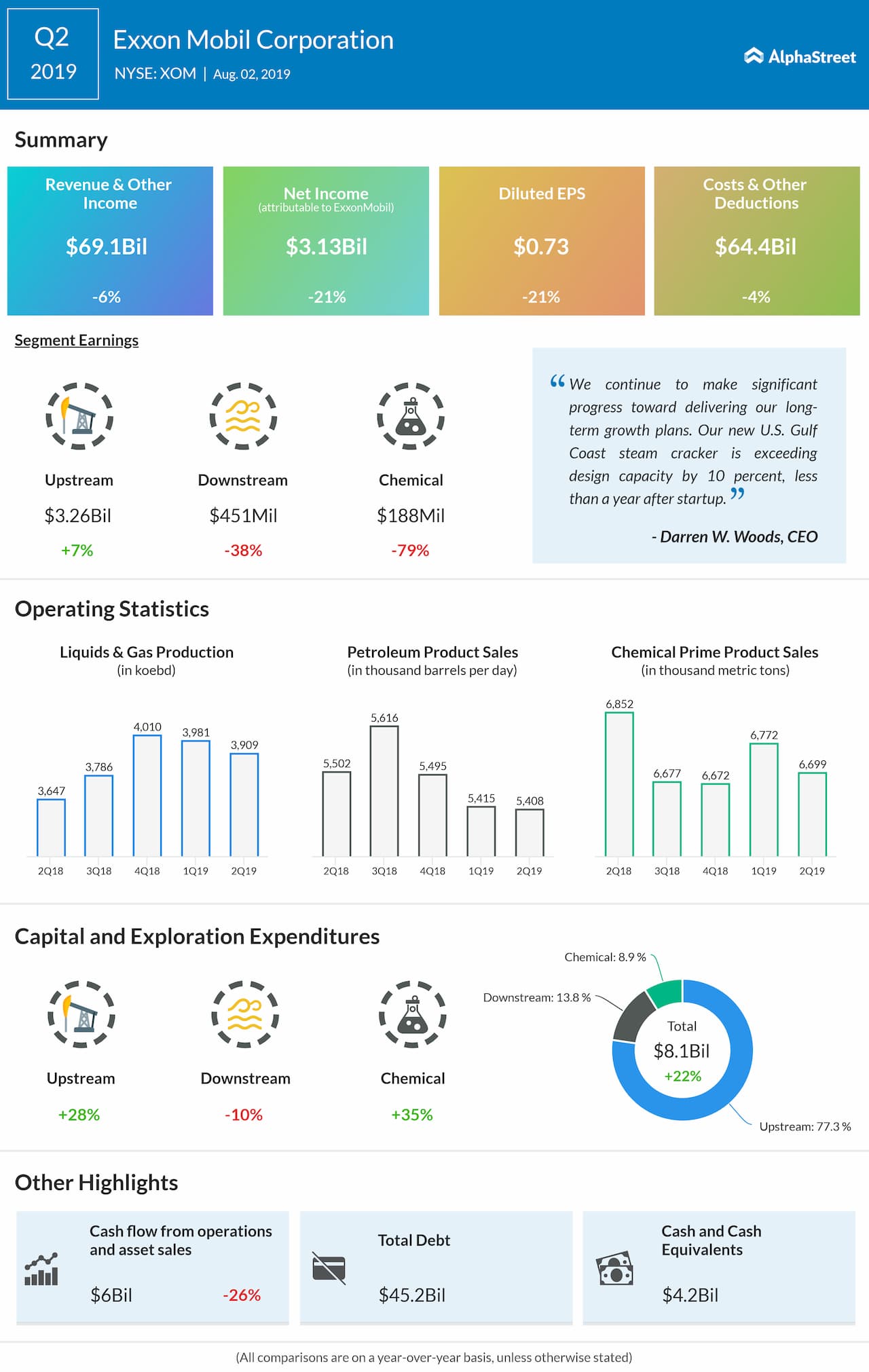

Currently, the stock is on an uptrend and the positive momentum is expected to continue and extend until at least in the first week of November when the company is scheduled to report its next quarterly results. In the second quarter, earnings dropped in double digits to $0.73 per share hurt by a 4% drop in revenues amid continuing softness in the downstream business.

Beating the Odds

Data shows that Exxon Mobile has stayed resilient to the stiff competition in the oil industry, registering revenue growth consistently in recent years while maintaining steady production levels. That, combined with the sustainable debt levels, seems to be luring investors to the company.

Like its peers, the company remains vulnerable to the fluctuations in oil prices and the unpredictable nature of the industry, which witnessed a spike in prices after the Saudi crisis. While maintaining the annual growth in its cash flow, the oil giant is poised to overcome uncertainties in the market and the global economy.

Dividend Hike

Interestingly, the company stands to benefit from any moderate variation in the oil price – upward and downward – due to its substantial engagement in both upstream and downstream activities. The stock probably offers everything that long-term investors look for in an energy company. The recent hike in dividend by five cents, after holding it steady for about a year, has made it more attractive.

Cost Pressure

Meanwhile, high costs might put pressure on profitability going forward, especially due to the company’s heavy shale investments. Also, the management expects to incur expenses totaling about $6 billion in connection with its activities related to environmental protection in the current year and in 2020, lifting the share of capital spending to about 30% total expenditure during the period.

Also read: Will renewable energy power the future?

Exxon Mobile’s stock has been impressing investors since the beginning of the year with steady gains, all along outpacing the industry and the S&P 500 index, though it briefly slipped to a nine-year low in August. In the past, however, the stock witnessed high volatility, marked by a persistent downtrend.