After reporting mixed results for the first quarter, amid widespread disruption caused by the COVID outbreak, one of the strategies laid down by 360 Finance, Inc. (NASDAQ: QFIN) was the scalable expansion of the business. With the aim of leveraging the unique business model, an affiliate of the China-based online consumer finance platform last week clinched a deal that would add value to its portfolio.

360 Group has acquired a major stake in Kincheng Bank of Tianjin Co, becoming the latter’s largest shareholder. The company’s stock made strong gains following the report and ended Friday’s session sharply higher. It is a mutually beneficial deal for the companies which had been operating in partnership for quite some time, with focus on customer service and technological innovation.

[irp posts=”62932″]

Being a full-fledged financial services provider, Kincheng Bank can help 360 Finance expand market share by offering a wide range of services, especially in the micro, small and medium segments. The key benefits of the association are lower funding costs, greater loan facilitation, and faster customer addition. By teaming up with Kincheng Bank, the company can also gain easy access to important banking licenses, something that is valued by financial service providers in China.

Unique Model

360 Finance’s technology-based business allows it to collaborate with traditional banks in a hassle-free manner. It also helps the partnerships leverage the company’s customer acquisition prowess and advanced digital platform.

“We believe this deal will allow us to generate greater operating synergies and further expand our financial ecosystem. It also showcases our determination to become the most respected fintech company in China in terms of planning for and staying ahead of regulatory compliance,” said Haisheng Wu, chief executive officer of 360 Finance.

