Sales Outlook

The Cincinnati-based company, which is specialized in personal care and hygiene products, sees a modest slowdown in sales due to the squeeze on consumers’ spending power. That would force the company and its retail customers to take a cautious pricing strategy. Elevated transportation costs and commodity prices would add to the pressure on profit margins. Still, P&G executives believe consumers would respond favorably to the price hikes being implemented.

Read management/analysts’ comments on P&G’s Q4 2022 results

The company that owns popular brands like Tide and Pampers sees risks to the business from macro headwinds like cost escalation and muted consumer sentiment. The management banks on the strategy of constructive disruption and agile organizational structure to beat the slump, which is expected to persist during the remainder of the year.

From P&G’s Q4 2022 earnings conference call:

“We’ve developed a productivity muscle that helps address some of the challenges we face. We remain fully committed to the cost and cash productivity in all facets of our business, up and down the income statement and across the balance sheet in each business and corporately. Productivity improvement is a necessity to drive balanced top and bottom-line growth and strong cash generation.”

Mixed Outcome

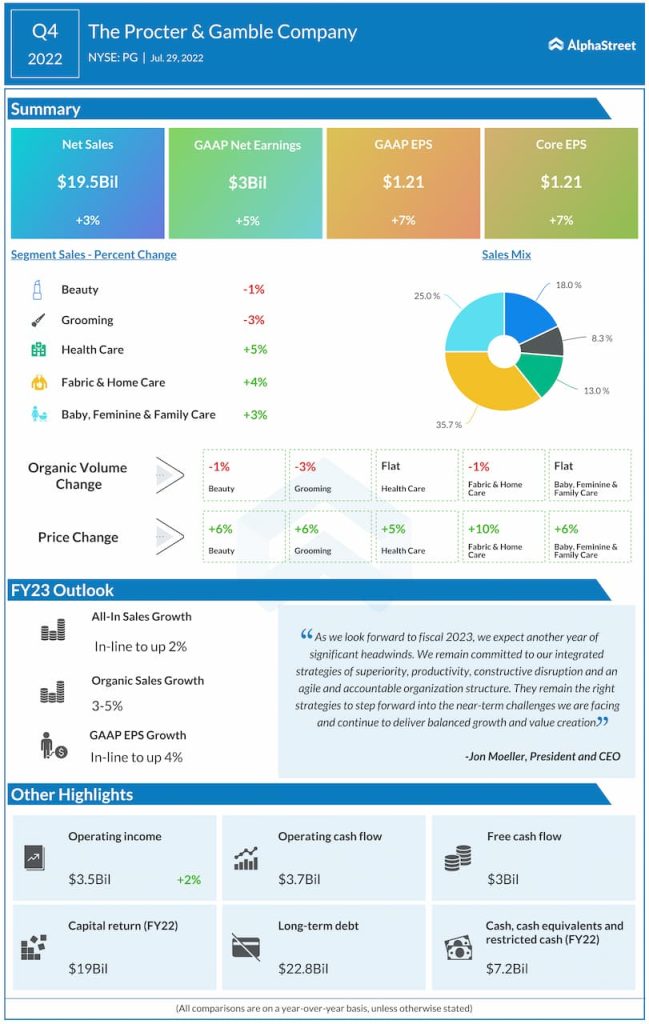

P&G ended fiscal 2022 on a mixed note, reporting fourth-quarter sales that topped expectations and weaker-than-expected core earnings, after beating bottom-line estimates regularly over the past several years. The top line rose a modest 3% to around $20 billion and net profit moved up 7% to $1.21 per share. Higher sales for the main operating segments more than offset weakness in the Beauty and Grooming divisions. A dip in sales volumes was compensated by higher prices in some product categories.

For fiscal 2023, the management issued sales guidance below the consensus forecast. Persistent uncertainties in key markets like China, where business is affected by COVID lockdown, and disruptions in Russia due to the Ukraine war would remain a drag on performance this year. The bottom line will be affected by higher costs and unfavorable foreign exchange rates, which has made the company forecast flat to low-single-digits earnings growth.

Kimberly-Clark Q1 profit drops but beats estimates; revenue up 7%

After entering 2022 on an upbeat note and peaking in the early weeks of the year, PG got caught up in the market selloff and maintained a downtrend since then. On Tuesday afternoon, the stock traded lower at around $142, which broadly matches its value 12 months ago.