Alphabet Inc. Q4 2022 Earnings Call Transcript

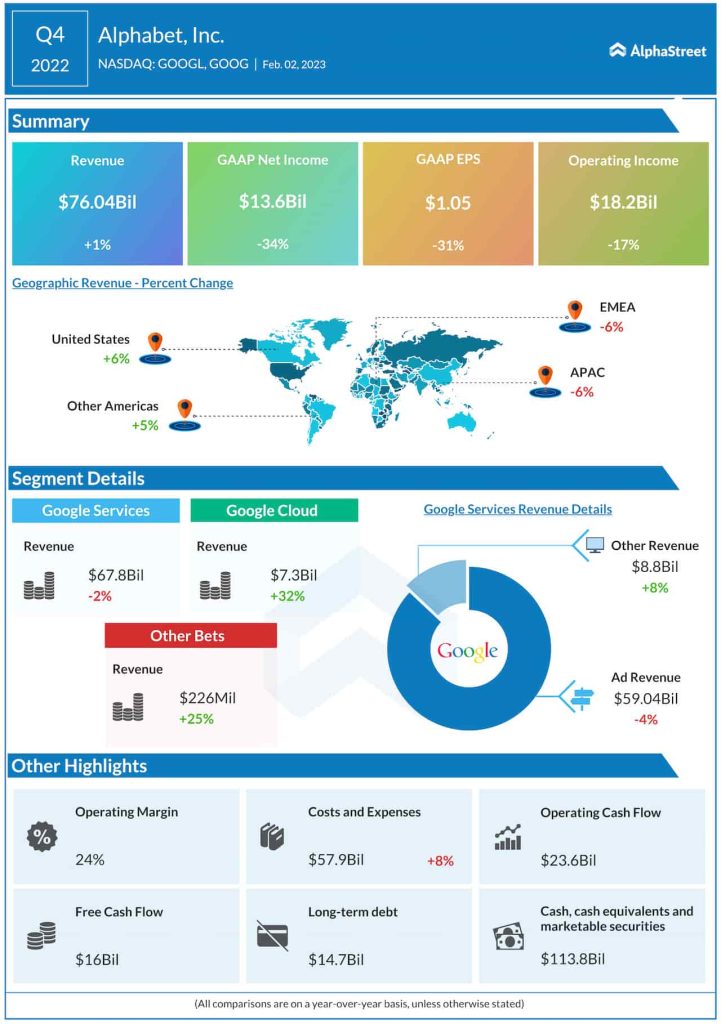

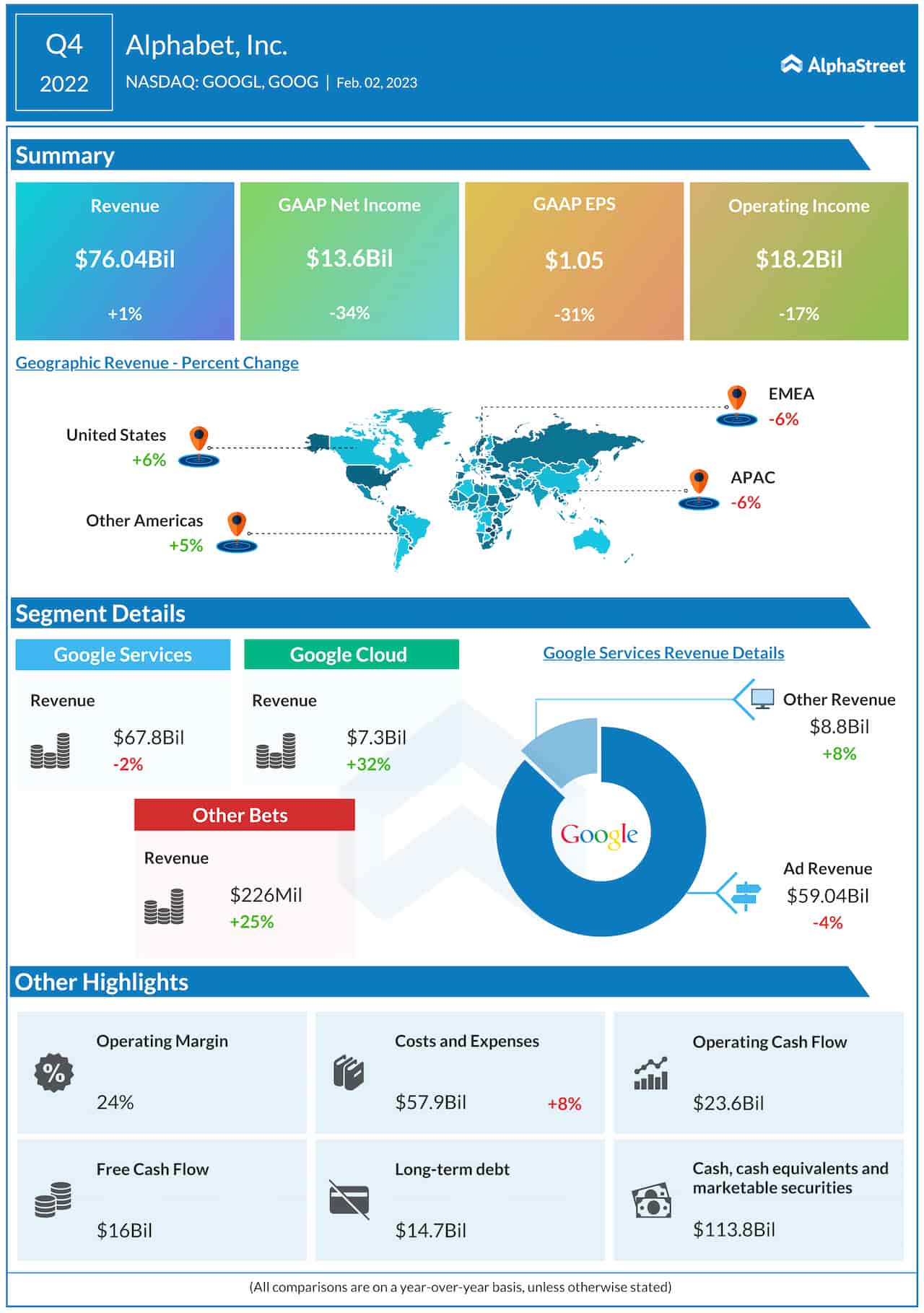

Revenues of the rapidly growing cloud business also came in below estimates, reflecting the widespread slowdown in the technology industry. That was expected since the performance of the cloud segments of competitors was also weak in their latest quarters.

Restructuring

Alphabet recently announced a major workforce reduction, as part of an organizational restructuring, joining other tech giants like Meta Platforms, Inc. (NASDAQ: META) and Amazon.com Inc (NASDAQ: AMZN). The move shows that there will be a decline in hiring in the coming months, as the company grapples with falling ad demand and intense regulatory scrutiny. Meanwhile, hiring activity is picking up across the technology industry, indicating that the present slowdown in temporary and business conditions would return to the pre-crisis levels at any time.

Alphabet’s subscription business is growing, with YouTube Music and Premium crossing 80 million subscribers. But efforts are needed to better monetize these services, considering their weaker-than-expected performance in Q4. The most promising non-core business is Google Cloud, which grew by 32% in the most recent quarter. The differentiated portfolio should continue to drive customer momentum, supported by advanced technologies like AI. Continued investments in technical infrastructure and ongoing initiatives to strengthen the portfolio, like enhancing the YouTube creator ecosystem, adds to the long-term prospects of the business.

Weak Q4

Fourth-quarter revenues and profit missed analysts’ forecasts, as they did in each of the trailing three quarters. While the top line edged up 1% to around $76 billion, earnings dropped a dismal 31% to $1.05 per share. The weakness was more pronounced in markets outside the Americas. Ad revenue, which accounts for around 90% of total service revenue, dropped by 4%.

Going forward, the bottom line will be negatively impacted by severance costs from workforce reduction and real estate-related charges. It is estimated that enterprise spending on digital advertising and cloud services is unlikely to rebound until next year.

MSFT Earnings: Microsoft Q2 profit drops amid weak revenue growth

“In the first quarter of 2023, we expect to incur approximately $500 million of costs related to exiting leases to align our office space with our adjusted global headcount look. This will be reflected in corporate costs. We will continue to optimize our real estate footprint. Turning to capital expenditure. For 2023, we expect total capital expenditure to be generally in line with 2022, with an increase in technical infrastructure versus a decline in office facilities,” said Alphabet’s CFO Ruth Porat.

Alphabet’s stock got a jolt after the earnings report last week and has maintained the downturn since then. Earlier, it entered the new fiscal year on a positive note and has gained about 18% so far.