Shares of American Airlines Group Inc. (NASDAQ: AAL) were up slightly on Friday. The stock has gained 37% year-to-date. The airliner reported its second quarter 2023 earnings results a day ago, surpassing projections on both the top and bottom line numbers. The company also raised its earnings outlook for the full year of 2023. Here’s a look at its expectations for the near term:

Revenue

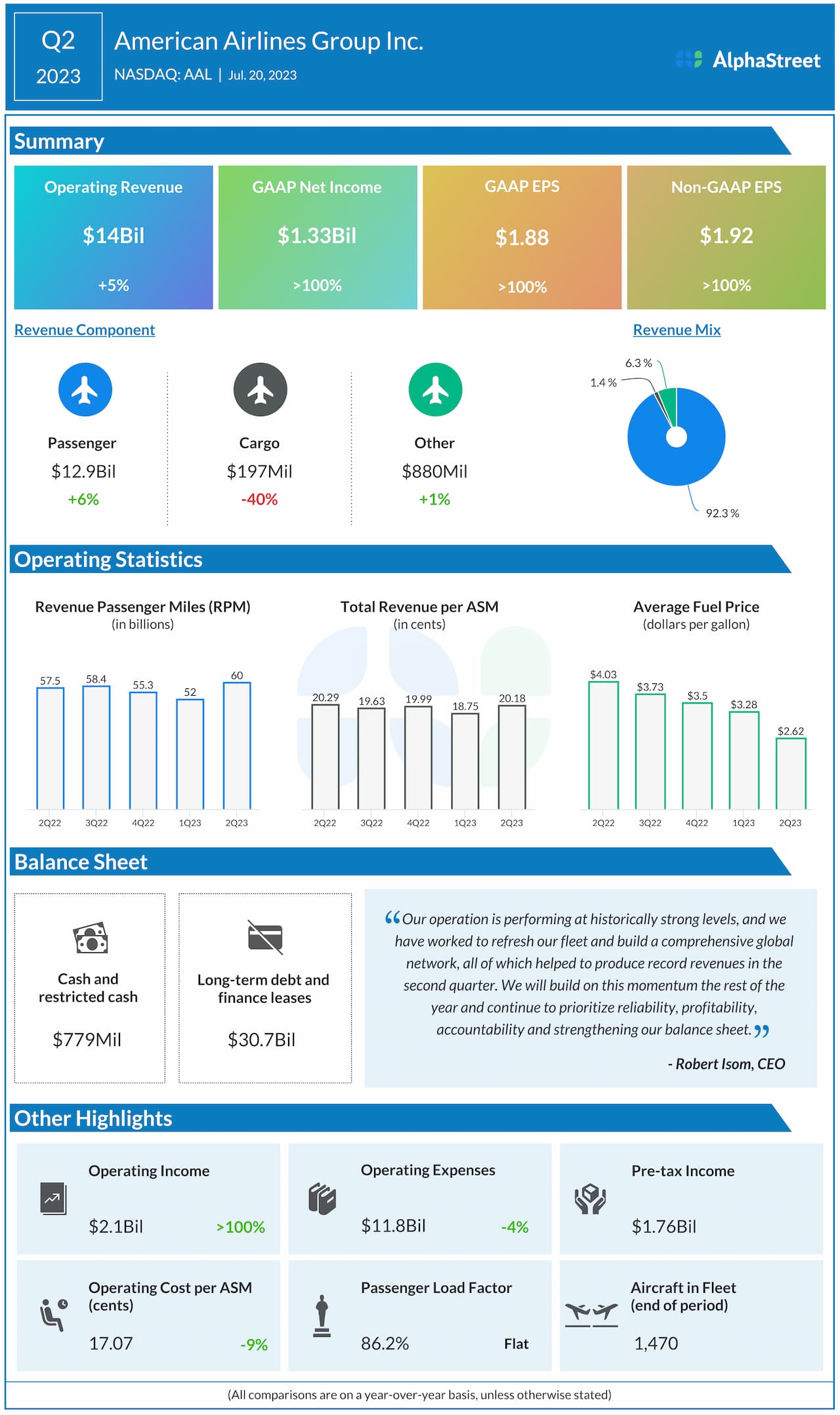

American Airlines delivered total operating revenues of $14.1 billion in Q2 2023, up 5% year-over-year. Passenger revenue grew 6% while cargo revenue was down 40%. In Q2, total revenue per available seat mile (TRASM), or unit revenue, dipped 0.5% from the same period last year. Domestic unit revenue dropped 1.9% YoY while international unit revenue rose 18.3%.

The demand environment remains positive and bookings remain strong. AAL generated robust revenue during the July 4 holiday period and it is seeing favorable trends in both domestic and international business travel.

For the third quarter of 2023, however, American expects TRASM to be down 4.5-6.5% YoY on 5-7% more capacity due to tough comparisons with the prior-year quarter. For the full year of 2023, it expects unit revenue to be up low single digits YoY. Capacity for FY2023 is expected to be up 5-8% YoY.

Profitability

In Q2 2023, American Airlines delivered GAAP net income of $1.3 billion, or $1.88 per share. Adjusted EPS more than doubled YoY to $1.92. For the third quarter, adjusted EPS is expected to range between $0.85-0.95. American raised its earnings guidance for the full year and now expects adjusted EPS of $3.00-3.75 versus the previous range of $2.50-3.50.

Adjusted operating margin was 15.4% in Q2. For Q3 2023, the company expects adjusted operating margin of 8-10%. Adjusted operating margin is expected to range between 8-10% for FY2023 as well.

Costs

Operating cost per ASM, excluding net special items and fuel, or CASMx, was up 3.7% in Q2. Average fuel price per gallon was $2.62. CASMx for Q3 2023 is expected to be up 2-4% YoY while fuel price is estimated to range between $2.55-2.65 per gallon. CASMx for FY2023 is also expected to be up 2-4% YoY. Fuel price for the full year is estimated to be $2.70-2.80 per gallon.

Fleet

At the end of the second quarter, AAL had 1,470 aircraft in fleet. On its quarterly conference call, the company stated that in 2023, it expects to take delivery of 23 new mainline aircraft which are all financed. It took 13 deliveries during the first half of the year and expects ten more deliveries by year-end.

For its regional fleet, AAL entered into agreements to purchase seven new Embraer 175 aircraft and seven used Bombardier CRJ 900 aircraft. These will be delivered starting in the fourth quarter of this year.