Walgreens Boots Alliance (NYSE: WBA) entered the new fiscal after a disappointing show last year, in terms of shareholder return and financial performance, which spurred speculations about the stock’s future. Despite being the worst-performing Dow component, the company remains a favorite among investors for its impressive dividend history.

Related: Walgreens Q4 2019 Earnings Conference Call Transcript

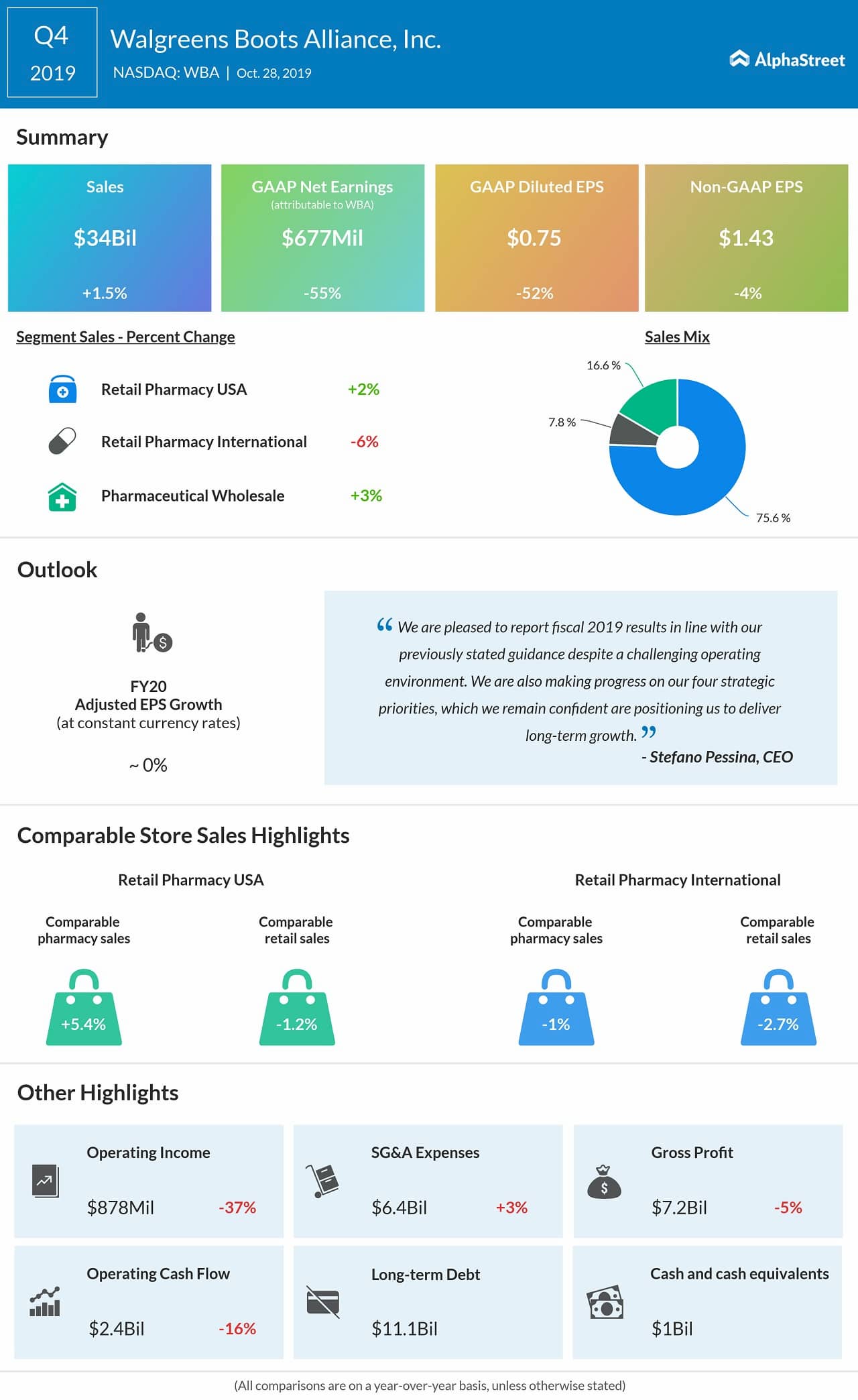

The recovery of the Retail Pharmacy USA, the core business segment, is estimated to have helped the company improve its revenue performance so far this year. Also, comparable pharmacy sales have been positive in recent quarters amid steady subscription growth, and the trend is expected to continue.

Earnings Slump

In the sign that the strain on profitably persisted in the early months of fiscal 2020, analysts see a 3% year-over-year decline in first-quarter earnings to $1.41 per share, on revenues of $34.59 billion. The results will be published on January 8 at 7:00 am ET.

Meanwhile, the century-old pharmacy giant continues to witness a slowdown in the other areas of its business, including Retail Pharmacy International and Pharmaceutical Wholesale, which could be a drag on earnings. It needs to be noted that while expanding the store network in key markets and pursuing strategic acquisitions, the management is reportedly exploring the prospects of taking the company private.

Pros & Cons

In the long term, the cost-cutting program – for which the annual target was recently raised from $1.5 billion to $1.8 billion – should play a key role in improving profitability. But, reimbursement challenges and the ongoing opioid-related litigation might add to cost pressures and weigh on margin performance. Also, low margins from generic products will remain a concern.

Looking Back

The company ended the last fiscal year on a low note, with fourth-quarter profit falling 4% to $1.43 per share. Though revenues moved up 1.5% to $34 billion and topped the Street view, it was not sufficient to drive the bottom-line performance.

Meanwhile, it was a slightly different story at rival drug retailer CVS Health (CVS), which recorded an increase in earnings for the most recent quarter even as revenues grew in double digits amid strong comparable-store sales. All the business segments performed above the estimates, which prompted the management to raise its full-year outlook.

Also read: Rite Aid stock soars to 9-month on strong results

Walgreens shares are yet to fully recover after falling to a six-year low early last year. The stock dropped about 16% in the past twelve months, underperforming the Dow Jones Industrial Average during that period.