100 restaurants shut

The company has shuttered 100 restaurants located in shopping centers and malls. The rest remain operational with takeaway, digital order, and delivery services.

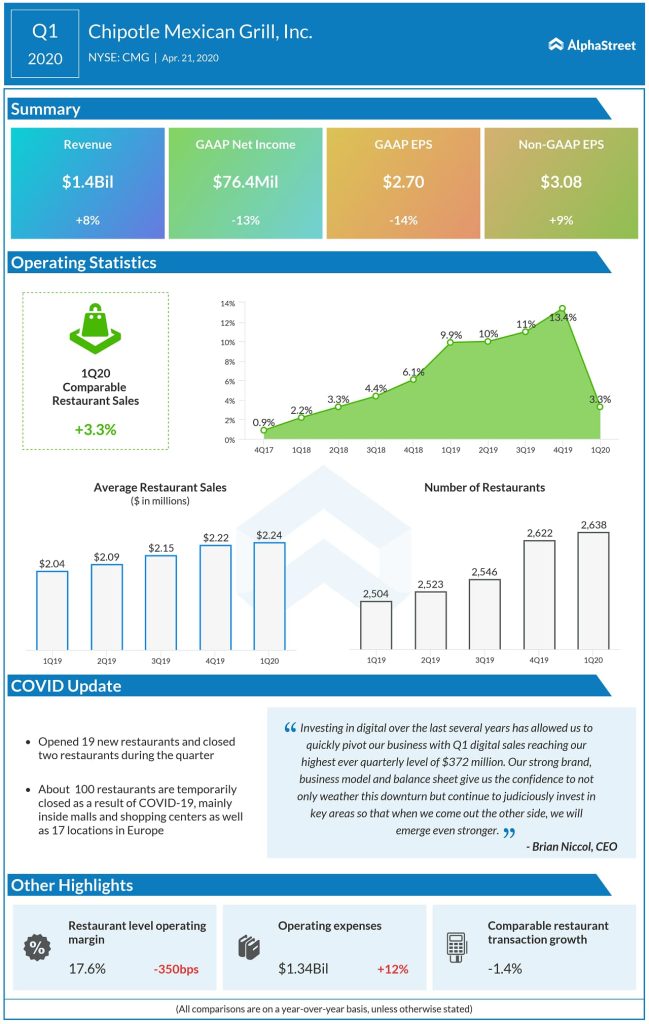

CMG reported that same-store sales decreased by 16%, in the month of March when the pandemic started taking a full swing. The sales mix has also seen a shift. CMG had been dependent on lunchtime orders, which have gone down drastically, and is receiving higher orders for dinner. Yet the revenues from digital sales keep revenues up by 8% at $1.4 billion.

Third-party inspection to ensure safety

Chipotle said it has recovered from the safety incidents lined up from 2015-2018, paying a record fine of $25 million to resolve criminal charges. Acknowledging that the consumer sentiment would trend towards safety concerns, it has installed supplied sanitizer for employees and mandated guidelines for safety. Separately, the chain has engaged a third-party consultant for inspection of restaurants and employed and independent Food Safety Advisory Council.

[irp posts=”57773″]

The management said it shifted its marketing activities away from television to social and digital platforms and are offering delivery incentives to its consumers. The customer survey has favored some new additions to the menu. Menu innovation ideas for beverage, quesadilla, and Blanco launch are in pipeline.

Long-term view

Like some peers, CMG pulled back its financial guidance for 2020. However, a higher number of repeat customers give an optimistic outlook.

[irp posts=”57952″]

The company ended Q1 2020, with $909 million in cash & cash equivalents, and zero debt. To keep its liquidity position intact and retain cash, it has suspended the share buyback program. The company has mentioned that they are not considering a dividend payment yet. However, it continues to keep the CAPEX spend at $30 million to $35 million a month, with a credit facility of $250 million to $500 million in banks from banks, if at all required.

Company execs also revealed plans to open drive-thru Chipotlane, but they expect delays therein.

For more updates, check out the earnings transcript here.

(Written by Manjula S)