Can you briefly talk about your business model and the value you add to the market?

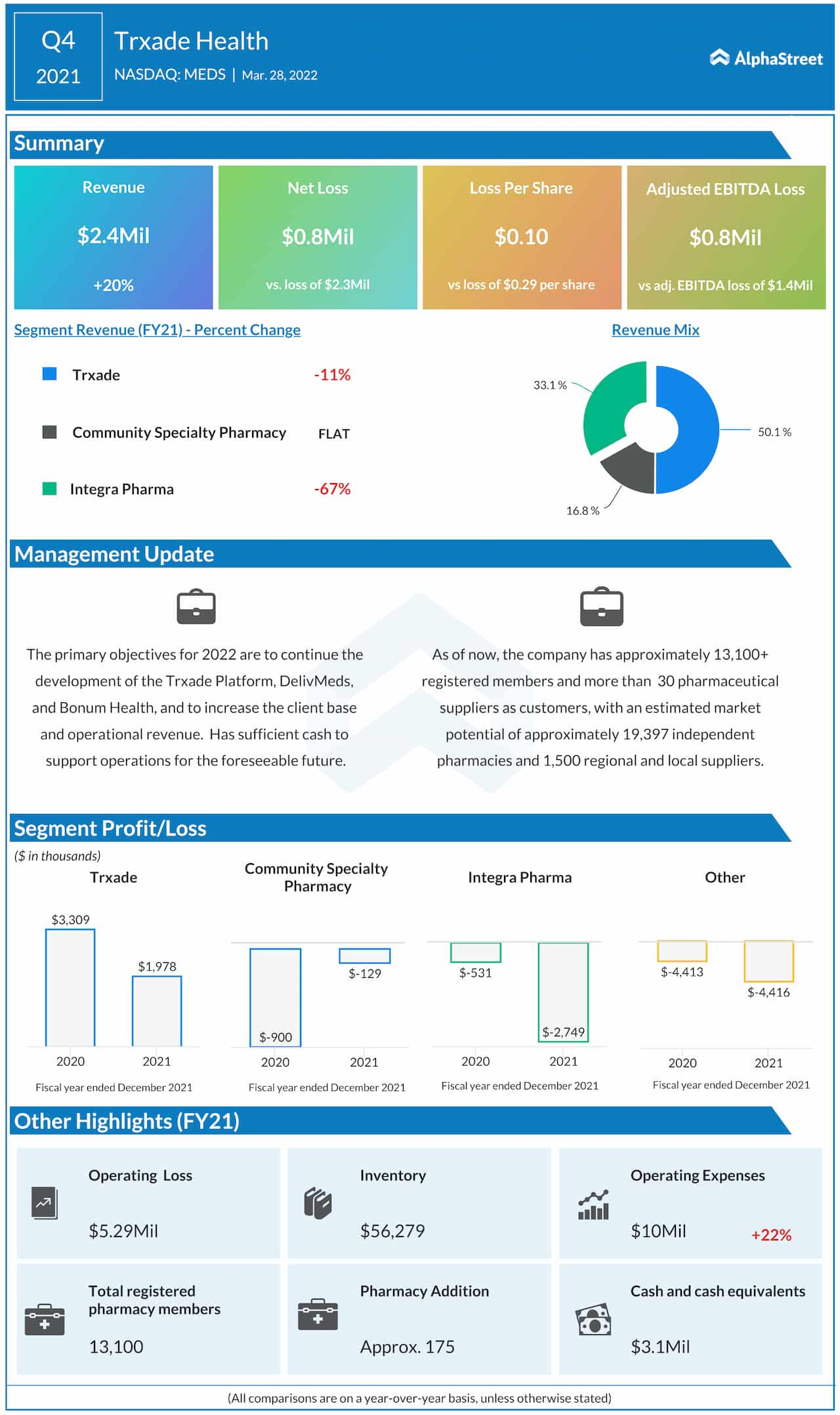

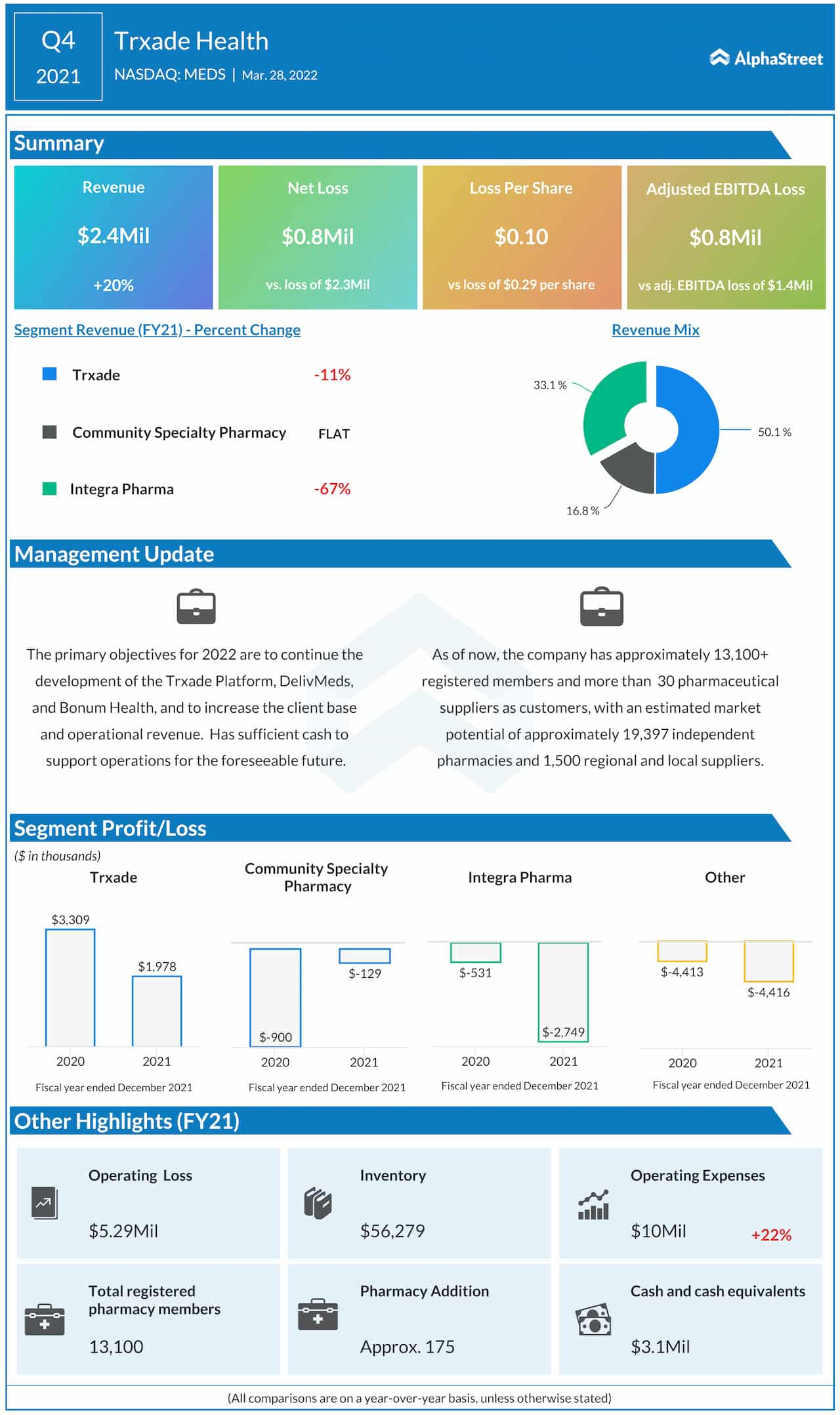

Trxade (NASDAQ: MEDS) is a health service IT company focused on digitalizing the retail pharmacy experience by optimizing drug procurement, prescription journey, and patient engagement in the US. There’s a lot of buzzwords out there. We provide a marketplace for independent pharmacies that don’t have the bandwidth or the resources to shop around. If you look at the total market size of $685 billion, most of the sales go through big-box chains like Walgreens and CVS. That’s not our market. We focus on the 19,400 independents that are out there; that have a purchasing power of $64.5 billion annually.

Usually, these pharmacies buy 80% of these products through their big wholesalers like McKesson, Cardinal, and AmerisourceBergen. That much concentration over the years created a lack of transparency, both in price and cost, thereby resulting in a severe limitation of the purchasing choices these independents have. On top of this, generic manufacturers made this industry a commodity. Once it becomes a commodity, you have inefficiencies and arbitrage. .

And, our primary target market of independents, as I mentioned, doesn’t have the bandwidth or the resources and it’s a mom-and-pop shop, single-owner. The lack of transparency pushes them to a corner to look for alternative ways and means of safeguarding their diminishing margin.

So, we started this platform or marketplace, the Trxade platform, for three identified problems that we brought in solutions for. One, cash flow issues — whatever I buy 1 to 15, I got to pay them by the seventh business day to my suppliers, while I’m waiting for my reimbursement to come 30 to 45 days. The second is the supply information, like short-supply information. So, simple economics; supply goes down, demand goes up, and the price goes up. That could be a crucial information that’s not readily available to these independents.

