Accenture plc Q2 2022 Earnings Call Transcript

It makes sense to add ACN to the watchlist since it is widely expected to breach the $400-mark this year. With an average yield of 1%, Accenture’s dividend is not very attractive. But the company returns the lion’s share of its cash to shareholders in the form of share buybacks and dividends, while continuing to reinvest in the business. Recently, Accenture launched what it calls a dedicated metaverse continuum, a futuristic concept that can redefine the way society and businesses work and Interact.

Broad-based Growth

The COVID-related tailwinds will continue contributing to revenue growth across all operating segments, mainly media, communications, financial services, and health & public services. The management’s growth strategy, focused on investing heavily in priority areas like cloud and IT security, should help the company effectively tap into emerging opportunities.

Having recovered from the initial slump, the company’s high-growth segments are expected to gain further momentum, while its legacy IT business experiences some weakness. Operating margins have increased steadily, thanks to the massive scale of the business and extensive global presence.

“We’ve increased significantly the investments in our business, which are all about driving growth today, but also tomorrow, right? We’re in an unprecedented labor market with wage inflation, which we are absorbing and still delivering at 10 basis points operating margin expansion. So, I feel really good about where we are as a company, both for this year and all the things that we’re doing to position ourselves to continue to grow in market-leading ways,” said Julie Sweet, chief executive officer of Accenture.

Q2 Outcome

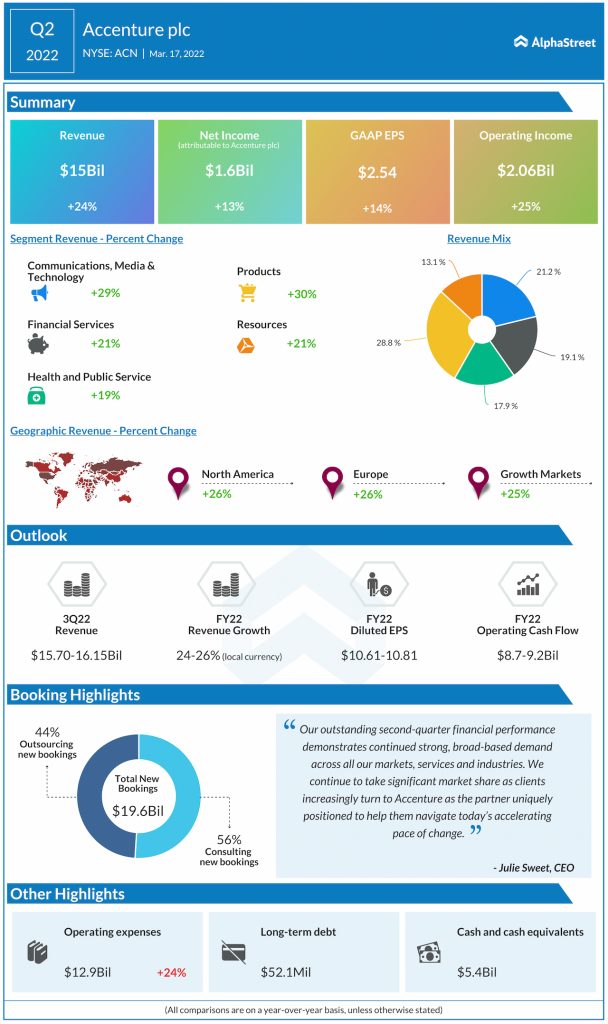

Earnings and revenues topped the market’s predictions in the second quarter of 2022, as they did in each of the trailing five quarters. At $2.54 per share, earnings were up 14% year-over-year in the most recent quarter. Net income rose 13% to $1.6 billion on revenues of $15 billion, which is up 24%.

Driving the top-line growth, all the operating segments registered double-digit increase and new bookings climbed to a record high. Encouraged by the strong demand across the board, the company forecasts double-digit sales growth for fiscal 2022.

Key highlights from Infosys Q3 2022 earnings results

Meanwhile, many investors would find the valuation too high despite the moderation in recent weeks. Also, Accenture continues to face competition from the likes of The Boston Consulting Group, McKinsey & Co, and Bain & Co. though it enjoys an edge over rivals.

Currently trading at the lowest level in about a year, ACN has lost about 22% so far this year. It opened Friday’s session slightly above $321 and traded higher in the afternoon.