Bearish Outlook

“Overall, we anticipate a reduction in our global workforce, which includes employees and contractors, of 15% by year-end 2022 versus 2019 staffing levels. The vast majority of these reductions are occurring in above-field or above-site organizations,” said Exxon’s senior vice-president Jack Williams during his post-earnings interaction with analysts.

Investing in XOM

While it is certain that the ongoing improvement in the pandemic situation will reflect in Exxon’s performance also, the stock is likely to remain in the danger zone. Experts’ cautious outlook points to the need to be careful with XOM, despite the positive target price. So, it’s better to wait and watch at least until the company releases its next quarterly numbers.

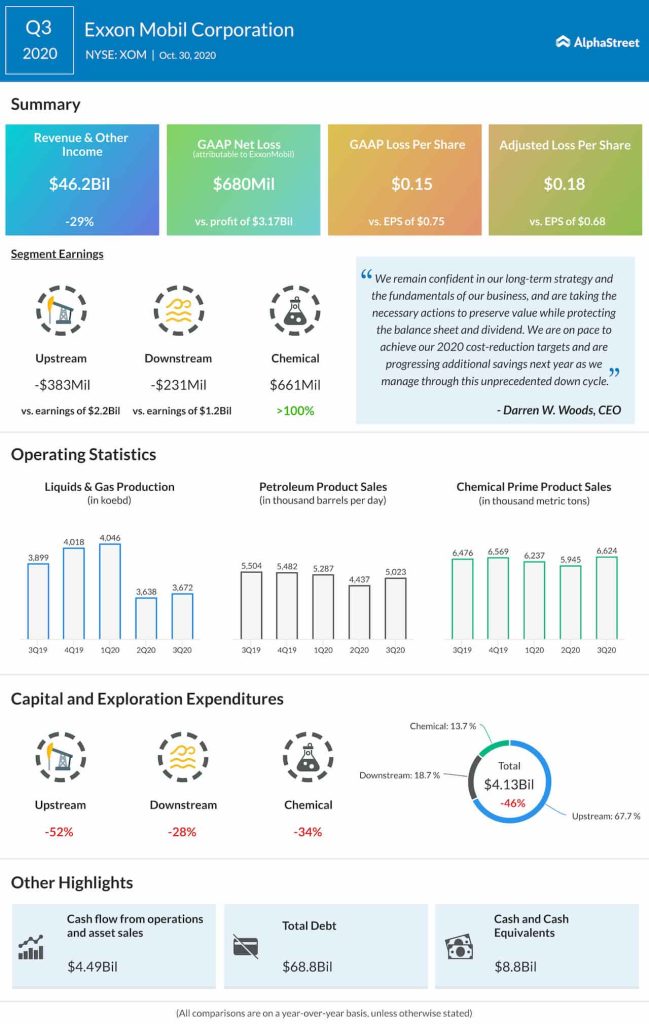

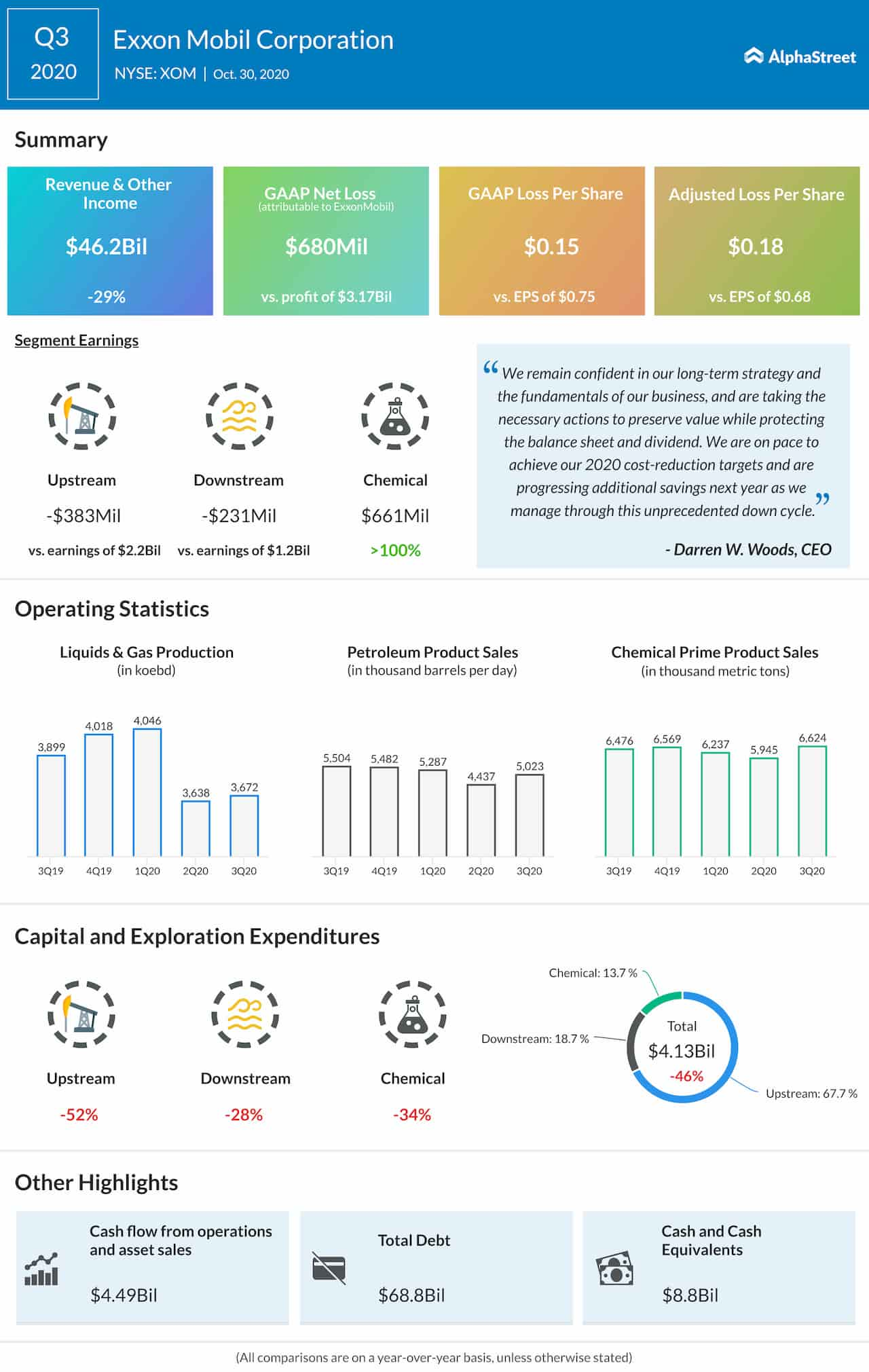

The company slipped to a loss of $0.18 per share in the third quarter, on an adjusted basis, as revenues plunged 29% to $46.2 billion. Though liquid realizations grew sequentially, aided by better prices and improved demand, that was more than offset by dismal gas realizations.

The Positives

The only bright spot was the Chemical division that generated profit, while both the Upstream and Downstream businesses remained in loss. Market watchers had predicted a bigger downturn. But weakening margins, mainly due to higher feedstock costs, offset the benefit of stable chemical demand to some extent.

In a sign the company’s cost-reduction drive is yielding the desired results, capital and exploration costs dropped 46% annually to $4.13 billion. The management is going ahead with a 30% cut in capital expenditure this year.

Cash is Key

For production to return to the pre-crisis levels – which did not improve meaningfully from last quarter’s lows – an extensive investment plan is required and that would put pressure on liquidity. Also, the company is keen on keeping the dividend intact, while some of its peers have hinted at reducing capital returns to maintain liquidity.

From Exxon’s third-quarter earnings conference call:

The impacts of increased curtailments are anticipated to be offset by seasonally higher European gas demand. In the Downstream, we anticipate demand to be roughly in line with the third quarter with higher scheduled maintenance. In Chemical, we anticipate margins to be impacted by increased supply from capacity additions and improved industry utilization with the recovery from hurricanes and reliability events. Our scheduled maintenance is expected to be in line with the third quarter.

Read management/analysts comments on quarterly results

Exxon’s shares have been in a free-fall for more than a year, with their value more than halving during that period. Though the stock suffered a setback soon after last week’s earnings report, it recouped pretty quickly and traded close to the pre-earnings levels on Monday. However, it continues to underperform the market.