Innovative Offering

Rarely do analysts unanimously assign any stock buy rating, as they did in the case of DOCU citing its strong short-term growth prospects. The 12-month target price represents a 32% upside from the last closing price. Investors, in general, are finding the stock more attractive than ever before. While the stock seemed expensive after last year’s rally, the valuation looks just right after the recent pullback. In short, DocuSign is unlikely to disappoint investors, rather it has the potential to generate good long-term returns.

One Bln Users

DocuSign Agreement Cloud is a software suite that automates the agreement process and includes e-signature and other applications for automating the process. Currently, the company serves more than 1 billion users and around 1 million customers, which is significant in terms of scalability.

The e-signature space is becoming increasingly competitive, but DocuSign enjoys an edge over rivals on the strength of its AI-assisted offerings. It has strived to enhance the portfolio through strategic buyouts, including the acquisition of Seal Software last year. The healthy cash flow should allow the company to continues with its growth initiatives.

Investing for top line growth remains a high priority for us in the second half of the year, including increasing sales capacity and marketing program, innovating our products, and scaling our back-office systems and processes. We see the tight current market as an opportunity to uplevel and develop our people internally while adding complementary skills as we drive the next phase of growth.

Cynthia Gaylor, chief financial officer of DocuSign

Though there are concerns that demand would soften when the market reopens fully, the company’s stable financial performance has allayed those fears to a large extent. However, it needs to be noted that DocuSign is not yet profitable on a GAAP basis. On a non-GAAP basis, it has generated profit since going public around three years ago. Over the years, earnings grew steadily and mostly beat the estimates.

Another Strong Quarter

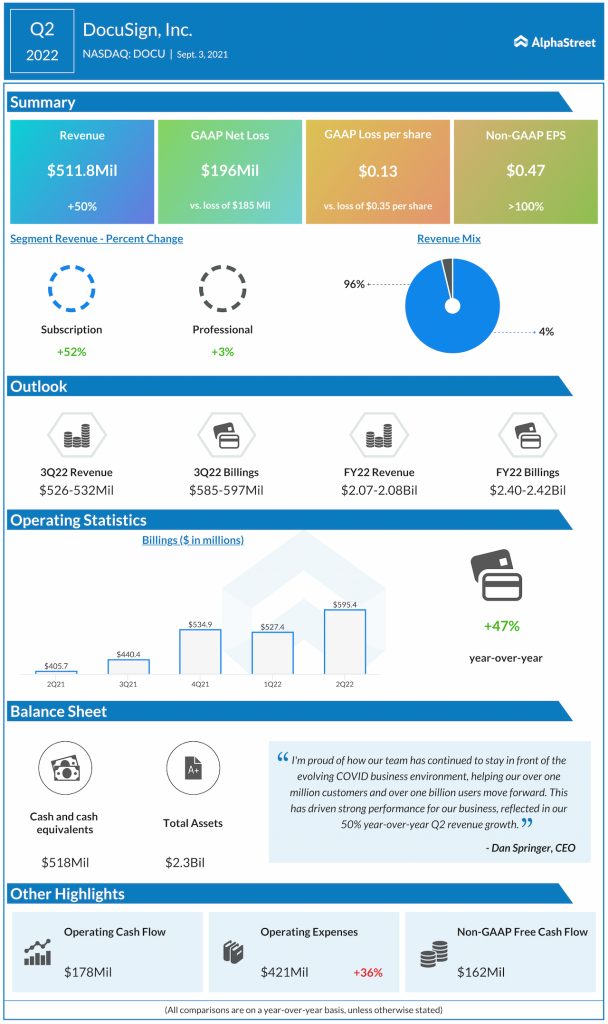

Last month, the company reported adjusted earnings of $0.47 per share for the July quarter, which was more than double the prior year’s number. The strong bottom-line performance reflects a 50% growth in revenues to $511.8 million. The numbers also surpassed experts’ projections. The subscription business, which accounts for more than 95% of the revenue, grew in double digits as billings rose to a record high. The management predicts that full-year revenues would grow about 39% and cross $2 billion.

Adobe reports 22% spike in Q3 revenue: Infographic

DOCU traded lower in the early hours of Tuesday, after opening the session down 1%. In the past twelve months, the stock gained 9%. The average price over the past 52 weeks was $243.35.