Q1 Revenue Soars

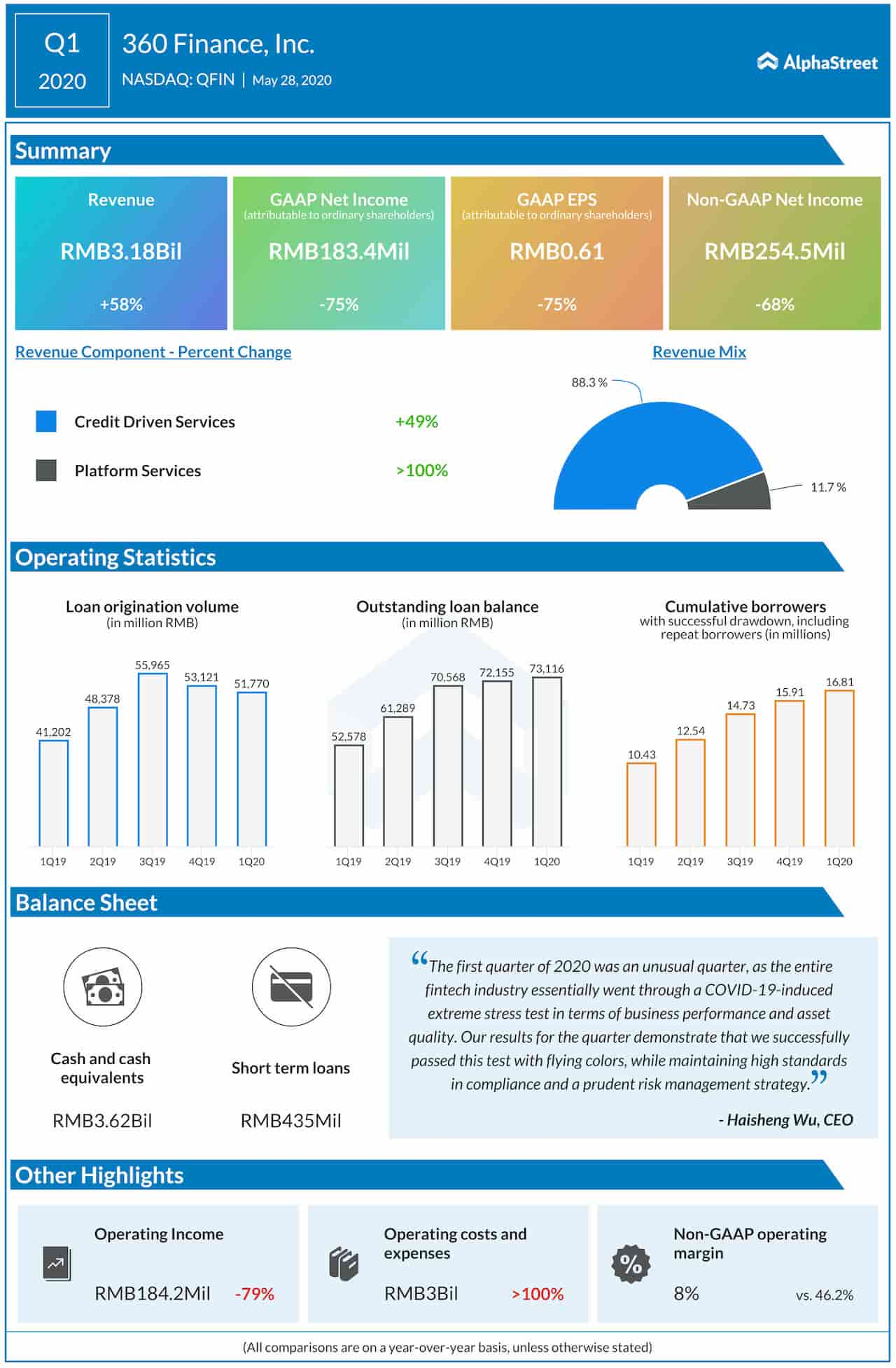

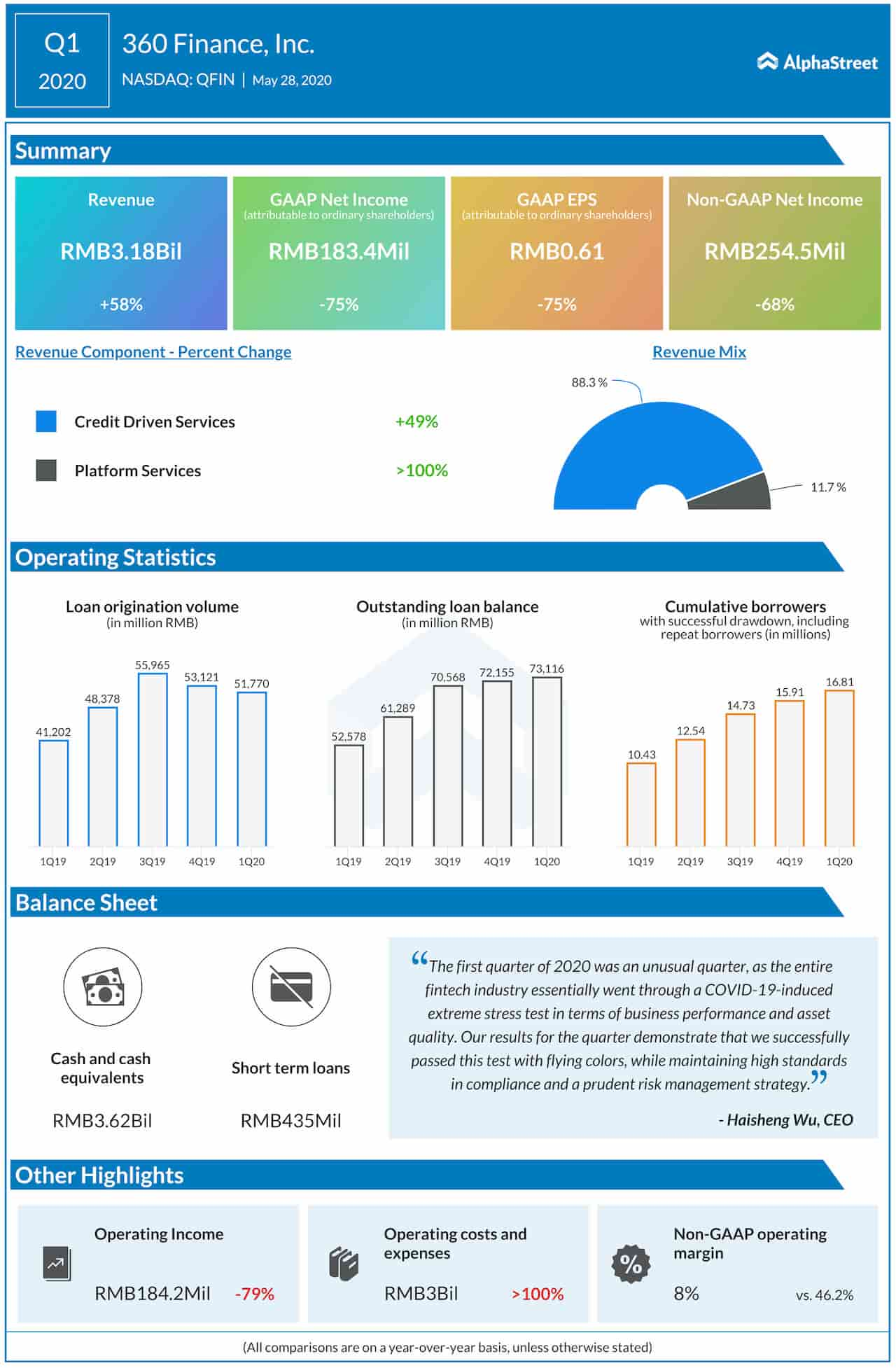

In the first quarter of 2020, revenues climbed 58% annually to RMB 3.2 billion, but earnings declined to RMB 0.61 per share reflecting a marked increase in operating costs. Revenues of the Platform Services segment more than doubled during the three-month period.

The company’s stable customer growth and positive revenue performance have helped the stock stay resilient to the market selloff, but there are growing concerns about the deteriorating US-China relations and its impact on Chinese companies. Things went from bad to worse after the senate recently passed a bill to delist certain Chinese stocks from American stock exchanges.

[irp posts=”59791″]

After dropping to a new low in mid-March, hurt by the COVID-induced selloff, shares 360 Finance maintained a steady uptrend. However, they are currently trading down 27% from last year’s levels.