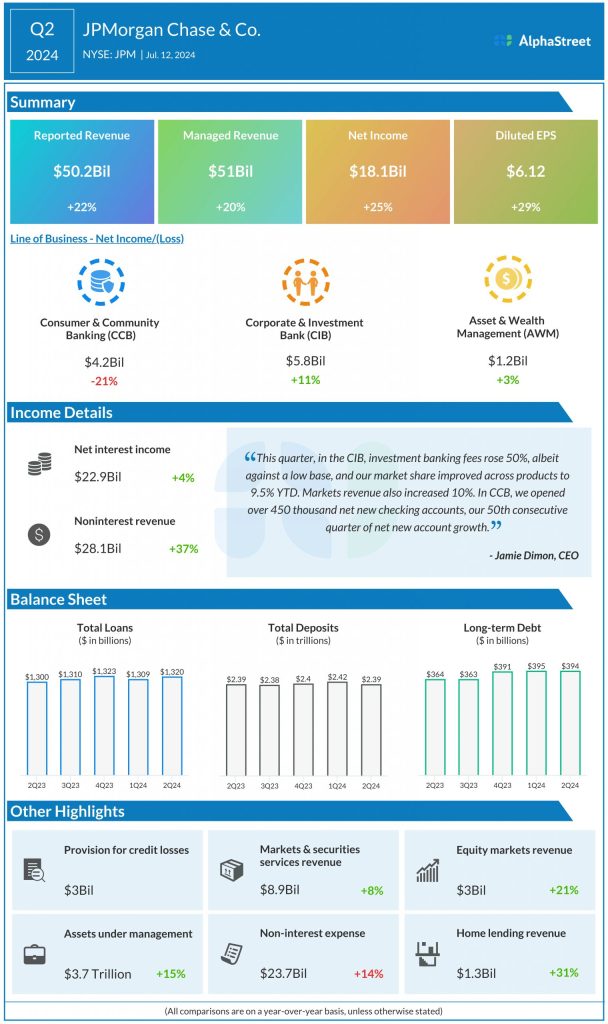

JPMorgan

Wells Fargo

Wells Fargo is expected to report earnings of $1.28 per share on revenue of $20.4 billion in Q3 2024, which compares to earnings of $1.48 per share on revenue of $20.8 billion reported in the year-ago quarter. In Q2 2024, Wells Fargo’s revenue inched up 1% year-over-year to $20.7 billion while EPS rose 6% to $1.33.

Goldman Sachs

Analysts estimate earnings of $7.69 per share on revenue of $12.15 billion for GS in Q3 2024. This compares to EPS of $5.47 on revenue of $11.82 billion reported in Q3 2023. In Q2 2024, the company reported net revenue of $12.73 billion and EPS of $8.62.

Citigroup

The consensus target for Citigroup’s revenue in Q3 2024 is $19.8 billion while for EPS it is $1.31. This compares to revenue of $20.1 billion and EPS of $1.63 reported in the prior-year quarter. In Q2 2024, Citigroup reported revenue of $20.1 billion and EPS of $1.52.

Morgan Stanley

Analysts are predicting earnings of $1.61 per share on revenue of $14.3 billion for MS in Q3 2024, which compares to earnings of $1.38 per share on revenue of $13.3 billion reported in Q3 2023. In Q2 2024, Morgan Stanley reported revenue of $15 billion and EPS of $1.82.