Shares of Alibaba Group (NYSE: BABA) have dropped 10% since the beginning of the year. The company reported mixed results for the fourth quarter of 2021 a day ago, with revenues surpassing estimates but adjusted earnings per ADS falling short of expectations. Here are some of the positives and negatives from the company’s Q4 earnings report:

Positives

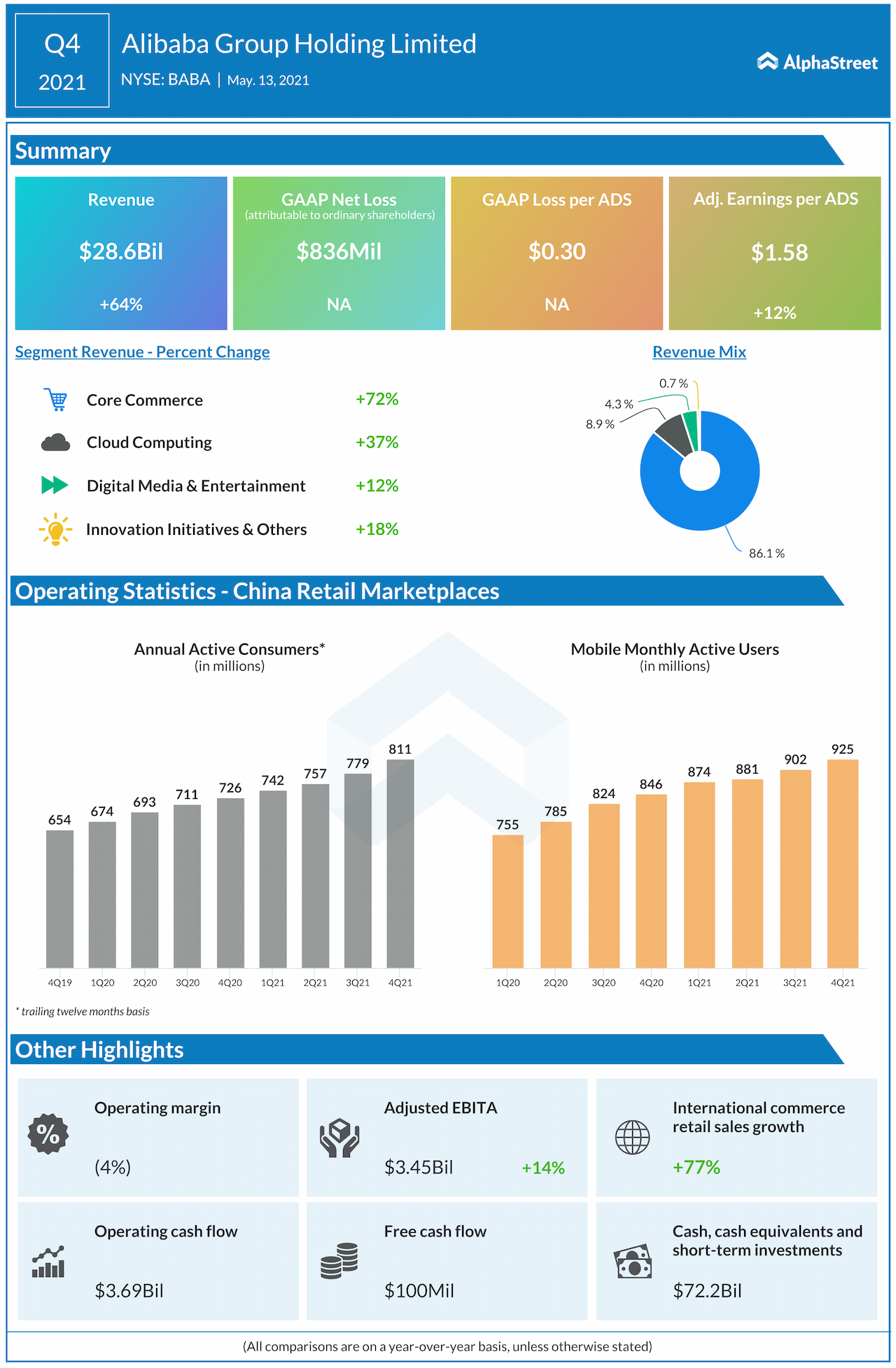

Alibaba’s total revenues for Q4 amounted to RMB187.3 billion, or $28.6 billion, reflecting a year-over-year growth of 64%. On its quarterly conference call, Alibaba stated that China’s GDP grew 18.3% year-over-year during the quarter ended March 2021. Against this backdrop, all of Alibaba’s businesses witnessed healthy growth.

