JPMorgan

Citigroup

Citigroup Inc. (NYSE: C) is slated to report its fourth quarter 2022 earnings results on Friday. Analysts are projecting earnings of $1.18 per share on revenue of $17.8 billion. In the year-ago quarter, the company reported EPS of $1.46 on revenue of $17 billion. In Q3 2022, Citigroup reported revenue of $18.5 billion, which was up 6% year-over-year and EPS of $1.63.

Bank of America

Bank of America Corporation (NYSE: BAC) is set to report its Q4 2022 earnings results on Friday. Analysts predict earnings of $0.78 per share on revenue of $24.4 billion. This compares to earnings of $0.82 per share on revenue of $22.1 billion in Q4 2021. In the third quarter of 2022, total revenue amounted to $24.5 billion while EPS was $0.81.

Wells Fargo

Wells Fargo & Company (NYSE: WFC) is slated to report Q4 2022 earnings on Friday as well. Analysts expect earnings of $0.64 per share on revenue of $19.9 billion. In the same quarter a year ago, the company reported earnings of $1.38 per share on revenue of $20.8 billion. In Q3 2022, Wells Fargo posted revenue of $19.5 billion and EPS of $0.85.

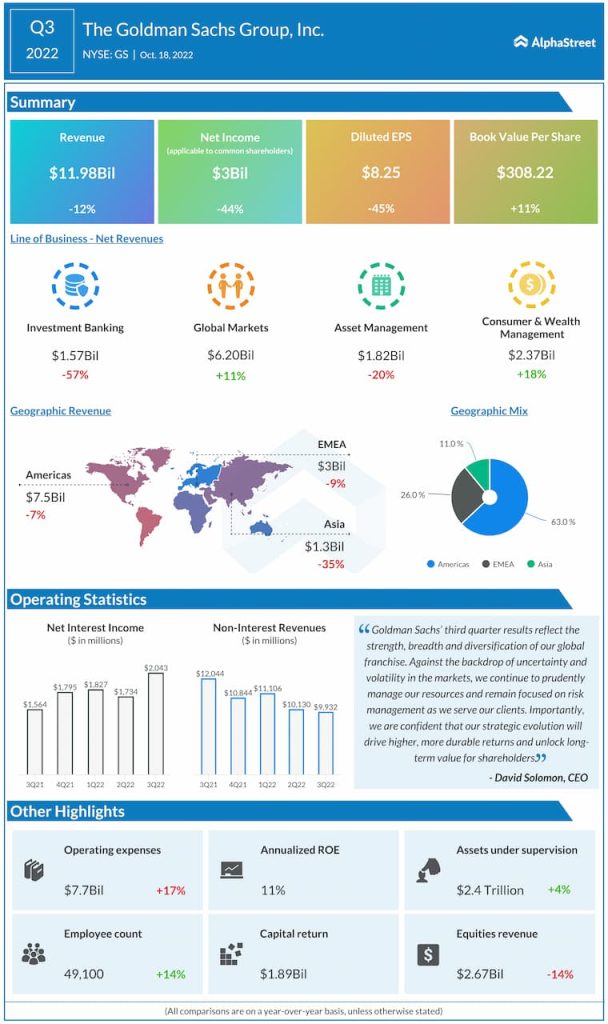

Goldman Sachs

The Goldman Sachs Group, Inc. (NYSE: GS) is scheduled to report its fourth quarter 2022 earnings results on Tuesday, January 17. Analysts are predicting earnings of $5.97 per share on revenue of $11.1 billion. This compares to EPS of $10.81 on revenue of $12.6 billion reported in Q4 2021. In Q3 2022, GS reported EPS of $8.25 and revenue of $11.98 billion.

Morgan Stanley

Morgan Stanley (NYSE: MS) is set to report Q4 2022 earnings results on Tuesday as well. Analysts project earnings of $1.29 per share on revenue of $12.7 billion. In Q4 2021, the company posted EPS of $2.01 on revenue of $14.5 billion. In Q3 2022, revenues amounted to $12.9 billion and EPS was $1.47.

Click here to access the infographics of the latest earnings of these banks