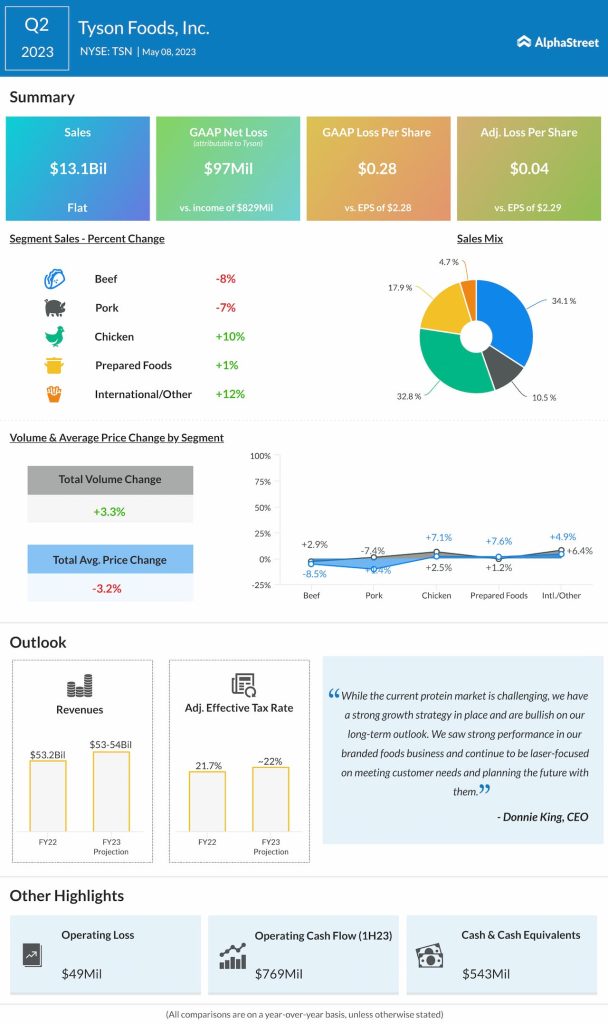

Flat revenue and an unexpected loss

Challenging market trends

On its quarterly call, Tyson said it is facing market challenges across all its core protein categories and high inflation has significantly impacted its costs. Within the chicken business, commodity prices are much lower than last year while input costs were higher. Higher input costs across most of its segments coupled with higher raw material and labor costs drove up its cost of goods sold. Lower earnings in beef and chicken took a major toll on adjusted operating income which was down 94% from last year.

Category performance

In Q2, sales in the Beef segment declined over 8% year-over-year. The results were impacted by lower price caused by a drop in domestic demand and softer export markets, as well as lower volumes. Lower sales and higher costs put pressure on margins as well. In the Pork segment, sales fell 7% as volume gain was offset by a 10% drop in sales price due to the soft global demand environment.

On the bright side, sales increased 10% in the Chicken segment driven by volume growth and price increases. Sales in Prepared Foods rose over 1% helped by price increases as well as gains in retail brands such as Jimmy Dean, Hillshire Farm, and State Fair.

Bleak outlook

Tyson cut its sales guidance for the full year of 2023 to a range of $53-54 billion from the prior range of $55-57 billion. The current outlook represents a flat to 1% growth for the year. The company expects adjusted operating margins for the year to range between a loss of 1% and a gain of 1% for both its Beef and Chicken segments. In the Pork division, margins are expected to come between a loss of 2% and breakeven. However, in Prepared Foods, margins are expected to be 8-10% due to strong gains in this segment.

So what’s next?

Tyson plans to drive growth in its core protein platform with the help of its diverse portfolio. It expects global demand for protein to continue to grow in the coming years, fueled by population growth and per capita income expansion, and believes it has the capacity in place to meet this demand.

Tyson also remains optimistic about the growth potential of its branded foods portfolio, based on the strong performances of brands like Jimmy Dean and Hillshire Farm. It also believes branded foods can help in margin expansion.

The company plans to focus on its international expansion as it believes most of the growth in protein consumption will happen outside the US and that it can take advantage of this opportunity by scaling its existing business and exploring new markets.