Buy FL?

The company’s stakeholders will be closely following the upcoming earnings event to assess the latest sales trend. It is worth noting that quarterly earnings surpassed the market’s projection consistently over the past two years. As far as investing in Foot Locker is concerned, it makes sense to wait until the picture becomes clearer.

Read management/analysts’ comments on Foot Locker’s Q4 2021 earnings

In February, Foot Locker’s shares dropped around 30% after Nike revealed plans to shift certain products to its direct-to-customer channel, in an effort to avoid intermediaries. Though the stock made a modest recovery since then, it is trading below the multi-year highs seen a year ago. On the plus side, the stock has become cheaper and more affordable after the dip. Also, experts predict a notable improvement from the current levels as the year progresses.

Foot Locker has an impressive history of returning value to shareholders through share buybacks and dividends. With a sustainable yield of above 5%, it remains an attractive bet for income investors and those looking for long-term engagement. The board of directors this week declared a dividend of $0.40 per share, payable on July 29 to shareholders of record on July 15.

Road Ahead

Considering its heavy reliance on Nike and the recent change in inventory position, Foot Locker needs to significantly expand offerings from other brands like Crocs, Inc. (NASDAQ: CROX) and Adidas to regain the sales momentum. Or, maybe it’s time for the company to revisit its business strategy. The management predicts single-digit sales decline for the current fiscal year, and is looking to diversify the mix.

From Foot Locker’s Q4 2021 earnings conference call:

“As we remix our business, 2022 will reflect an acceleration of preexisting strategies that are well underway and have already been yielding success. On the product front, we will continue to work to further diversify our merchandise and vendor mix, including new brands and elevating brands and categories where we are underpenetrated. We continue to strengthen our consumer concept offense to deliver exclusive product storytelling driven by our extensive consumer insights.”

