The pandemic has proved to be a double-edged sword for the semiconductor industry. Orders are pouring in but manufacturers often fail to fulfill them, triggering a severe chip shortage that customers are struggling to deal with. After maintaining stable growth during the crisis so far, chipmaker Analog Devices Inc. (NASDAQ: ADI) is busy streamlining operations with focus on capacity expansion to ease supply constraints.

Buy ADI?

The current trend indicates the stock is probably on its way to cross $185 in the next few months and market watchers overwhelmingly recommend buying it. Earlier this month, the stock had peaked after gaining about 47% in the past twelve months. Despite that, ADI looks poised to gain further in the coming weeks.

Read management/analysts’ comments on Analog Devices’ Q2 report

Moreover, the company has raised its dividend almost every year in the past, with the latest being an 11% hike in February 2021. That, combined with the handsome returns, might have certainly brought cheer to shareholders.

In Growth Mode

The Massachusetts-headquartered chipmaker, which is specialized in power management technology, signal processing, and data conversion, ended the first half on an upbeat note. Net profit grew consistently since the beginning of last year as the favorable demand conditions translated into higher gross margins.

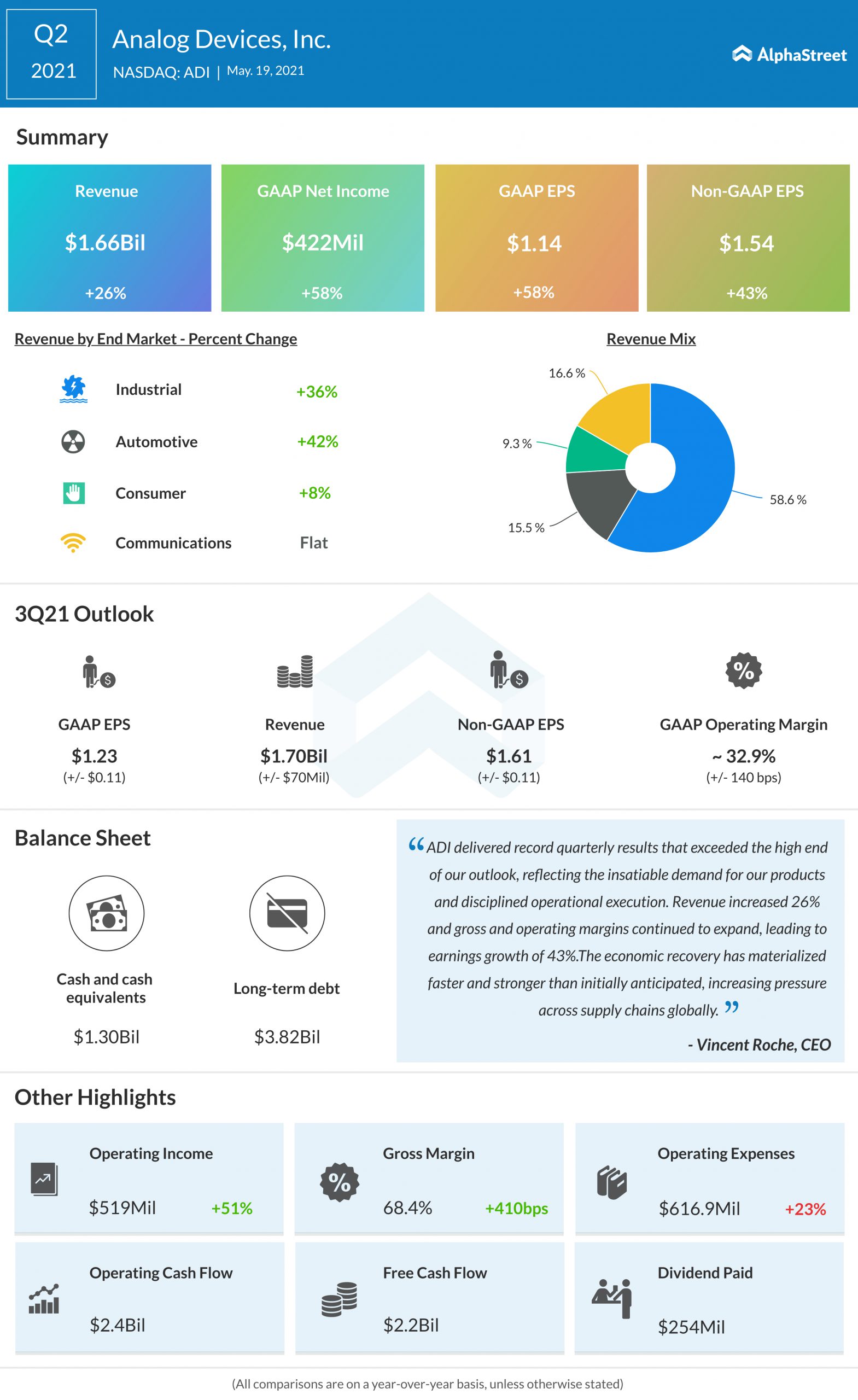

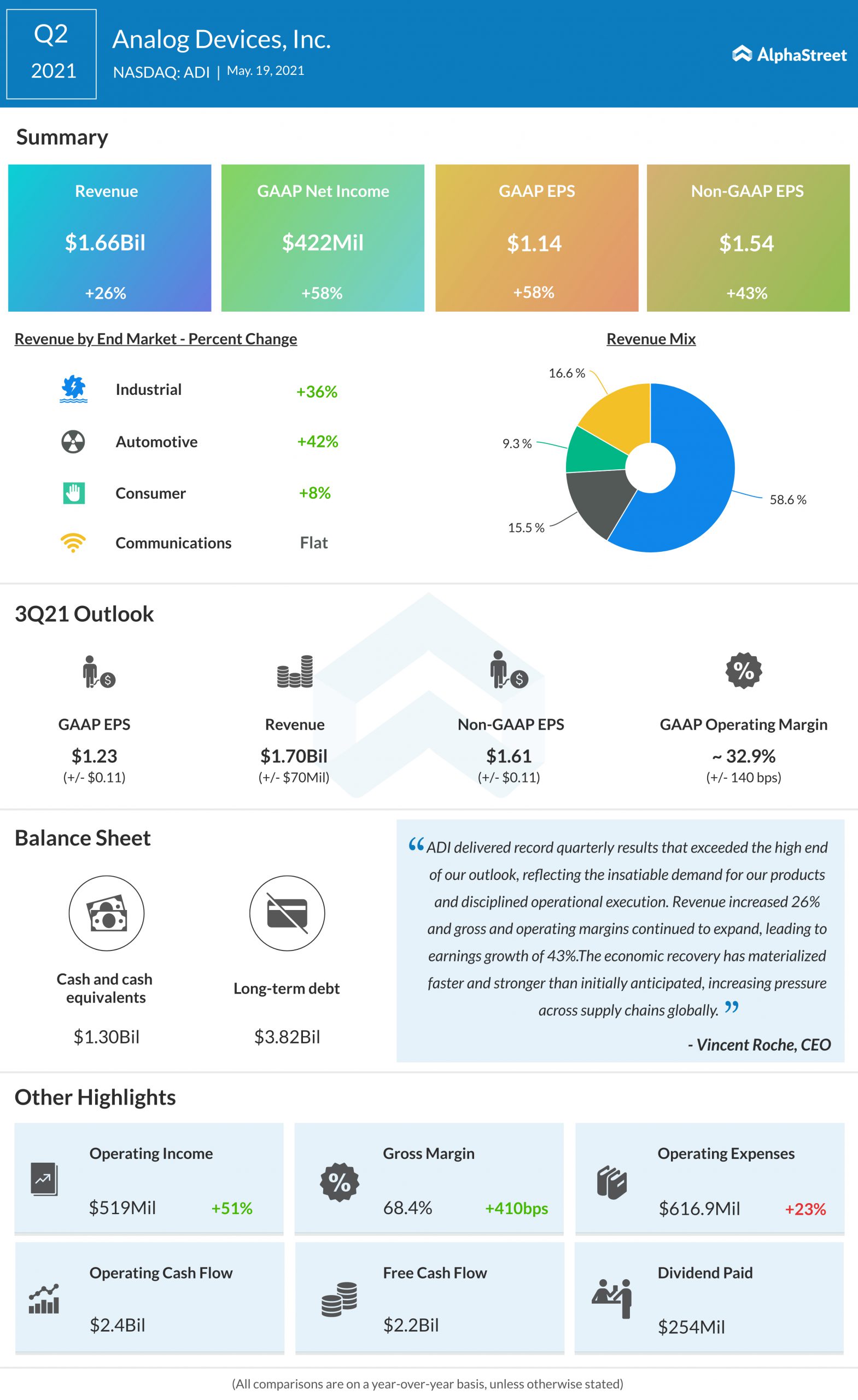

The market will be closely following the company’s third-quarter earnings, which is due on Wednesday, to get a sense of where the semiconductor market is headed in the second half. It is widely expected that earnings would increase as much as 19% from last year to $1.62 per share, on revenues of $1.71 billion. That is broadly in line with the management’s projection.

