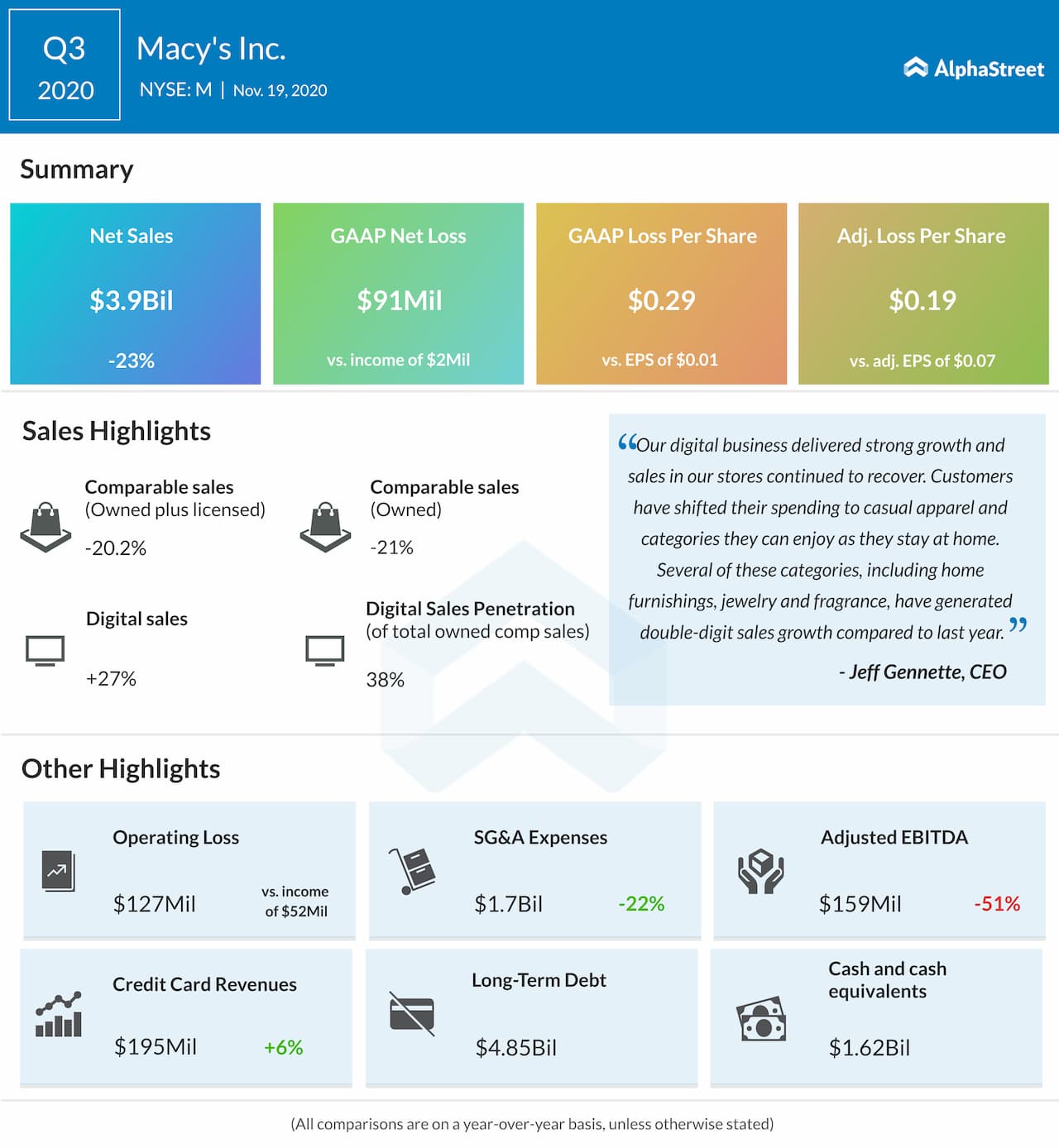

Macy’s Inc. (NYSE: M) saw a double-digit sales decline in its most recent quarter along with an adjusted loss. Comparable sales were down both on an owned basis as well as owned plus licensed basis, but digital sales witnessed strong momentum. Macy’s benefited from earlier than normal holiday demand in October.

Digital

Macy’s saw strong growth in its digital channel during the third quarter with sales up around 27%. Digital penetration came to around 38%, up significantly from last year. The company is seeing momentum in traffic, search and conversion and has witnessed strong retention rates among the 4 million new customers that came onto its digital platform last quarter.

Macy’s continues to improve its mobile and dot.com features and sees digital as an important part of its growth strategy both for the holiday season and beyond. The company has partnered with payment services firm Klarna and hopes this alliance will help attract younger customers.

Categories

Macy’s saw strong performance in jewelry, beauty, furniture and Backstage during the third quarter. The company also saw strong demand in textiles, housewares, and home entertainment and décor with these categories generating double-digit sales growth. Macy’s will continue to focus on these categories going forward. While the apparel category as a whole is yet to see a recovery, the company is seeing healthy demand trends within active and casualwear.

Fulfillment options

The company has rolled out its same-day delivery partnership with DoorDash across all its Macy’s and Bloomingdale’s stores in order to increase speed and convenience for customers during the holiday season. The company has also improved its curbside pickup services by making the digital check-in experience and curbside order processing more convenient.

Macy’s stores are seeing steady recovery across all its three brands. Store sales decline during the quarter was 36%, which was better than what the company had expected.

The resurgence in COVID-19 continues to hinder recovery. For the latter half of the year, Macy’s expects total comps to be down in the low-to-mid 20s range.

Click here to read the previous stories on TJX Companies, Target Corp. and Kohl’s Corp.