Also Read: TRxADE HEALTH, Inc. Q4 2021 Earnings Call Transcript

Finally, the third point is the negative reimbursement — not knowing what I’m going to get when I’ve already paid for the product creates a negative reimbursement in my products. Combining all these, we brought in a technology platform called Trxade that eliminates the inefficiencies and arbitrage and provides the fair market price these independent pharmacies look for. So, how do we make money? We make money on the transactional volume, like a PayPal or Visa-like fee structure. But if we look at it, it’s not a new concept; we’ve seen this in other online trading platforms like eBay, Kayak, or, Amazon. But the good old concept of bringing buyers and sellers together is same here in ours, and it is a first in pharmaceuticals.

PPE sales have been a key contributor to revenue growth for some time. Do you see the improvement in the pandemic situation and market reopening weakening the PPE segment?

If you look at it, the pandemic started back in 2020. If you are looking for that, there was a one-time sale in 2020. We came back to the normalcy in 2021. Most of our revenues came from our traditional technology platform, and that’s the reason you saw the gross margin growth in the last quarter. So, we don’t expect that we will ever go back to the PPE sales. We focus on the traditional technology platform. We want to stay to the core of our existing technology platform for margin growth.

What is your strategy for business expansion this year, at a time when the healthcare market is undergoing a major transformation, and how do you see Trxade’s product portfolio evolving?

If we look at it, we started off as an independent pharmacy technology platform. Now we are expanding into the clinics, like podiatrists, ophthalmologists, dentists, and so on and so forth that are out there, almost like 30,000 to 40,000 independents. Like I mentioned earlier, 19,400 has a purchasing power of $64 billion. Now, you add on another 40,000 to these clinics, and that’s our purchasing power that even grows almost like $128 billion in genetic sales. That’s one way we’re trying to expand.

The second is that we’ve launched the JV called SOSRx, which is for short-dated, overstock, and slow-moving vehicles. This is a technology platform that brings the manufacturers to the wholesalers, small grocery chains, and so on and so forth. So, those are the two areas where we see growth. But at the same time, we’d like to see a per-wallet share per month increase in the traditional Trxade platform.

Besides lower costs, what are the other factors that contribute to margin growth for the core business, and do you expect the trend to continue for the long term?

As I mentioned, we are focusing mainly on the technology platform. With the existing infrastructure, we would like to call the top-line revenue and at the same time increase the gross margin. I think we’ve announced around 55.1% gross margin in the fourth quarter and would like to see that continue.

Also Read: “We expect capital-light to become a larger portion of our business in the long run”

Since the pandemic, a lot of companies have shifted their focus toward the eCommerce business. So, considering this, whom do you see as your biggest competitor in the market? And, how do you plan to tackle them?

I would consider e-commerce businesses as a delivery service, and I know it’s an online business. But if you look at it, our business started in 2010, before the pandemic hit in 2020 — that’s 10 years ago. But we want to empower our independent pharmacies that can deliver the goals. Our niche is involving our 13,100 member pharmacies or members that are involved in trading on a daily basis and empowering them to deliver these goods to the end-users that are indirectly targeting 15 to 20 million patients.

So, to answer your question on e-business, am I going to empower my independents, take care of that online presence, or digitalization? I think I’ve mentioned that our company is a healthcare IT services company focused on digitalizing the retail pharmacy experience, whether it’s a drug procurement, a prescription journey, or patient engagement. Trxade Health’s goal is that we would like to bring both doctors and pharmacies into the common man’s house inexpensively and instantaneously.

As I mentioned, pretty much we are sitting on a good balance sheet. I know we have been under the radar for a while, but we’re trying to create awareness by presenting at investor conferences and so on. As I mentioned, even though we uplisted in 2020, we’ve been under the radar for a while. We’re working on gaining more awareness by the investment community. As we execute our business plan, we’re trying to improve our visibility. I think that we have an exciting value proposition, not only in terms of what we’re doing to grow our revenues and earnings but in our larger mission to enhance the quality of life for millions of patients.

Over the years, we’ve tried to maintain a favorable capital structure for the company, like with our uplisting to the NASDAQ –approximately 8.3 million outstanding shares, maybe some additional shares issued depending on the capitalization. We have a relatively small number of issued and outstanding shares when compared to some comparable public companies that have hundreds of millions of shares outstanding. This capital structure enables reasonable earnings per share fairly quickly. And that’s the key differentiator of ours that I want to emphasize to the investment community.

Also Read: Instructure’s technology is an integral part of all education models: CEO Steve Daly

I think we offer significant potential for return on investment because of our capital structure and diversified sources of revenue. Because our trading platform is very unique, with minimum competition in terms of our cumulative services offering, we intend to establish a first-mover advantage in our space. We intend to bring, as I mentioned earlier, doctors and pharmacies in patients’ homes for their non-emergency care inexpensively and instantaneously — an almost end-to-end solution the industry desperately lacks.