Back on Track?

Read management/analysts’ comments on ExxonMobil’s Q2 report

While the positive momentum brought by market reopening makes the stock attractive it is not entirely risk-free, given the threat of fresh curbs after the detection of new virus variants. Going by experts’ forecast of double-digit growth, buying the current dip can bring handsome rewards in the long term.

The demand recovery and rising oil prices have come as a big relief for the virus-hit energy sector and most producers are using the opportunity to repay debt and return capital to shareholders, while slashing capital spending budgets significantly. So, it’s time to look at energy stocks from a different perspective.

Green Campaign

ExxonMobil, which recently came under pressure from some stakeholders demanding the shift to clean energy, has finetuned its environmental policy with additional stress on emission control amid allegations that it is not investing enough in cleaner energy solutions. Also, in a major development, the company appointed Kathyrn Mikells as the new chief financial officer.

We remain focused on delivering industry-leading operating performance, continuing to significantly reduce costs, advancing our portfolio of high return advantaged projects, executing value accretive divestments, and rebuilding the strength of our balance sheet. In addition, as a need for climate solutions beyond wind, solar and electric vehicles grow, we are working to expand our portfolio of strategically and financially accretive low carbon solutions investments.

Darren Woods, chief executive officer of ExxonMobil

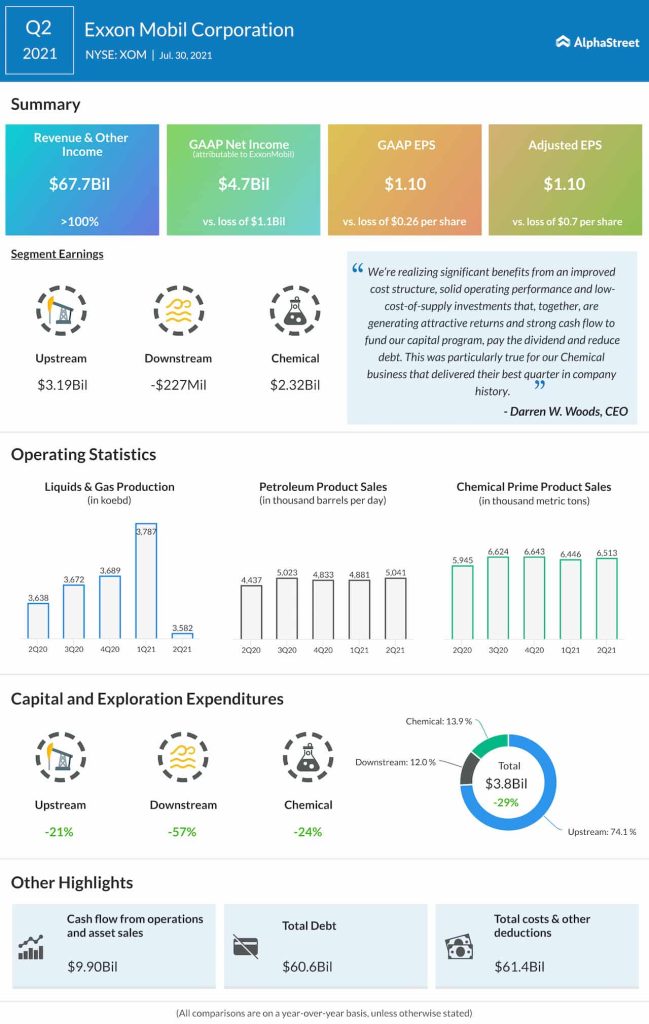

In the second quarter, revenues, earnings, and upstream profit all flew past Wall Street’s estimates. Revenues more than doubled to around $68 billion, driving up earnings to a one-year high of $1.10 per share. The bottom line also got a boost from aggressive cost-cutting — as much as $1 billion was saved in the first half, after slashing about $3 billion of costs last year.

Strong Q2

The chemicals division remained surprisingly resilient to the crisis while the upstream segment bounced back from last year’s record lows, aided by favorable pricing and the steady improvement in the global economy. On the other hand, the downstream business, which involves the refining and marketing activities, remained in loss as it failed to take advantage of the market recovery.

A similar pattern was visible in the performance of rival energy producer Chevron Corp. (NYSE: CVX), which turned to profit in the June quarter from last year’s loss, reflecting blockbuster top-line performance and synergies from the company’s recent merger with Texaco.

Stock Performance

XOM registered one of the biggest short-term gains last week, immediately after the release of second-quarter numbers. The shares traded notably higher early Monday, after closing the last session at $57.57. They are up 41% since the beginning of the year.