Shares of Delta Air Lines Inc. (NYSE: DAL) were up 3.2% in midday trade on Thursday after the company reported better-than-expected results for the fourth quarter of 2021. Both revenue and earnings beat estimates and the company remains relatively optimistic about the upcoming fiscal year. The stock has gained 7% year to date.

Quarterly performance

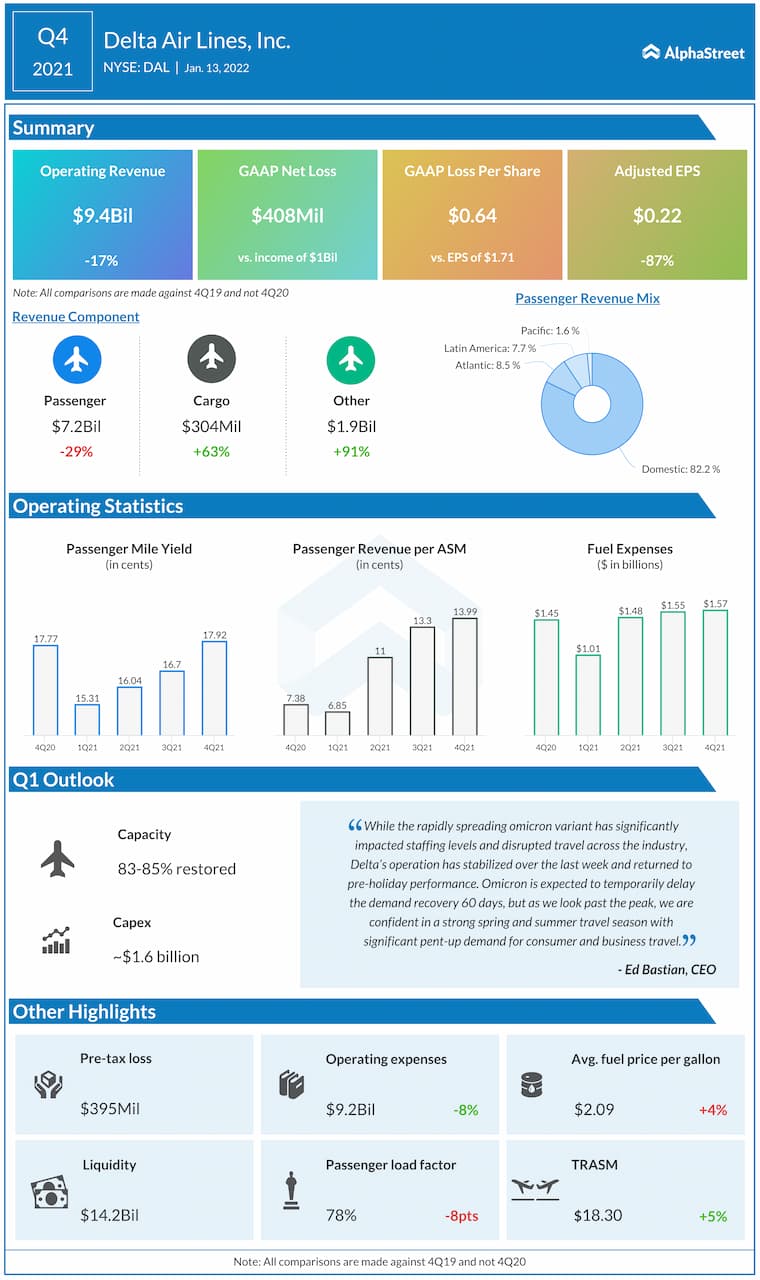

Operating revenues amounted to $9.4 billion, which was down 17% from the fourth quarter of 2019. On an adjusted basis, operating revenues dropped 26% to $8.4 billion versus Q4 2019. Adjusted revenue was 74% recovered versus Q4 2019 on capacity that was 79% restored.

On a GAAP basis, the company reported a net loss of $0.64 per share while on an adjusted basis, EPS fell 87% to $0.22 compared to the fourth quarter of 2019. Despite the declines, both the top and bottom line numbers surpassed expectations.

Trends

Delta witnessed strong demand and pricing during the holiday period along with promising trends in international and business travel. The company ended December with revenues that were nearly 80% restored versus 2019 levels.

Strong demand for leisure travel, improvements in corporate travel trends and strong holiday bookings helped drive domestic passenger revenue, which was 78% restored versus Q4 2019. International passenger revenue recovered to 50% of Q4 2019 levels.

Delta is also seeing improvement in demand for business travel with domestic passenger volumes nearly 60% restored during the quarter. Cargo revenue increased 63% to $304 million compared to the fourth quarter of 2019, marking the fifth consecutive quarter of positive growth. This momentum was driven by strong holiday demand and yields.

Although the Omicron variant disrupted travel across the industry, Delta saw its operation stabilize over the past week and return to pre-holiday performance. The company expects Omicron to cause a delay in the demand recovery but a pickup is anticipated from the President’s Day weekend onwards. Delta remains confident that it will see strong trends during the spring and summer travel season on the back of significant pent-up demand for consumer and business travel.

However, due to the impacts of Omicron, the company expects to incur losses in January and February with a return to profitability in March. Although Delta predicts a loss for the March quarter, it expects to deliver healthy profits in the June, September and December quarters thereby generating a meaningful profit in 2022.

Outlook

For the first quarter of 2022, Delta expects total revenue to recover to 72-76% of 2019 levels. Capacity is expected to be restored to 83-85% compared to the March quarter 2019. Gross capital expenditures is expected to be approx. $1.6 billion.

Click here to access the full transcript of Delta Air Lines’ Q4 2021 earnings conference call