Strong results

Strength in digital

Chipotle’s digital sales gained momentum during the pandemic and its investments in technology helped boost its capabilities to meet this rise in digital orders. In Q2, digital sales grew nearly 11% YoY to $916 million and accounted for around 49% of total sales.

The company continues to expand its digital drive-thru footprint with the majority of its new restaurant openings comprising Chipotlanes. Digital pickup orders, which are high margin transactions, are gaining traction and this is expected to continue with the addition of more of these drive-thru lanes.

Chipotle has expanded its digital capabilities to Europe and Canada thereby boosting its international digital investment. Although digital sales might slow down over the coming months as restrictions ease and people go back to eating out more often, the channel will still see significant momentum due to the convenience factor and change in consumer habits.

New restaurants

Chipotle opened 56 new restaurants during Q2, of which 45 included a Chipotlane. The new restaurant formats have improved the convenience factor for customers and are driving better sales, margins and returns. The new Chipotlanes are seeing around 20% higher sales compared to the non-Chipotlanes. As of the end of June, the company had a total of 244 Chipotlanes.

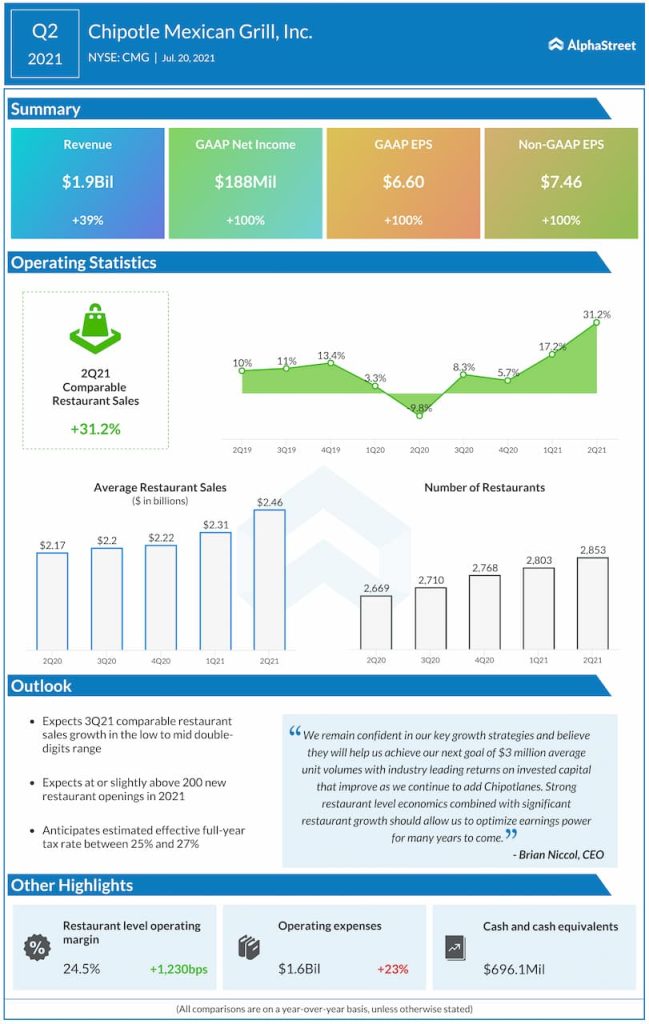

For the full year of 2021, Chipotle expects to be at or slightly above its guidance of 200 new restaurant openings. The company’s trailing 12-month average unit volume is $2.41 million. Over the long term, Chipotle aims to have 6,000 restaurants in North America with AUVs well beyond $3 million.

Outlook

For the third quarter of 2021, Chipotle expects comparable restaurant sales to grow in the low to mid double-digits range helped by menu price increases and recovery in in-restaurant sales.

Click here to read the full transcript of Chipotle Q2 2021 earnings conference call