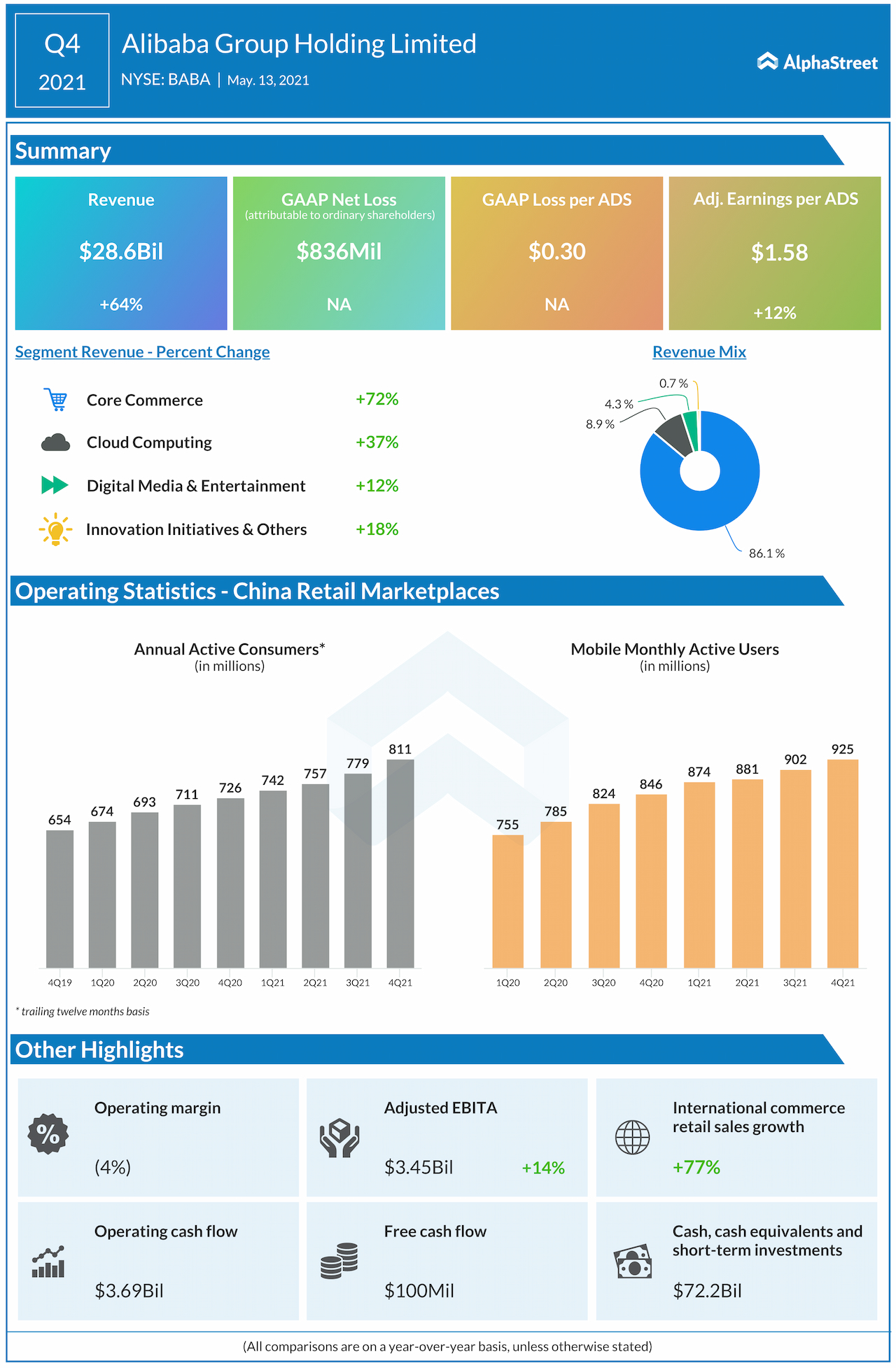

Its retail marketplaces are seeing strong growth and retention rates among new and existing customers. As of March 31, 2021, annual active customers on its China retail marketplaces stood at 811 million, reflecting a quarterly increase of 32 million customers.

Alibaba’s strategy of offering a broad range of products and services and expanding into less developed cities and towns has helped drive strong GMV growth as well as an increase in users on its China retail marketplaces. Online physical goods GMV, excluding unpaid orders, grew 33% YoY in Q4.

Alibaba’s Taobao Deals platform, which offers products at affordable prices to price-conscious customers, witnessed rapid growth with over 150 million annual active customers as of March 31, 2021.

Alibaba saw strong same-store sales growth across its retail chain Freshippo and the company increased the number of Freshippo stores to 257 as of March 31, 2021 compared to 202 stores in the same period last year. Its food delivery service Ele.me saw strong growth in average daily number of paying members which was up around 40% YoY in Q4.

Alibaba expects to see further growth in the coming year and projects total revenues will be over RMB930 billion in FY2022.

Negatives

Alibaba reported a net loss of RMB5.4 billion, or $836 million, in Q4 due to the $2.8 billion anti-monopoly fine that was imposed on it by the Chinese government. Diluted loss per ADS amounted to RMB1.99, or $0.30, for the quarter.

Excluding this one-time impact, along with certain other items, adjusted net income was RMB26.2 billion, or $4 billion, and adjusted earnings per ADS was RMB10.32, or $1.58. Adjusted earnings per ADS came below market estimates. Alibaba faces the risk of regulatory scrutiny and this does raise concerns about any potential future problems that may arise for the company.

In Q4, Alibaba’s cloud computing revenue grew only 37% compared to the year-ago period. The growth rate was slower compared to the past three quarters and was caused by the exit of a top cloud customer.

The customer, who has a significant presence outside China, decided to end the relationship with respect to their international business for reasons not related to the company’s products. Going forward, Alibaba will have to focus on further diversifying its cloud computing revenue across customers and industries.

Click here to read the full transcript of Alibaba’s Q4 2021 earnings conference call