Shares of Alaska Air Group Inc. (NYSE: ALK) were down slightly on Tuesday. The stock has dropped 15% over the past three months. The company is slated to report its earnings results for the first quarter of 2023 on Thursday, April 20, before market open. Here’s a look at what to expect from the earnings announcement:

Revenue

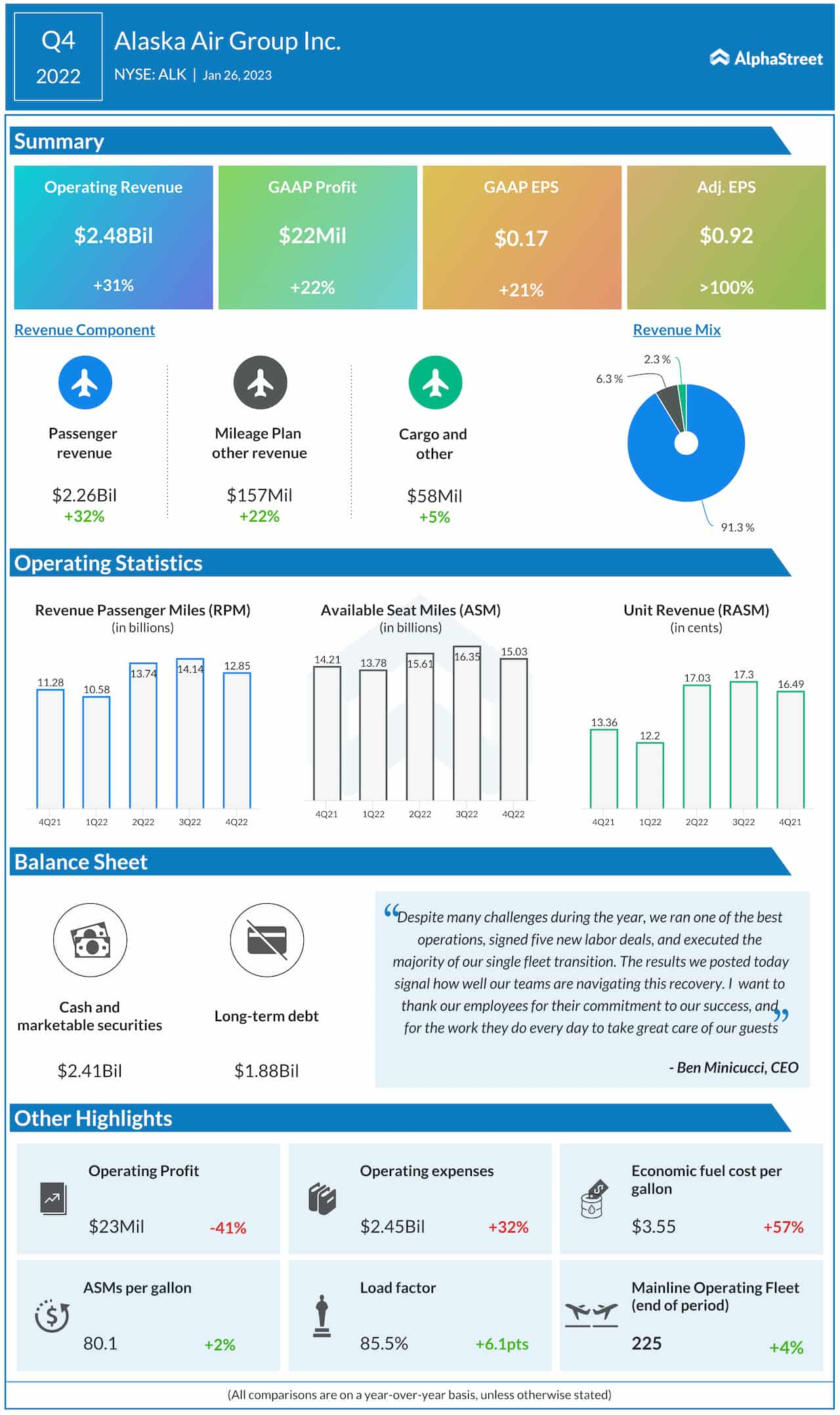

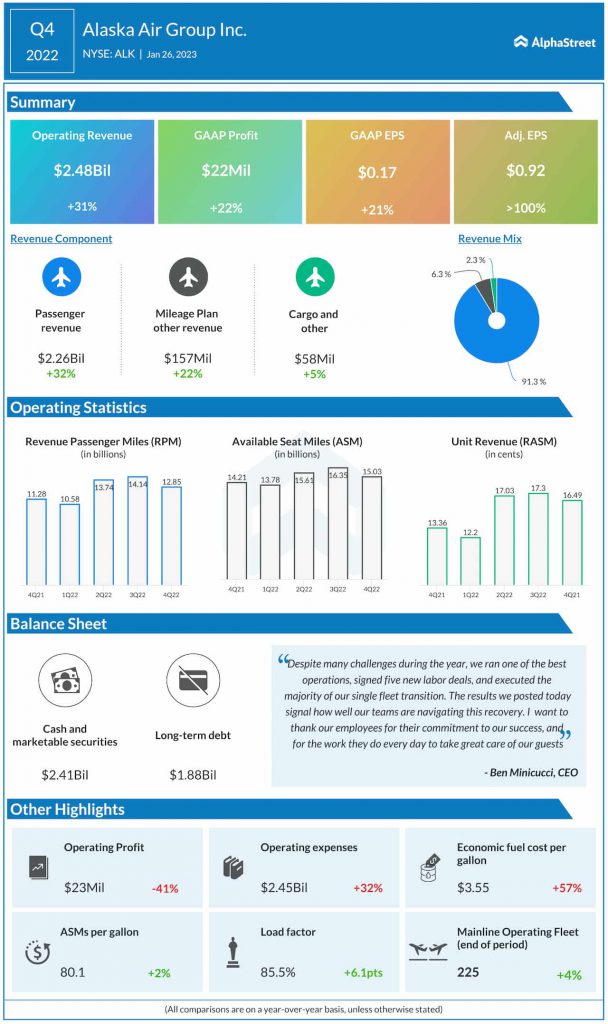

Alaska has guided for total revenue to be up 29-32% year-over-year in Q1 2023. Analysts are projecting revenue of $2.19 billion, which would reflect a 30% growth over Q1 2022. In the fourth quarter of 2022, revenue increased 31% to $2.48 billion.

Earnings

Analysts are projecting a loss of $0.48 per share for Alaska in Q1 2023, which compares to a loss of $1.33 per share reported in Q1 2022. In Q4 2022, adjusted EPS was $0.92.

Points to note

On its Q4 conference call, Alaska said it was seeing healthy leisure travel trends and despite some softness in corporate travel, it remains optimistic on its recovery prospects. In Q4, passenger revenue increased 32% YoY. Traffic increased 14% while unit revenue rose 23% in the fourth quarter. Alaska saw a 16% increase in yield while load factor was 85.5% in Q4.

Alaska anticipates returning to pre-pandemic levels of capacity during the first half of 2023. The company has guided for capacity to be up 11-14% in Q1 2023. In Q4, capacity was up nearly 6%.

In Q4, CASMex increased 10% year-over-year. CASMex was up 24% versus 2019, mainly due to lost capacity and incremental costs due to adverse weather conditions. Alaska expects CASMex to be down 0-2% YoY in Q1 2023.

Alaska now expects economic fuel cost per gallon to range between $3.35-3.45 in Q1 2023 versus the earlier outlook of $3.15-3.35.