Competition

and market share

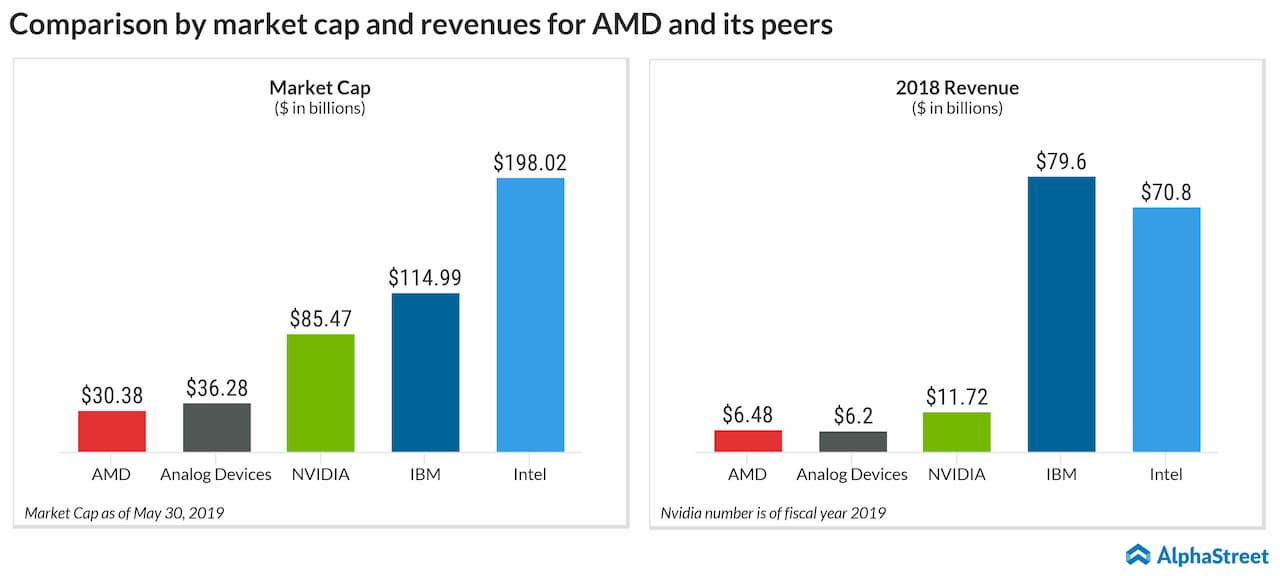

Of the four, Intel is the most formidable opponent. The company has a market cap of $198 billion and delivered revenues of $70.8 billion in fiscal-year 2018, with double-digit revenue growth in most of its business units for the year.

IBM had total revenues of $79.6 billion in

2018, though only a small portion of it came from semiconductors. NVIDIA reported

total revenues of $11.7 billion for its fiscal year 2019, while Analog Devices posted

revenues of $6.2 billion in its latest fiscal year.

According to a report by

Jon Peddie Research, in the first quarter of 2019, overall

GPU shipments decreased 18.62% from last quarter. Intel saw the biggest drop of

over 22%. This was followed by Nvidia (down 12.7%) and AMD (down 4.6%).

AMD’s market share grew by 2.3% from last quarter,

while Intel’s decreased by 3.4%. Nvidia’s market share, meanwhile, rose by

1.10%.

Earlier this week, CNBC reported that analysts believe AMD’s new chips, set to release in July, will help it snatch market share from Intel. As per the report, AMD’s third-generation Ryzen chip is said to have outperformed Intel’s CPU by over 16%.

Segments and product line-up

As a semiconductor company, AMD operates

its business under two segments – namely Computing and Graphics as well as

Enterprise, Embedded and Semi-Custom. The company’s products include x86

microprocessors as an accelerated processing unit (APU) and chipsets, besides discrete

and integrated graphics processing units (GPUs). It also provides server and

embedded processors, as well as technology for game consoles.

