Quarterly performance

User base

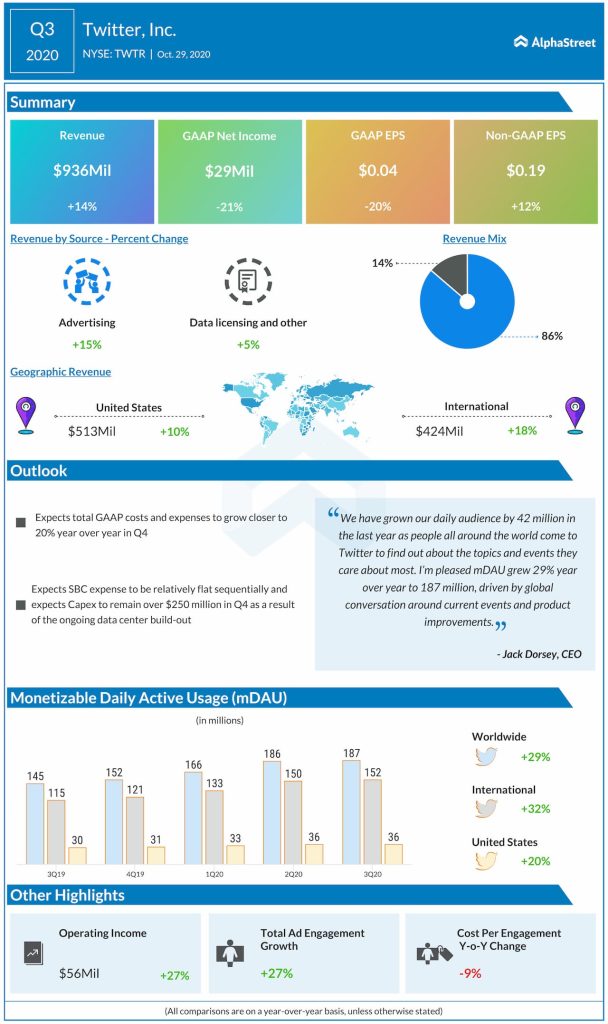

Twitter has seen a steady growth in the number of its users over the past two years but its growth rate has been slow. During the third quarter, average monetizable daily active usage (mDAU) grew 29% year-over-year but gained only 1% sequentially.

User growth saw a significant pickup in the first two quarters of this year due to the COVID-19 pandemic as people stayed at home and started using social media more to keep themselves updated on the latest developments.

On a sequential basis, total mDAU grew 9% in Q1 2020 and reached double-digit growth for the first time in two years with 12% in Q2. The number of users totaled 186 million in the second quarter but rose by only 1 million in Q3 to reach 187 million. On a year-over-year basis, mDAU grew 24% in Q1 and 34% in Q2 but this growth rate dropped to 29% in Q3.

In the US, user growth has been relatively stagnant with a meaningful spike seen in the first two quarters of this year. On a sequential basis, mDAU remained flat at 36 million from Q2 to Q3. On a year-over-year basis, Q2 saw the highest growth at 24% which slowed down to 20% in Q3.

Growth in international users has picked up steadily and reached its highest level in Q2 both sequentially and year-over-year. mDAU grew 14% sequentially and 37% YoY to reach 150 million users last quarter. But in Q3, this growth rate dropped to 1% sequentially and 32% year-over-year to reach only 152 million users.

Twitter has attributed the YoY growth in its user base to product improvements such as tailoring content based on topics and interests. The company believes that people come to its platform for a particular reason but end up staying on as they find relevant topics that interest them.

Despite the year-over-year growth, Twitter’s user base remains relatively small in the US. During its results announcement, Twitter did not touch upon the issue of toxic content or its efforts to tackle it at all.

Looking ahead, Twitter believes that its revenue product improvements and its new product launches along with the increase in its audience will help drive growth. However, the slowdown in the user base still raises questions as to how long can Twitter manage to woo the Twitterati.

Click here to read the full transcript of the Twitter Q3 2020 earnings conference call