Late last year, ADI moved with speed and agility, proactively making capital investments to add capacity, positioning us to navigate this disruption and better serve our customers. That said, we like many others in the industry will face a supply-constrained environment through the balance of 2021. Despite this backdrop, we are positioned for a strong second half as our continued capital investments are aligned with robust demand.

Vincent Roche chief executive officer of Analog Devices

Strong Q2

In the second quarter of 2021, the industrial and automotive segments expanded in double digits, lifting the topline to around $1.7 billion – up 26%. Consequently, adjusted earnings jumped 43% year-over-year to $1.54 per share and topped the Street view.

In the latest quarter, the main growth driver would be the high demand from automation, instrumentation, and energy businesses, including for the company’s battery management system that is gaining ground among EV battery manufacturers. Continuing product innovation and portfolio expansion might have added to the tailwind. Overall, the company is catering to a market that stays on the fast track.

Intel Q2 2021 profit, revenue beat estimates

Of late, the focus of capital spending has been on strategic acquisitions, technology, and capacity expansion, amid concerns that the ongoing chip shortage would continue for the remainder of the year and beyond.

Stock Peaks

Shares of Analog Devices ended Monday’s session at $171.07, which is well above their long-term average. After experiencing volatility in the early part of the year, the stock bounced back in mid-May and has maintained the uptrend since then.