Units

Shanghai 360 Financing Guarantee Co. — (May 2019)

Shanghai Qiyue Information & Technology Co. — (August 2018)

HK Qirui International Technology Company – (June 2018)

Fuzhou 360 Financing Guarantee Co. — (June 2018)

Fuzhou 360 Online Microcredit Co. — (March 2017)

Shanghai Qiyu Information & Technology Co. — (July 2016)

Operating Segments

The ‘capital-light’ model, which along with other technology-powered solutions accounted for about 27% of total loan originations in the second quarter, has been a phenomenal success. This innovative concept was incorporated into the Platform Services segment last year, marking the company’s transition from a traditional loan facilitator into a technology enabler. Credit Driven services, the other segment that is relatively capital heavy, accounts for around 90% percent of total revenues. Tasks like matching of borrowers with funding sources, incremental credit assessment, and collection mainly come under its purview.

Sector

Consumer lending is a fast-growing area of the Chinese financial services sector, partly due to the emergence of online platforms that use advanced technology for loan distribution. The future of internet-based consumer finance looks bright, thanks to favorable government policies and the growing adoption of digital technology. However, a significant portion of consumer loans are still processed by conventional players like commercial banks and licensed finance companies.

Strategy

Earlier this year, 360 DigiTech acquired a major stake in Kincheng Bank as part of its policy of achieving “scalable” business expansion. Leveraging its effective customer acquisition prowess and advanced online platform, the company also pursues partnerships with traditional banks. Such associations provide access to important banking licenses and create a backdrop for meeting regulatory compliance. The technology that supports the platform and customer acquisition is managed by 360 Group, the primary financing partner. Precautions are taken to protect privacy at every stage, without compromising on customer experience. The arrangement allows users to navigate the many external platforms that constitute the digital ecosystem.

Competition

The bank has been using innovation to tackle competition, with the latest such move being the launch of virtual credit card product V-pocket that got an overwhelming response. The strategy assumes significance considering the influx of new players into the online consumer finance market. The large volume of client data and access to multiple sources for gathering borrower information give the company an edge over peers. The other key advantages are the proprietary risk management system and competitive pricing.

The main rivals include customer credit technology firm Qudian Inc. (NYSE: QD), which operates in the domestic market under the two segments of Instalment Credit Services and Transaction Services. Yirendai (NYSE: YRD), with a market cap of about $338 million, offers an array of products including loans for education, home remodeling, and travel.

Key Statistics

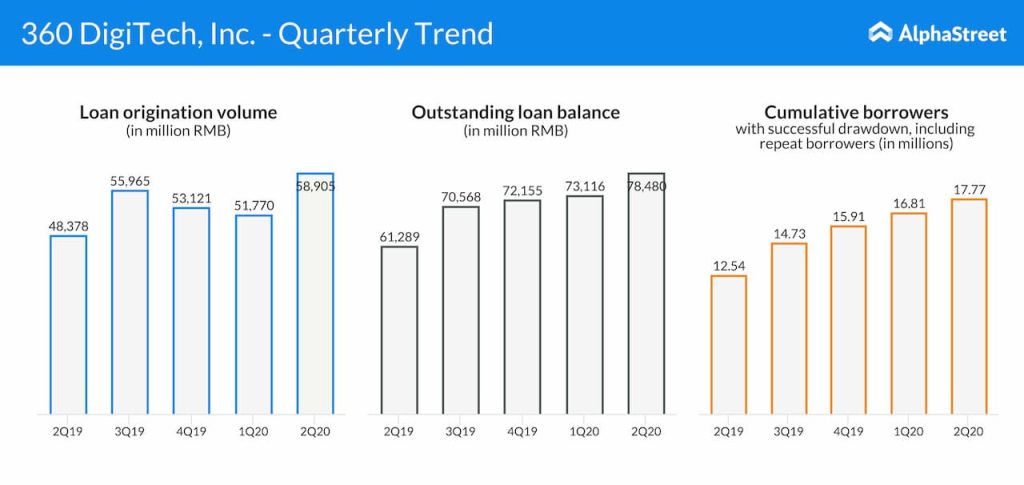

In the quarter ended June 2020, 360 DigiTech recorded loan originations of RMB 58.9 billion, catering to a total of 17.77 million borrowers. It represents a 22% growth from the same period of last year. Adjusted profit climbed 36% annually to RMB 942 million during the quarter, aided by a 50% growth in revenues to RMB 3.3 billion. The outcome marked an improvement from the prior quarter, supported by a whopping 68% fall in operating expenses. At the end of the last fiscal year, the company had 81 institutional funding partners comprising peer-to-peer associates and financial institutions.

Challenges

Currently, the biggest risk facing China’s financial service sector is the macroeconomic challenges posed by coronavirus, though the country’s corporate world is rapidly emerging from the crisis. Loan originations and demand for credit might remain subdued in the second half. For non-traditional financial service providers, a potential drag on profitability and strain on asset quality has been a cause for worry. 360 DigiTech’s business model is such that it is often influenced by credit cycles and changes in the general economy.

On the Bourses

The company’s shares, which had been trading around the $10-mark for quite some time, improved their position this week. However, they are trading far below the peak seen in early 2019.

The pandemic-related slowdown did not have any major impact on the stock as investors responded positively to the stable customer growth and impressive financial performance. The promising target price, which represents a 75% upside, has added to the upbeat sentiment.

Latest Updates

On September 15, 2020, the company secured shareholders’ approval to change its name from 360 Finance, Inc. to 360 DigiTech, Inc., effective immediately. The purpose of the rechristening is to expand the purview of the brand. It is expected that the new identity would help in representing the firm’s long-term strategic positioning in the market more effectively. On the next day, the ordinary stock and American depositary shares started trading under the new name. Earlier, 360 Group received regulatory approval for the planned acquisition of a 30% stake in Kincheng Bank of Tianjin. In July, the company appointed Alex Xu as chief financial officer, to succeed Jiang Wu.

Forecast

The relatively unfavorable macroeconomic conditions and the evolving regulatory environment have prompted the management to adopt a conservative strategy, while maintaining the progressive business momentum and growth plans. On the positive side, China’s Banking and Insurance Regulatory Commission recently published a notification that validates 360 DigiTech’s business model. Also, a guideline issued by the country’s apex court points to a gradual decline in interest rate.

Read management/analysts’ comments on 360 DigiTech’s Q2 2020 earnings

The company continues to expect loan origination volume to be in the RMB200—220 billion range in fiscal 2020. As the new brand identity indicates, it will focus on the technology-centric strategy and strive to build a data-driven platform in the long term. Also, there will be a continued focus on diversifying the funding sources to banks, consumer finance companies, and peer-to-peer lending platforms.

Conclusion

After a successful but challenging first half, 360 DigiTech is better-equipped to take advantage of the positive momentum in the Chinese consumer finance market, thanks to the shift in government’s policies that puts additional stress on household consumption. Currently, the company is riding the wave of economic recovery in the country, supported by its risk management capabilities even as credit demand and asset quality gradually return to the pre-crisis levels.

_________