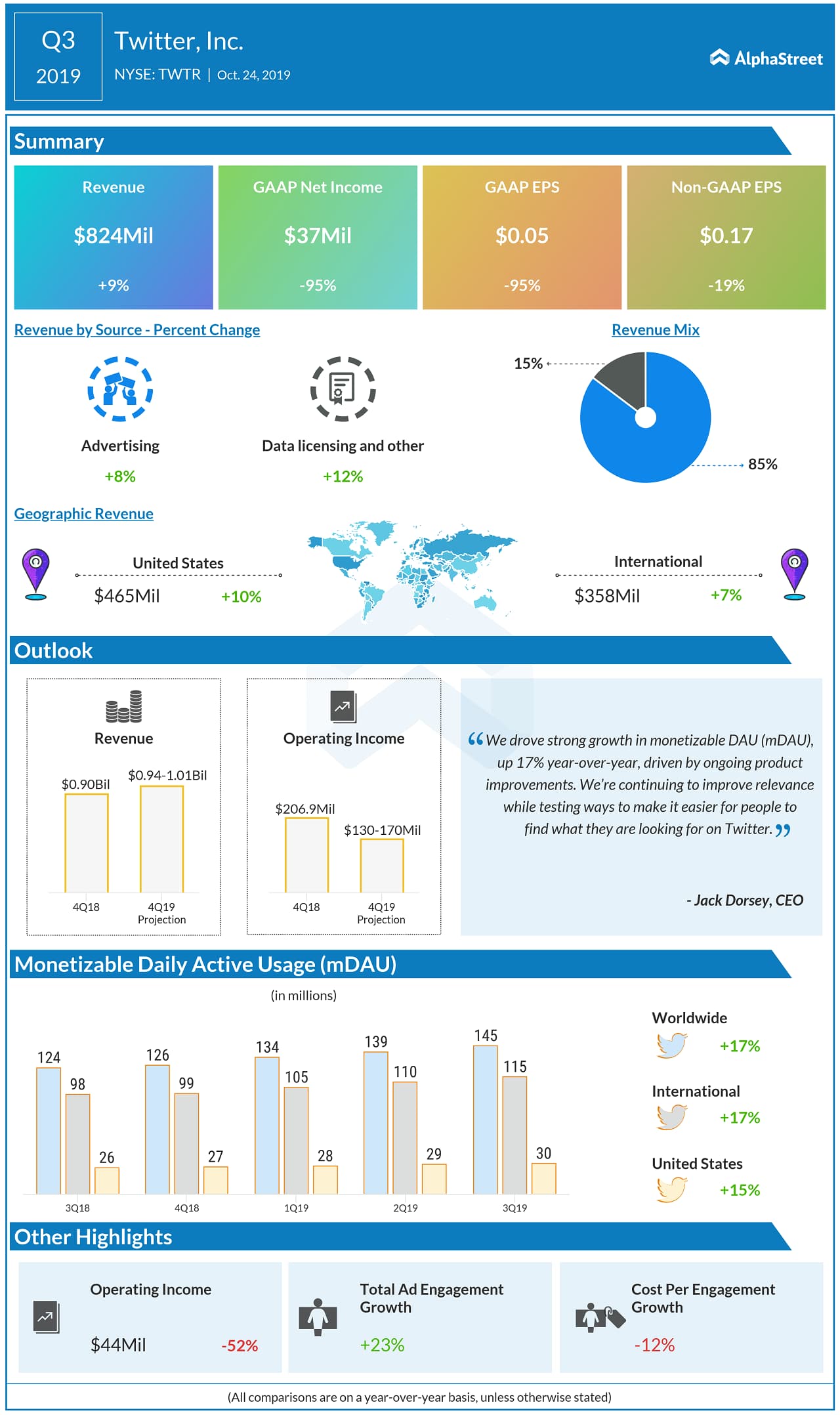

Revenue grew by 9% to $824 million, mainly driven by the strength in US advertising. The performance was impacted by revenue product issues, which reduced year-over-year growth by three or more points, along with greater-than-expected seasonality.

Total advertising revenue jumped by 8% to $702 million, driven by double-digit increases in both domestic and international ad revenue. Data licensing and other revenue rose 12% to $121 million.

Looking ahead into the fourth quarter of 2019, Twitter expects a total revenue of $940 million to $1.01 billion. The operating income is predicted to be in the $130 million to $170 million range.

For the full year of 2019, the company now expects capital expenditures to be at or near the low end of its previous forecast range of $550 million to $600 million. The stock-based compensation expense is now projected to be at or near the midpoint of its previous outlook range of $350 million to $400 million.

Twitter drove strong growth in monetizable DAU (mDAU), up 17% year-over-year to 145 million, driven by ongoing product improvements, organic growth and, to a lesser extent, marketing.

Total ad engagements increased by 23% year-over-year, resulting primarily from increased ad impressions driven by audience growth and improved clickthrough rates across most ad formats. However, cost per engagement was down 12%, reflecting a mix shift from Mobile Application Promotion to video ad formats and like-for-like price decreases across most ad formats.

The company improved its ability to proactively identify and remove abusive content, with more than 50% of the Tweets removed for abusive content in Q3 taken down without a bystander or first-person report.