Shifting Focus

The beverage makers have been pursuing partnerships and strategic acquisitions to cash in on the growing popularity of sports drinks and sparkling water, while also expanding the market for their successful products. Taking inspiration from partner-cum-rival Coca-Cola, which last year announced its entry into the cannabis beverages space, Monster Beverage (MNST) recently hinted at launching its own brands of marijuana-based non-alcoholic beverages.

Coca-Cola

It is a fact that the return to Coca-Cola shareholders has been lower than the S&P 500 average in the past five years. The softening sales of flagship brands like Coke, Sprite, and Fanta has made the company think about transforming into a full-fledged beverage maker that offers much more than just soft drinks. Soon, the brand portfolio will include non-soda drinks like tea, coffee, and fruit juice. Though the transition is tough, the company’s extensive experience in the field and presence in core markets will be helpful.

The beverage makers are pursuing partnerships and acquisitions, while also expanding the market for their successful products

The contributions to margin growth from the remodeling of the bottling and distribution network are expected to continue in the coming quarters, which also gives Coca-Cola an edge over PepsiCo.

PepsiCo

While dividend investors are disappointed by PepsiCo’s historically low annual dividend growth this year, the expansion initiatives with stress on the snacks and food segment make it an attractive investment target.

Also see: Cannabis-beverage industry is something you don’t want to miss

The lackluster revenue performance of the North American Beverage segment has been a cause for concern for PepsiCo, which has been focusing only on soft drinks over the years. However, the company is set to gain from its consistent performance in the international market, supported by the strength of the food business, overall brand value, and expansive distribution network.

Monster Beverage

Monster Beverage, which has long been dominating the energy drink market, with popular brands like Caffe Monster, Monster Energy and Espresso Monster, has an advantage over its larger beverage rivals when it comes to expansion. Frequent innovation, product launches, and growing brand strength keep it on the growth trajectory.

These positive factors, combined with continuing overseas growth and access to Coca-Cola’s distribution network, have reflected in the company’s recent financial results and stock performance. Going by the current trend, the complex business partnership between Coca-Cola and Monster Beverage will likely be more beneficial to the latter in the long-term.

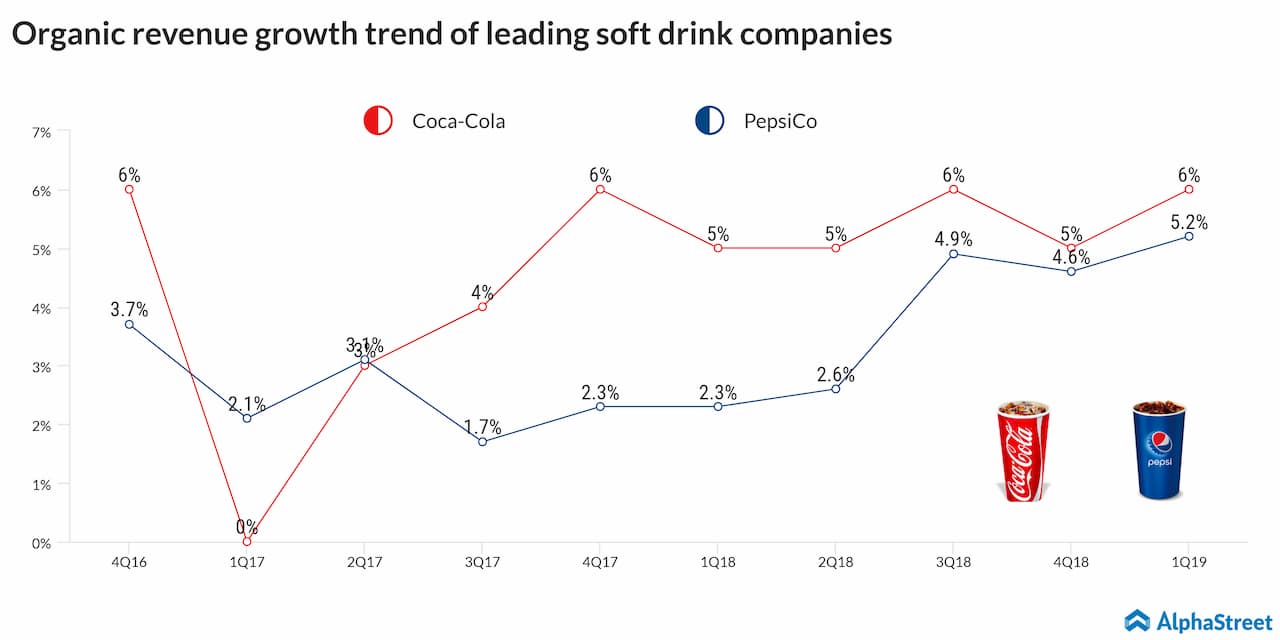

Quarterly Performance

Benefitting from the management’s farsighted growth strategies, Coca-Cola’s first-quarter revenues gained 5% to about $8 billion, driving earnings higher to $0.48 per share. However, the weak sales growth, mainly due to changing consumer preferences, has prompted the company to guide full-year numbers below the previous year’s levels.

Related: Monster Beverage Q1 2019 Earnings Conference Call Transcript

PepsiCo delivered a comparatively better show in the latest quarter when most of the products witnessed sales growth in key markets. A 3% revenues growth pushed up earnings as much to $0.97 per share. The company forecasts a stronger performance this year compared to 2018.

Monster Beverages started 2019 on a positive note, posting double-digit growth in first-quarter sales and earnings to $946 million and $0.48 per share, respectively. Sales of strategic brands grew by 6.9% and those of energy drinks, the company’s main growth driver, moved up 11.5%

Also see: The Coca-Cola Q1 2019 Earnings Conference Call Transcript

ADVERTISEMENT

The Stocks

Coca-Cola shares gained about 8% since the beginning of 2019. PepsiCo, like its main rival, also maintained a consistent upward trajectory but on a larger scale. When it comes to the recent stock performance, Monster Beverage has a clear lead over the others, with a 30% growth in the past six months.