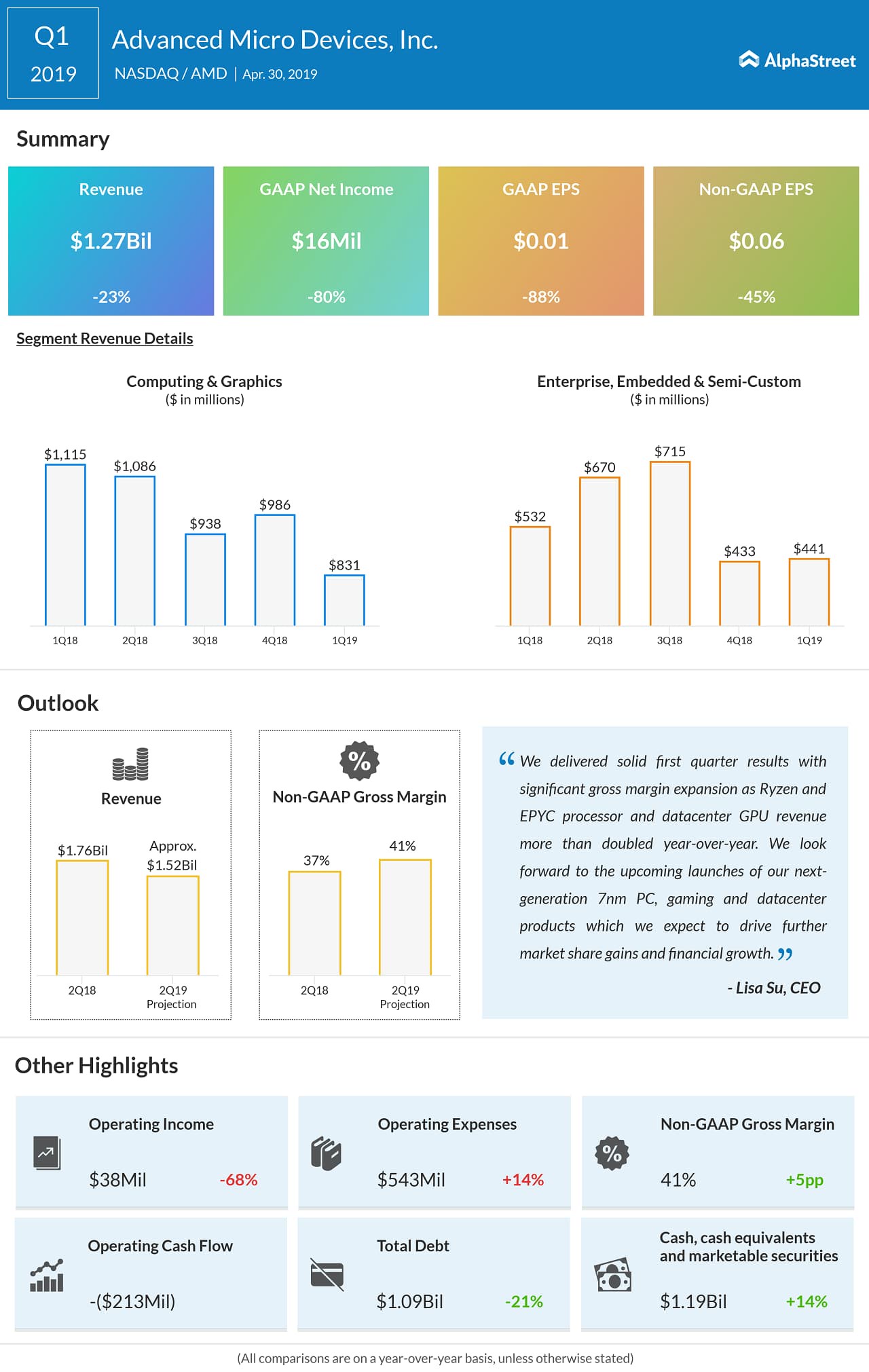

Over the past few quarters, the company has

been struggling to drive top line growth as the Computing and Graphics segment,

which was the sole contributor till last year, has fallen considerably while the

Enterprise, Embedded and Semi-Custom segment showed lackluster performance.

A decline in PC sales and the absence of crypto-related GPU contributed to the falling revenues in the Computing and Graphics segment, which had been displaying a growth streak for 11 consecutive quarters before that. Investors are hoping that the current trend would change by the second half of this fiscal year, as gaming GPU sales return to normal.

In the most

recent quarterly results, both the segments were impacted by slower graphics

channel sales and lower semi-custom product revenue. This was partly offset by the

growth in Ryzen processor sales and datacenter GPU sales. This growth, however,

did not meet the anticipated levels.

Financial

trend

AMD

has a pretty impressive history of beating analysts’ estimates on earnings. In

the past five quarters, it has never

missed on the bottom-line, and boasts of an average surprise of 11.6%. However,

the same cannot be said about the top-line. In the trailing five quarters, the

company has twice missed revenue estimates, though both times, it did report a

year-over-year growth.

Talking about the topline, the chipmaker has been seeing some deceleration in revenue growth off late, driven by weakness in the Computing and Graphics segment. The company reported a 23% decline in topline in the most recently reported quarter, as revenues from the computing segment plunged 25% year-over-year.

Cash

flow situation

AMD’s recovery from negative cash flow that lasted for several years got an impetus after it rolled out the Polaris GPUs a few years ago. More recently, the popular Ryzen and EPYC chips helped the company elevate its cash flows to the positive territory.

AMD recorded cash, cash

equivalents and restricted cash of $1.08 billion at the end of 2018, down 9% from

last year, reflecting a 44% increase in spending on infrastructure development.

Nevertheless, the company has managed to keep capital spending low when compared to Intel, which outsources most of the production to third-party entities, thereby incurring relatively higher capex that runs into several billion dollars.

LISTEN TO: Advanced Micro Devices Q1 2019 earnings conference call

Though AMD’s operating

cash flow increased to $34 million last year from $12 million in 2017, it was

not enough to meet the capital requirements. In a sign that the balance sheet

is getting stronger, meanwhile, long term debt decreased 16% to $1.1 billion at

the end of 2018.

At (-) $275 million, free

cash flow remained negative in the March quarter, marking a deterioration from

(-) $153 million recorded a year earlier and $79 million in the preceding quarter.

Looking

Ahead

For the full year 2019, AMD has reiterated

its expectation of high single-digit percentage revenue growth. The upcoming

launches of next-generation 7-nanometer Ryzen, EPYC and Radeon datacenter GPU

product sales are expected to boost AMD’s market share gains and its financial

growth. The company’s ability to lead the roadmap for PC, gaming, and

datacenter markets is expected to bear fruit throughout 2019.

AMD views that its top and bottom lines will resume to growth in the back half of 2019. However, investors have to be conscious of the headwinds that are created by the trade war between the US and China. If the trade war doesn’t end before the fall, AMD stock is expected to have a setback.