Shares of Accenture (NYSE: ACN) gained over 7% on Thursday after the company delivered better-than-expected earnings results for the first quarter of 2025 and raised its outlook for the full year. The quarterly performance reflected broad-based revenue growth and strong demand in artificial intelligence (AI).

Results beat estimates

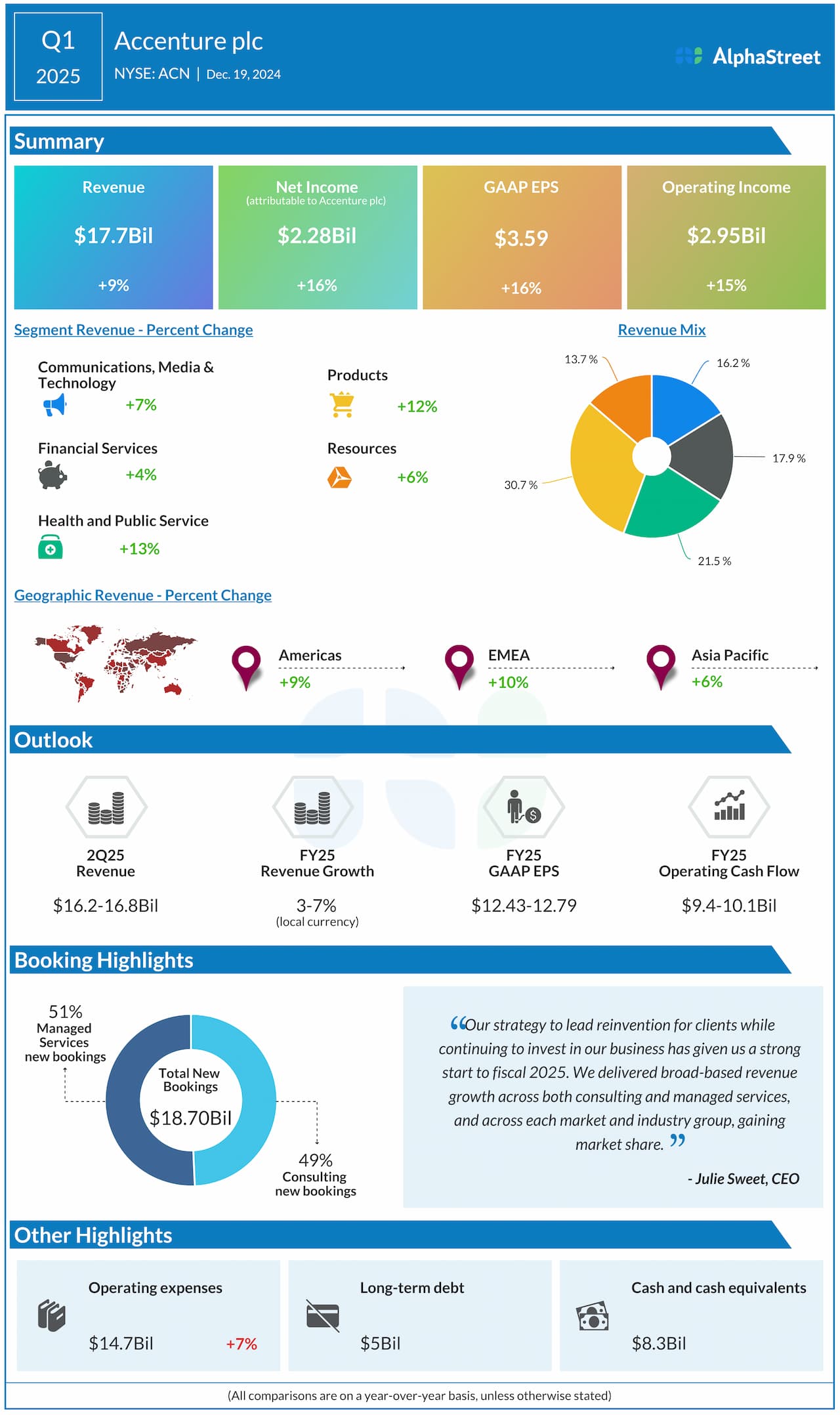

Accenture’s revenues for the first quarter of 2025 increased 9% year-over-year to $17.7 billion, beating estimates of $17.1 billion. Revenues grew 8% in local currency. GAAP earnings per share were $3.59, up 16% compared to last year, and up 10% over adjusted EPS of $3.27 reported in Q1 2024. The bottom line number surpassed projections of $3.42 per share.

Business performance

In the first quarter, Accenture recorded broad-based revenue growth across both consulting and managed services, and across all its markets and industry groups, gaining market share. New bookings rose 1% YoY to $18.7 billion, including 30 quarterly client bookings of more than $100 million and new bookings of $1.2 billion in generative AI.

Consulting revenues grew 7% to $9.05 billion in Q1. New bookings in consulting were $9.22 billion, or 49% of total new bookings. Managed Services revenues increased 11% to $8.64 billion. Managed Services new bookings totaled $9.48 billion, or 51% of total new bookings.

Revenues in Communications, Media & Technology grew 7% to $2.86 billion while Financial Services revenues rose 4% to $3.17 billion. Revenues in Health & Public Service increased 13% to $3.81 billion. Revenues in Products grew 12% to $5.43 billion while in Resources, revenues grew 6% to $2.42 billion.

Revenues in the Americas region increased 9% to $8.73 billion in Q1. Revenues in EMEA grew 10% to $6.41 billion while in Asia-Pacific, revenues rose 6% to $2.54 billion.

Raised full-year guidance

Accenture raised its revenue guidance for fiscal year 2025. The company now expects revenues to grow 4-7% in local currency versus its prior expectation of 3-6%. GAAP EPS for FY2025 is now expected to range between $12.43-12.79 versus the previous range of $12.55-12.91. The earnings outlook represents an increase of 9-12% over GAAP EPS of $11.44 and an increase of 4-7% over adjusted EPS of $11.95 reported in FY2024.

For the second quarter of 2025, the company expects revenues to range between $16.2-16.8 billion, representing a year-over-year growth of 5-9% in local currency.