For the restaurant industry, things have not changed much since being hit hard by the pandemic nearly two years ago when people were forced to stay indoors. But food chains that quickly adapted to the changing market environment and customer preferences managed to get back on track, and McDonald’s Corporation (NYSE: MCD) is one of them.

Read management/analysts’ comments on McDonald’s Q3 2021 results

Bringing cheer to its shareholders, the San Bernardino-based burger giant’s stock reached an all-time high this week, at the same time raising concerns that the valuation is too high. But experts following the stock see further room for growth citing the company’s stable financial performance, benefiting from the digital push and virus-driven tailwinds.

Brand Power

For prospective investors, McDonald’s represents a brand that rules the rapidly growing global fast-food industry. Given its impressive track record and global reach, the company has what it takes to stay unaffected by economic crises like the one caused by COVID-19. Moreover, McDonald’s is a favorite among income investors because it has raised dividend on a regular basis over the years. MCD is one of the safest Wall Street stocks that have the potential to create strong shareholder returns.

The company’s margin performance has been one of the best in the industry, staying above 40% consistently except during the early phase of the pandemic when sales softened. The management’s initiatives like streamlining the menu and promoting the digital channel for order/delivery are already contributing to the bottom line.

From McDonald’s Q3 2021 earnings conference call:

“We’re evolving the customer experience in ways both large and small to meet changing customer needs and maintain our market leadership. Our three growth pillars are known as our MCDs marketing core menu and the 3Ds of digital, delivery and drive-thru guide our business. This includes amplifying contactless channels like delivery and drive-thru and creating digital experiences that are seamless personalized and easy to use.”

Diversity

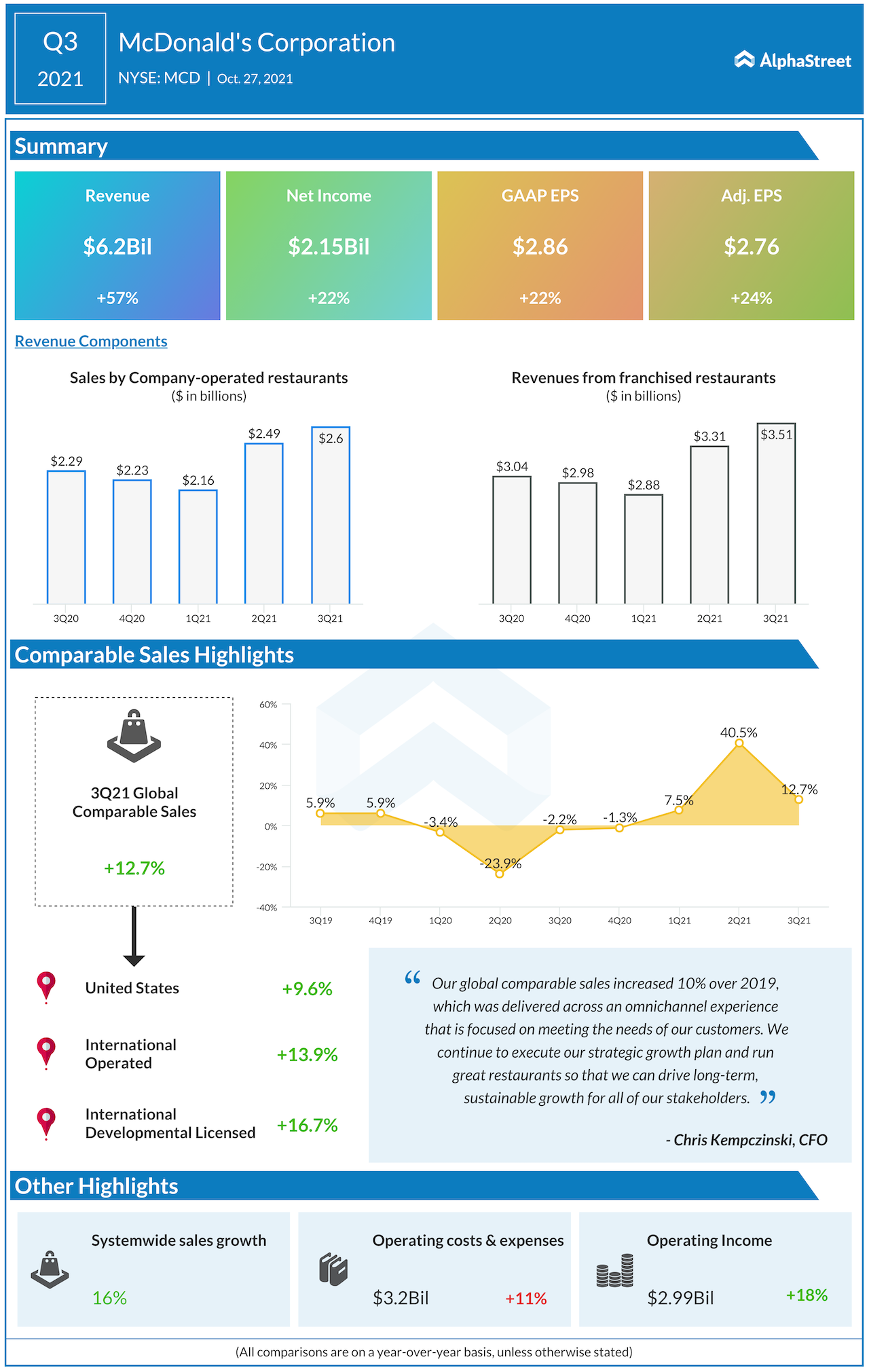

The company has a diversified revenue stream — ranging from franchise fees and rent to loyalty income and food sales — a strategy that gives it an edge over rivals. In the third quarter of 2021, revenues jumped 57% annually to $6.2 billion, which translated into a 24% growth in adjusted earnings to $2.76 per share. In the overseas markets, comparable-store sales grew in double-digits, though at a slower pace than in the prior quarter.

But the fast-food space is getting crowded and top brands like McDonald’s keep innovating to safeguard their market share. Also, intense competition might make it difficult for the company to maintain the current level of margin growth. The deepening inflationary pressure – rising wages and raw material costs — can also have a negative impact on profitability.

Dynamic Yield Sale

Recently, the management surprised everyone with its decision to divest Dynamic Yield, an Israel-based artificial intelligence start-up acquired a couple of years ago during the tenure of former CEO Steve Easterbrook. Then, the deal had raised questions about the rationale behind the deal.

KO Earnings: All you need to know about Coca-Cola Q3 2021 earnings results

MCD briefly breached the $280-mark for the first time this week but withdrew later. The stock closed Thursday’s regular session higher, after growing 5% in the past 30 days.