schlumberger.

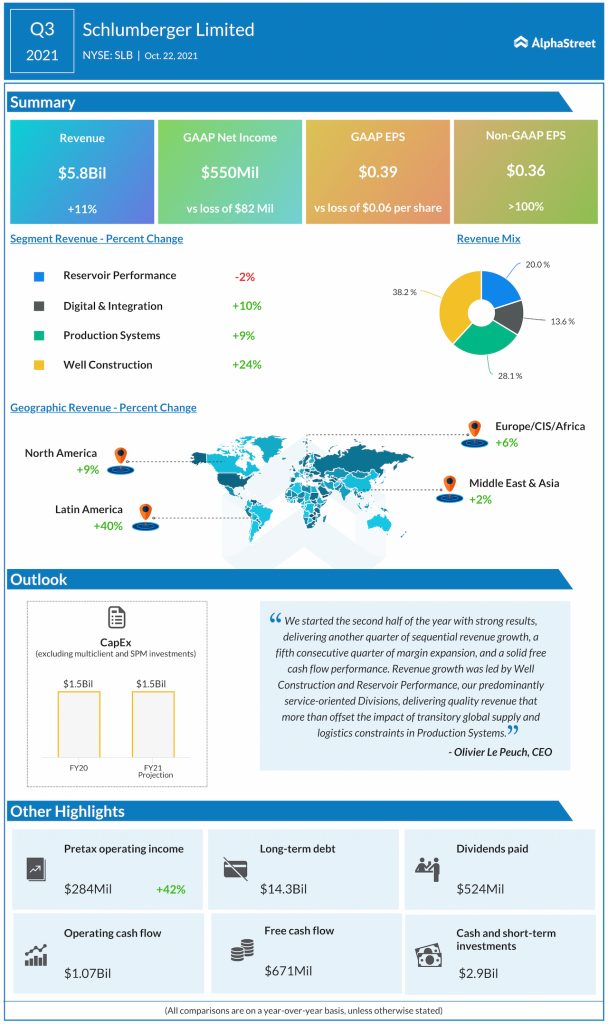

The company’s top-line has been under pressure for some time, mainly due to disruptions caused by the shutdown and the general slump in the oil and gas industry. The resultant strain on the bottom line weighed on profitability, but quarterly earnings beat expectations consistently in recent years. Things got better in the most recent quarter when margins expanded for the fifth time in a row, and free cash flow remained healthy.

Strong Q3

In the third quarter of 2021, adjusted earnings more than doubled to $0.36 per share and topped expectations. With the key operating segments performing better than in the prior-year period, total revenues grew 11% to $5.8 billion. The company is scheduled to publish fourth-quarter results on January 21 before the opening bell.

Key highlights from Exxon Mobil’s Q3 2021 earnings results

Schlumberger’s stock entered the new year on a positive note and stayed above its 52-week average so far. It traded lower in the early hours of Thursday, after closing the previous session lower.