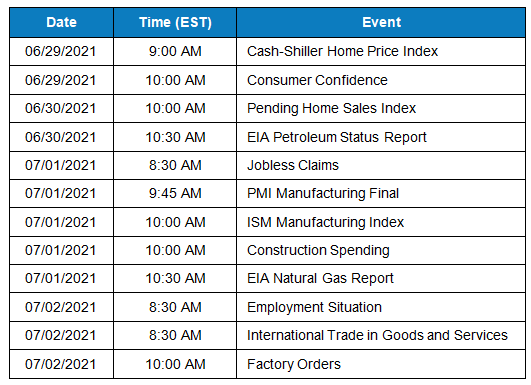

The number of Americans filing for Jobless claims dropped to 411,000 but missed economists’ forecast by a wide margin, probably due to a temporary delay in filling new job openings.

After making steady gains throughout the week, the benchmark S&P 500 index opened Friday’s session at a record high of 4,274.45, even as economic recovery continued to pick up the pace. The Dow Jones Industrial Average recovered from last week’s dip and once again breached the 34,000-mark.

The technology sector has witnessed hectic activity so far this year, with companies taking the IPO and M&A routes to expand business. IT major Hewlett Packard Enterprises this week bought San Francisco-based machine learnings platform Determined AI. Meanwhile, design automation expert Synopsys agreed to acquire the display solutions arm of South Korea-based BISTel for an undisclosed amount.

In another semiconductor deal, Verizon added location-responsive solutions firm Senion to its fold, while software firm NetApp bought cloud analytics firm Data Mechanics. However, the deal that elicited maximum investor interest was probably game publisher Electronic Arts’ $1.4-billion acquisition of Playdemic from Warner Brothers Games and AT&T.

The other important deals include the purchase of Europe-based open banking platform Think by Visa for EUR1.8 billion and Amazon Web Service’s acquisition of encrypted messaging app Wickr.

After a slow start to the week, earnings activity picked up momentum early Thursday when professional services firm Accenture reported broad-based revenue growth for the third quarter. After the market’s close, cargo giant FedEx and sneaker maker Nike posted impressive results for their most recent quarters.

The other closely-followed events were the financial releases of used-car retailer CarMax and payroll solutions firm Paychex – both reported stronger-than-expected earnings on Friday.

The lull phase is expected to extend into early next week, with no major events scheduled until mid-week. On June 30, Bed Bath & Beyond will publish data for the first three months of 2021.

The home décor retailer will be joined by alcohol giant Constellation Brands and convenience store operator General Mills before the opening bell. Chipmaker Micron Technology is all set to release earnings report in the after-hours. The third-quarter statement of Walgreens Boots Alliance is slated for July 1.

Key Earnings to Watch

Monday: LiveXLive Media

Tuesday: FactSet Research Systems, Herman Miller, and High Tide

Wednesday: Micron Technology, General Mills, Bed Bath & Beyond, Constellation Brands, and Novagold Resources

Thursday: Walgreens Boots Alliance, The Simply Good Foods Company, and Acuity Brands

Friday: Fiem Industries Limited

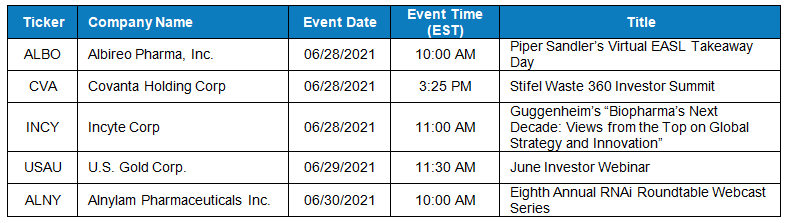

Key Corporate Conferences to Watch

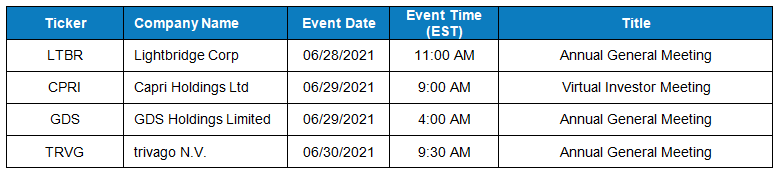

Key Investor Days/AGMs to Watch

Key US Economic Events

Notable Transcripts

The following are notable companies which have reported their earnings last week. In case if you have missed catching up on their performance, click the respective links to skim through the transcripts to glean more insights.

Accenture Q3 2021 Earnings Transcript

Darden Restaurants Q4 2021 Earnings Transcript

Nike Q4 2021 Earnings Transcript

BlackBerry Q3 2021 Earnings Transcript

FedEx Q4 2021 Earnings Transcript

CarMax Q1 2022 Earnings Transcript

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.