Production Woes

There are concerns about production disruptions at the refining division due to the scheduled maintenance activities. Margins have been under stress due to muted demand at the chemicals division amid excess supply, and the stress will likely persist in the near term due to the spike in spending. However, the modest production recovery seen at the beginning of the year, after a long-drawn slump, came as a morale booster for the stakeholders.

Related: Exxon Mobil Q1 2019 Earnings Conference Call Transcript

The upstream business in the domestic market is estimated to have affected by the unfavorable oil pricing. Though upstream operations outside the US are expected to grow moderately, June-quarter earnings might be impacted by seasonal factors, especially the relatively low demand for gas in Europe.

Liquidity Crunch

Neither is the company’s cash position encouraging, as its asset sale program is a getting a lackluster response from the industry due to the challenging market conditions. The strained cash flow will also put constraints on the management’s share buyback program.

Partially offsetting the weakness in upstream operations, the downstream business is expected to recover in the to-be-reported quarter after faltering at the beginning of the year, lifting margins.

Past Performance

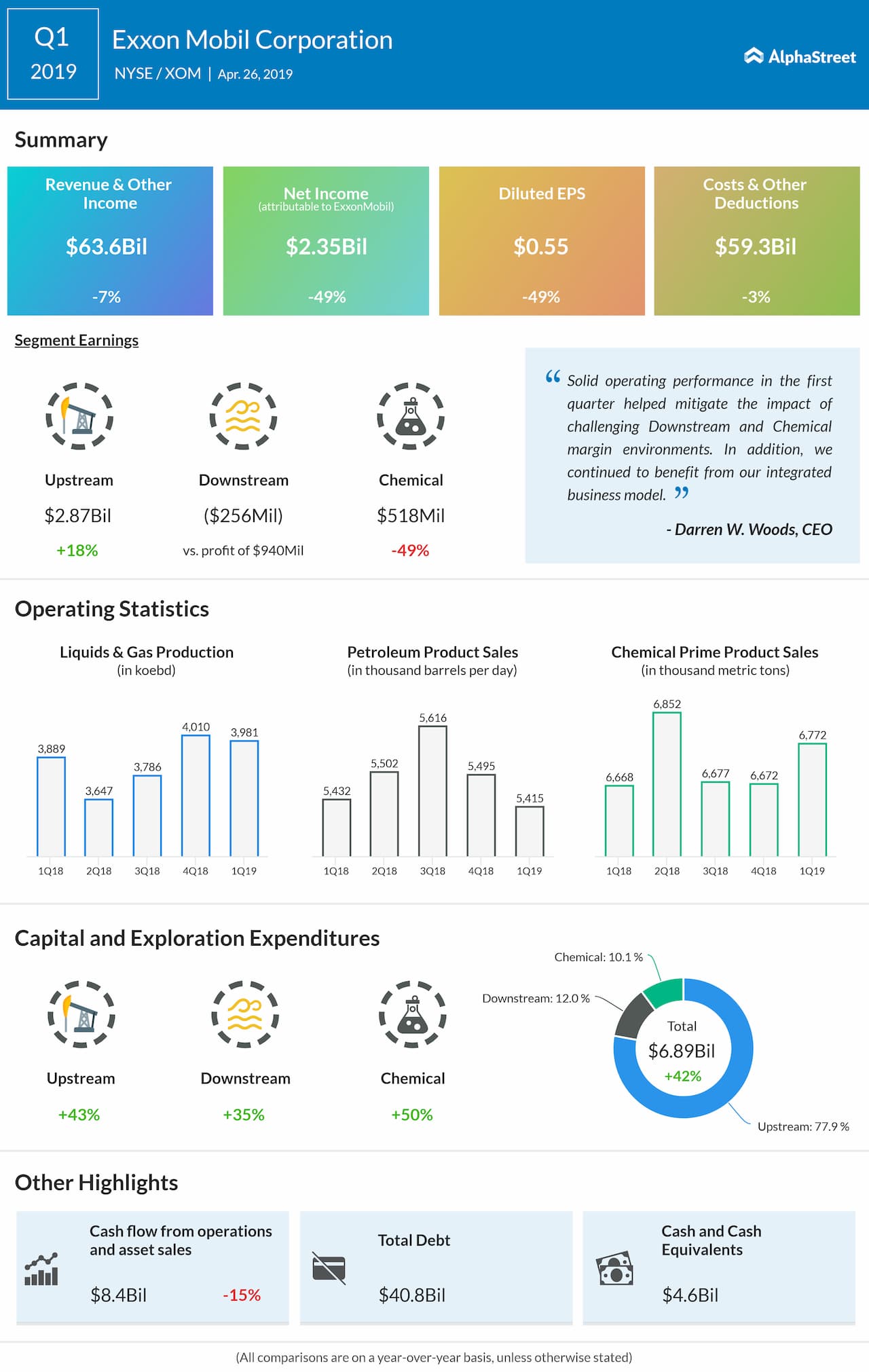

In April, the company’s dismal first-quarter results triggered a stock selloff, denting its market value. Earnings plunged about 50% year-over-year to $0.55 per share, hurt by a 7% decline in revenues. The results also fell short of Wall Street’s expectations.

Also see: Chevron Q1 2019 Earnings Conference Call Transcript

Coinciding with ExxonMobil’s quarterly announcement, rival oil explorer Chevron (CVX) will be publishing results for its most recent quarter on Friday.

ExxonMobil’s shares have witnessed severe volatility after hitting a record high a few years ago. The stock gained about 8% so far this year, after slipping to an eight-year low in the final weeks of last year.