Q1 Report on Tap

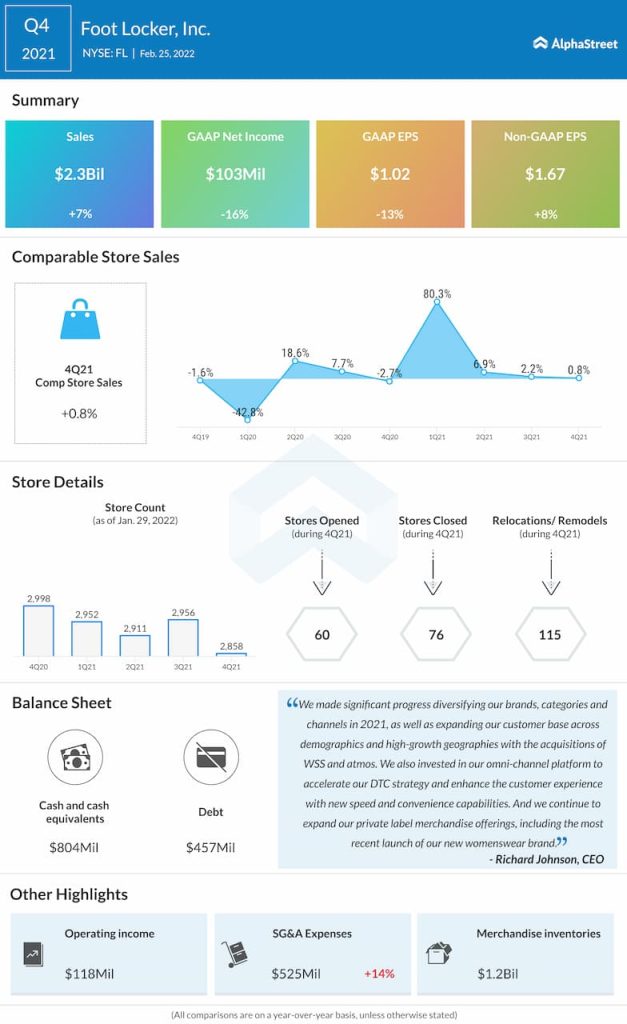

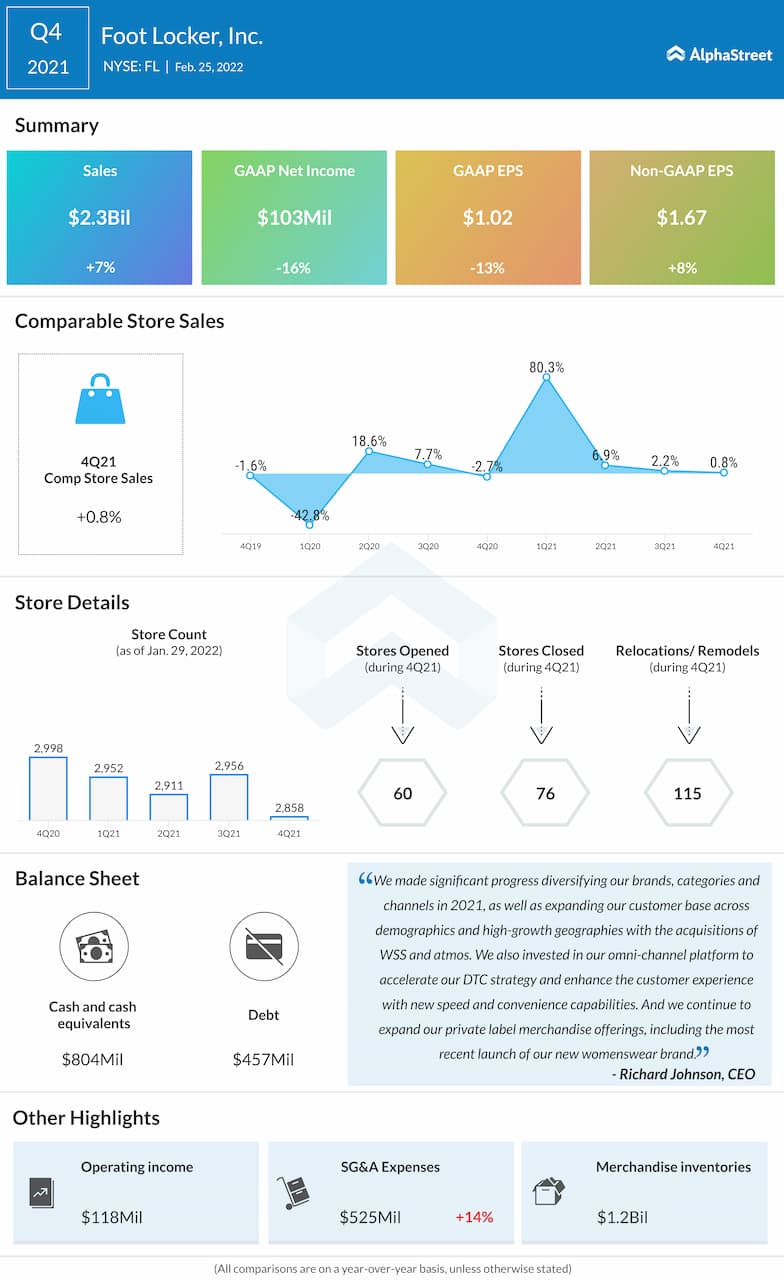

Foot Locker is expected to announce first-quarter results on May 20 before the opening bell. Analysts predict a double-digit fall in earnings to $1.52 per share on revenues of $2.19 billion. In the final three months of fiscal 2021, comparable-store sales remained almost flat, extending the recent weakness. Net sales rose modestly to $2.3 billion and matched the Street view. At $1.67 per share, adjusted earnings were up 8% year-over-year and above estimates.

Infographic: Highlights of Under Armour’s March-quarter earnings report

FL has lost about 31% since the beginning of the year and continues to trade sharply below its 52-week average. The stock closed the last trading session lower.